- Saudi Arabia

- /

- Basic Materials

- /

- SASE:9601

Three Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. indices like the S&P 500 and Dow Jones Industrial Average recording significant gains amid easing inflation and robust bank earnings, investors are increasingly looking toward small-cap stocks for potential opportunities. In this environment, where value stocks have outperformed growth shares, identifying undiscovered gems involves seeking companies that demonstrate strong fundamentals, resilience in diverse economic conditions, and the ability to capitalize on emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Commercial Bank International P.S.C | 0.33% | 5.59% | 28.69% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

LU-VE (BIT:LUVE)

Simply Wall St Value Rating: ★★★★☆☆

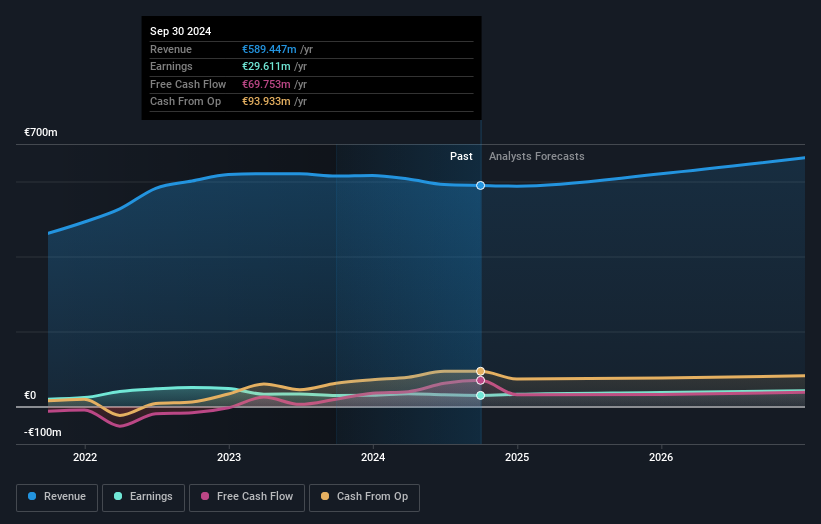

Overview: LU-VE S.p.A. is involved in the production and marketing of heat exchangers and air-cooled equipment, operating both in Italy and internationally, with a market capitalization of approximately €618.45 million.

Operations: LU-VE generates revenue primarily from two segments: Components (€283.49 million) and Cooling Systems (€296.15 million).

LU-VE, a noteworthy player in the building industry, has seen its debt to equity ratio increase from 136.7% to 141.8% over five years, indicating a high leverage position with a net debt to equity ratio of 40%. Despite this, the company's earnings grew by 1.7% last year and are expected to rise by an impressive 15.23% annually moving forward. With interest payments covered comfortably at 13.1 times EBIT and positive free cash flow of €69.75 million as of September 2024, LU-VE seems well-positioned for growth despite some financial headwinds in recent sales figures (€436.81 million).

- Take a closer look at LU-VE's potential here in our health report.

Assess LU-VE's past performance with our detailed historical performance reports.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

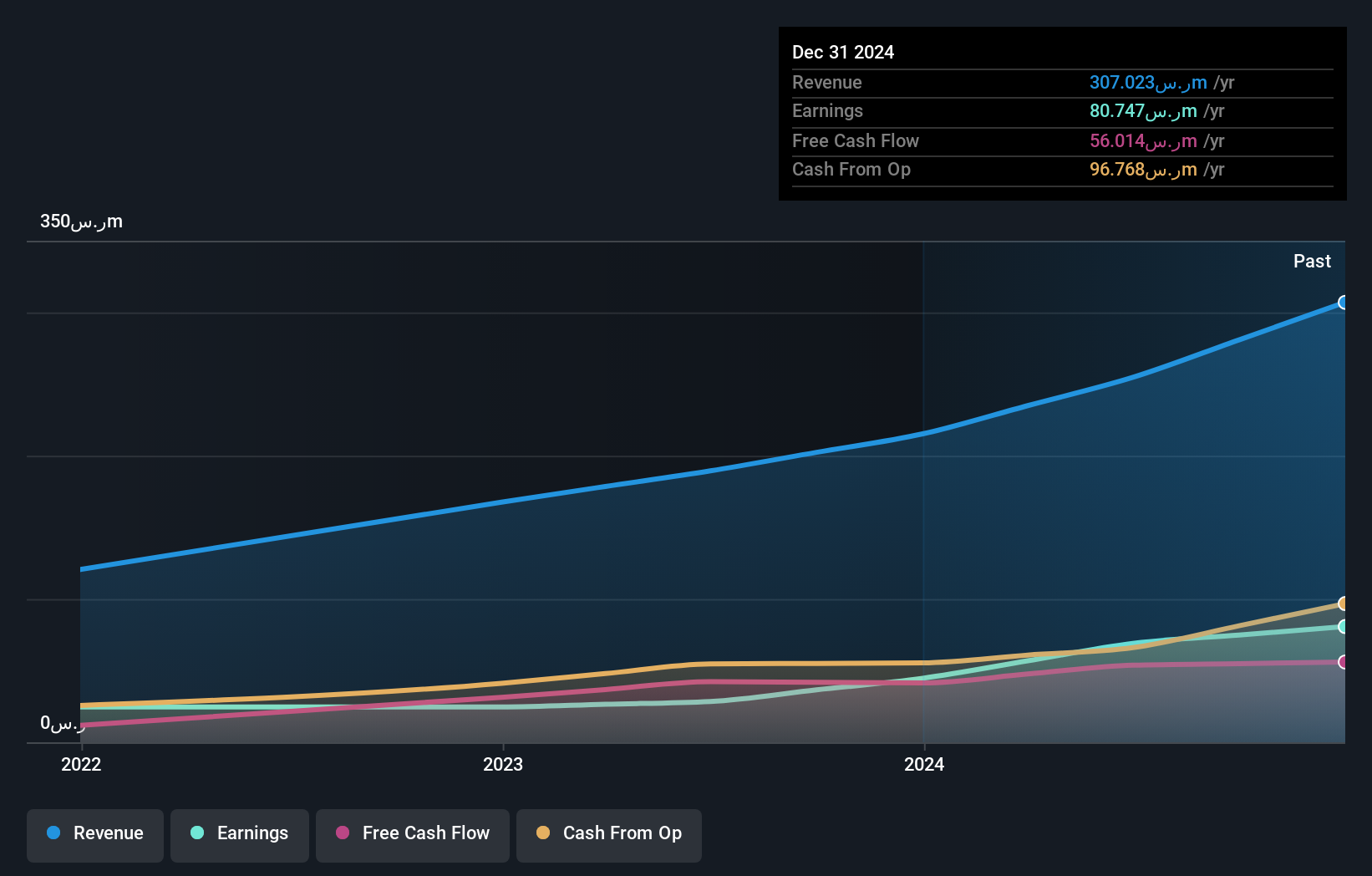

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications, with a market capitalization of SAR1.26 billion.

Operations: The company generates revenue primarily from sales, amounting to SAR246.94 million, with a smaller contribution from contracting services at SAR7.73 million.

Mohammed Hadi Al-Rasheed, a relatively smaller player in the market, has demonstrated impressive earnings growth of 142% over the past year, significantly outpacing the Basic Materials industry's 12%. The company's Price-To-Earnings ratio stands at 18.2x, which is below the SA market average of 24.3x, suggesting it may be undervalued. Despite recent share price volatility, its financial health appears robust with more cash than total debt and positive free cash flow reaching US$53.78 million as of June 2024. These factors combined indicate potential for continued strong performance in its sector.

China Catalyst Holding (SHSE:688267)

