- Japan

- /

- Tech Hardware

- /

- TSE:6670

Discovering 3 Undiscovered Gems with Strong Financial Footing

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, small-cap stocks have shown resilience compared to their larger counterparts, even as major indices like the S&P 500 and Nasdaq Composite faced declines. With global markets navigating through fluctuating labor data and manufacturing slowdowns, investors are increasingly looking for opportunities in smaller companies that boast strong financial fundamentals. In this context, identifying stocks with solid balance sheets and sustainable growth potential becomes crucial. These undiscovered gems can offer stability amid market volatility while providing potential upside as they capitalize on niche markets or innovative strategies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 20.47% | -3.86% | -2.71% | ★★★★★☆ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Qingdao Yunlu Advanced Materials Technology (SHSE:688190)

Simply Wall St Value Rating: ★★★★★☆

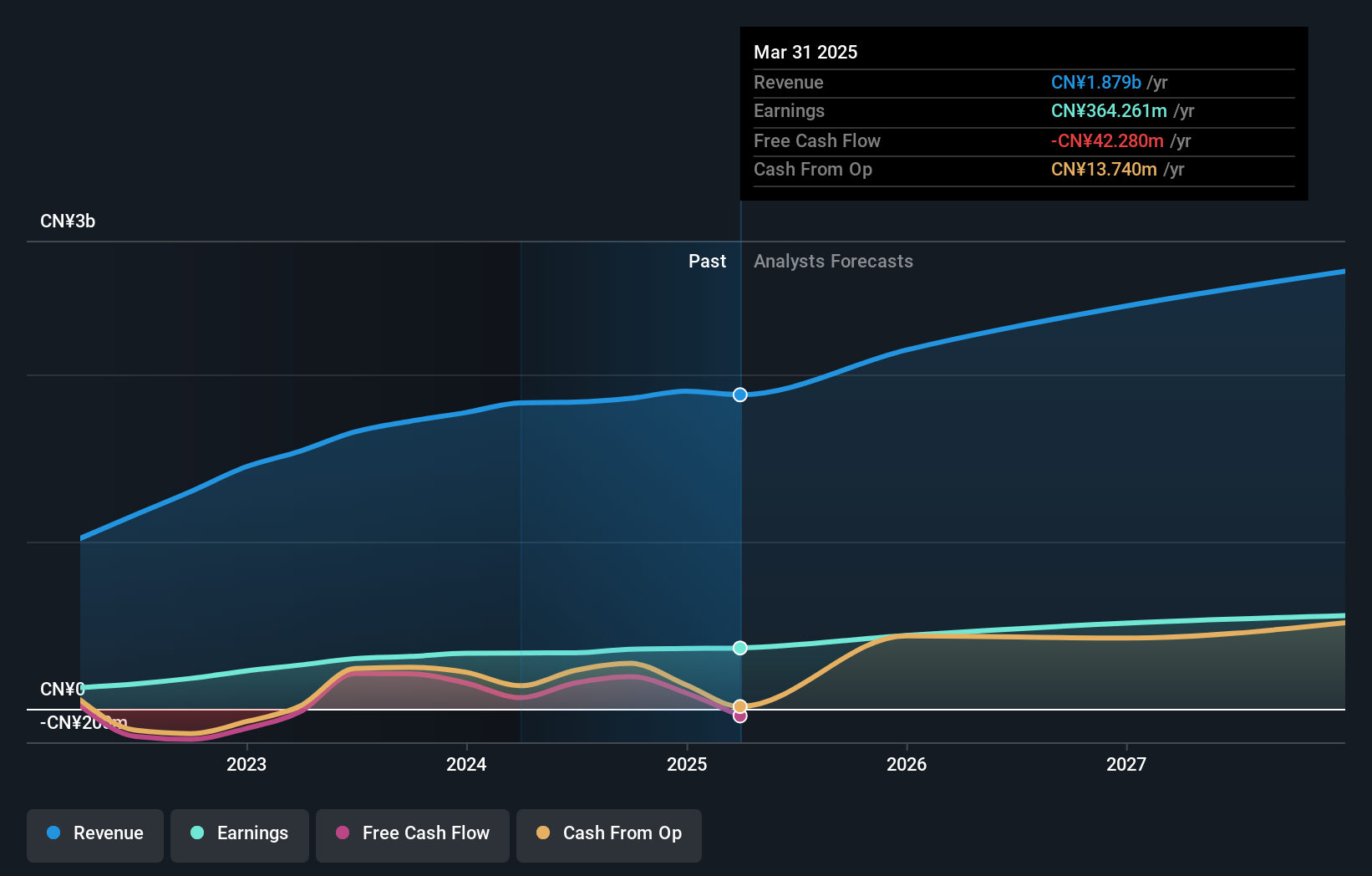

Overview: Qingdao Yunlu Advanced Materials Technology Co., Ltd. operates in the advanced materials sector and has a market capitalization of CN¥10.18 billion.

Operations: Qingdao Yunlu Advanced Materials Technology generates revenue through its advanced materials segment. The company's financial performance shows a focus on optimizing its cost structure to enhance profitability. It has reported a net profit margin trend worth noting, reflecting its strategic approach in managing expenses relative to income.

Qingdao Yunlu Advanced Materials Technology, a nimble player in the materials sector, showcases a promising profile with its earnings growth of 13.8% over the past year, outpacing the broader Metals and Mining industry at -2.3%. The company reported sales of ¥1.39 billion for the nine months ending September 2024, up from ¥1.30 billion previously, while net income rose to ¥262.86 million from ¥238.24 million last year. With a price-to-earnings ratio of 28.6x below China's market average of 34.4x and high-quality earnings reported consistently, it seems poised for continued upward momentum in profitability forecasts at an annual rate of 16.69%.

Xintec (TPEX:3374)

Simply Wall St Value Rating: ★★★★★★

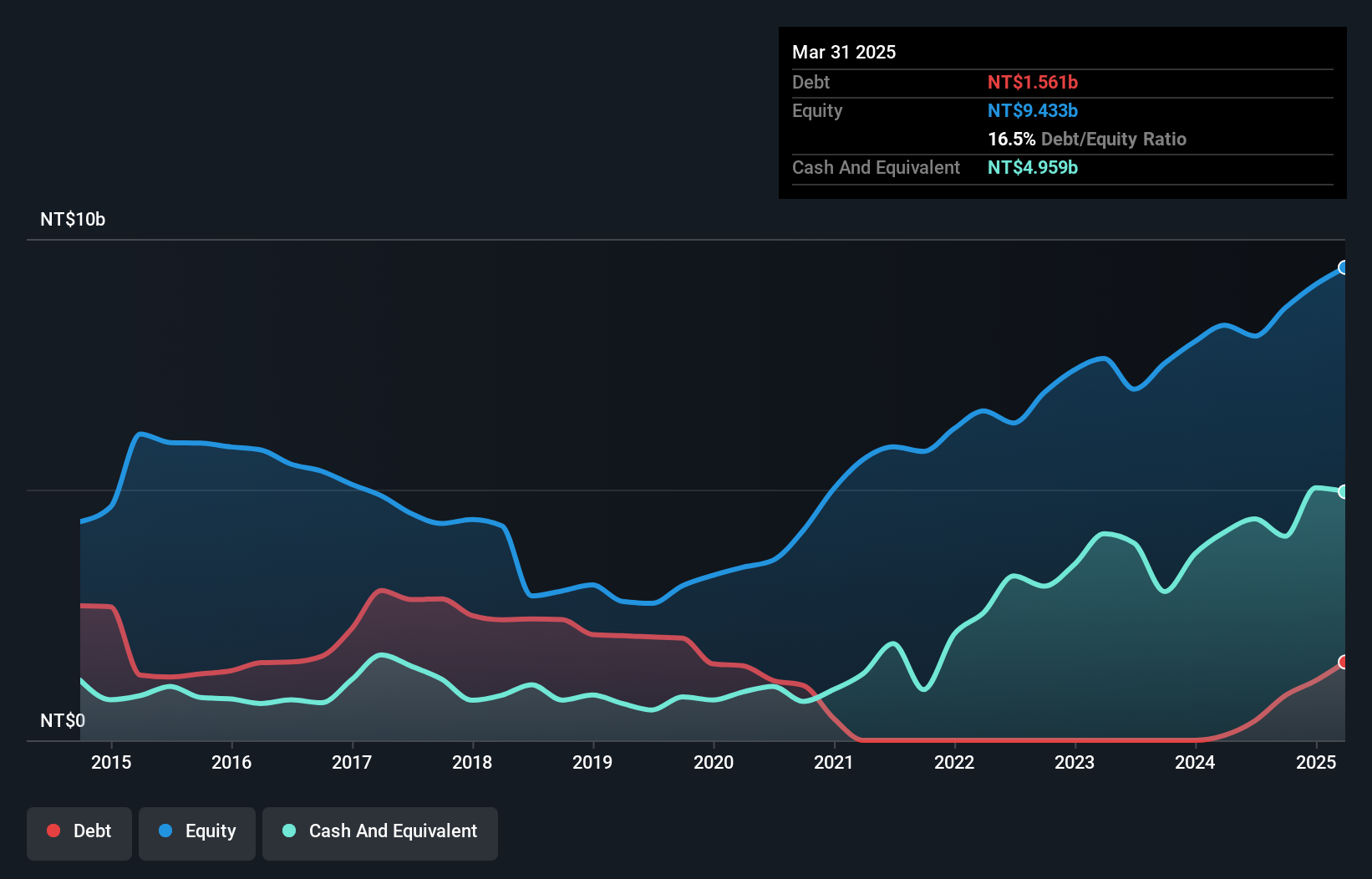

Overview: Xintec Inc. is a wafer level chip scale packaging company with operations in Asia, the United States, and Europe, and has a market cap of NT$58.48 billion.

Operations: The primary revenue stream for Xintec comes from its Semiconductor Equipment and Services segment, generating NT$6.75 billion.

Xintec's recent performance highlights its potential as an emerging player in the semiconductor industry. With earnings growth of 7.7% surpassing the industry's 0.01%, Xintec shows promising momentum. The company's debt-to-equity ratio has impressively decreased from 75.4% to 4.8% over five years, indicating strong financial management and reduced leverage risk. In the latest quarter, sales reached TWD 1,642 million, up from TWD 1,408 million a year ago, while net income climbed to TWD 325 million from TWD 199 million previously. Despite some share price volatility recently, Xintec remains free cash flow positive with robust non-cash earnings contributing to its solid financial foundation.

- Get an in-depth perspective on Xintec's performance by reading our health report here.

Explore historical data to track Xintec's performance over time in our Past section.

MCJ (TSE:6670)