Simply Wall St Value Rating: ★★★★★★

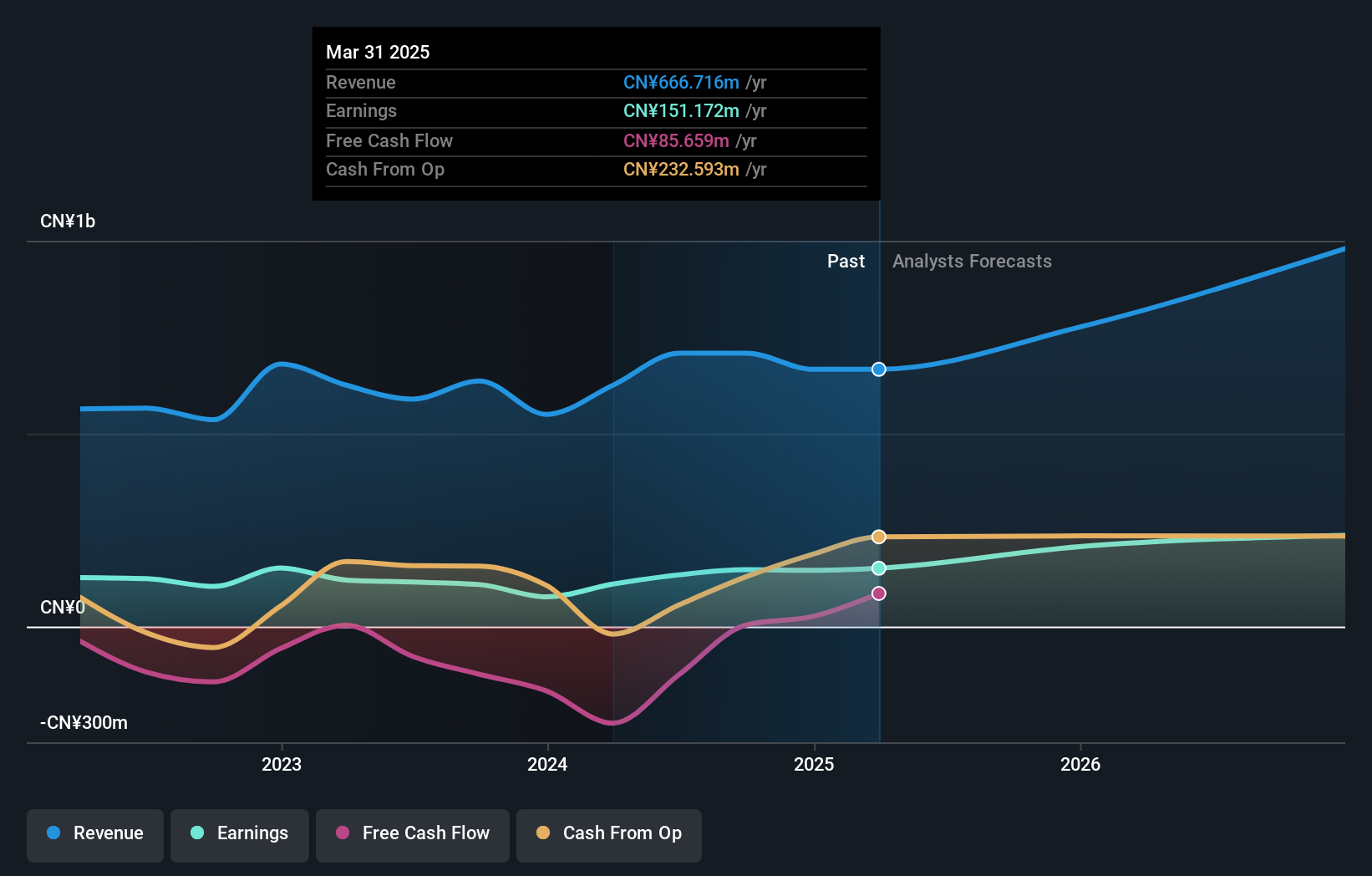

Overview: China Catalyst Holding Co., Ltd. focuses on the research and development, production, and sale of zeolite catalysts, customized process package solutions, and fine chemicals both within China and internationally, with a market cap of CN¥4.07 billion.

Operations: The primary revenue stream for China Catalyst Holding comes from its chemical reagent and auxiliary manufacturing segment, generating CN¥708.63 million. The company's market cap stands at approximately CN¥4.07 billion, reflecting its scale in the industry.

China Catalyst Holding showcases a promising profile with earnings surging 35.5% over the past year, outpacing the Chemicals industry's -5%. This growth trajectory is bolstered by a sharp reduction in its debt-to-equity ratio from 24.9% to just 0.02% over five years, indicating strong financial health. The company reported net income of CNY 113.66 million for nine months ending September 2024, up from CNY 43.28 million year-on-year, reflecting robust operational performance and high-quality earnings. With a price-to-earnings ratio at an attractive 27.6x compared to the CN market's average of 34.8x, it presents potential value opportunities within its sector context.

Summing It All Up

- Investigate our full lineup of 4655 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9601

Mohammed Hadi Al-Rasheed

Produces silica sand for various industrial applications.

Excellent balance sheet with proven track record.