Simply Wall St Value Rating: ★★★★★★

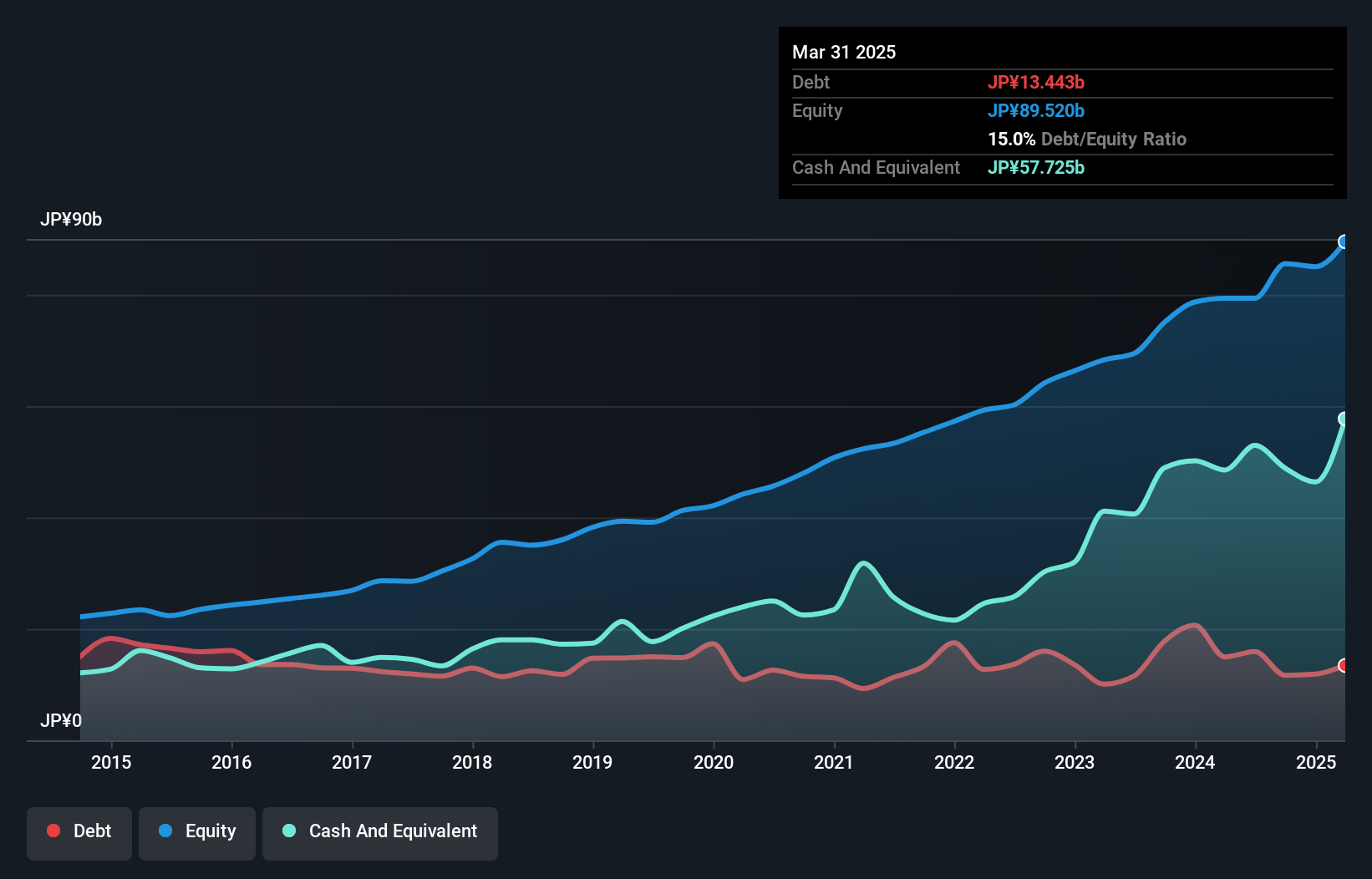

Overview: MCJ Co., Ltd. operates in Japan's PC-related and entertainment sectors with a market capitalization of ¥149.26 billion.

Operations: MCJ Co., Ltd. generates revenue primarily from its Personal Computer Related Business, which accounts for ¥186.49 billion, and a smaller portion from its Comprehensive Entertainment Business at ¥5.96 billion.

MCJ, a compact player in the tech sector, showcases promising financial health with high-quality earnings and an impressive 28% growth over the past year, outpacing the industry average of 5.6%. Trading at 37.2% below estimated fair value, it presents a potential bargain for investors. The company's debt-to-equity ratio has improved significantly from 38.3% to 20.1% over five years, indicating prudent financial management. With more cash than total debt and positive free cash flow, MCJ seems well-positioned for future growth as earnings are forecasted to rise by 3.6% annually, aligning with its strategic objectives in the tech landscape.

- Click here to discover the nuances of MCJ with our detailed analytical health report.

Assess MCJ's past performance with our detailed historical performance reports.

Next Steps

- Explore the 4733 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6670

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives