- China

- /

- Metals and Mining

- /

- SHSE:688102

Is Shaanxi Sirui Advanced Materials Co., Ltd.'s (SHSE:688102) Recent Stock Performance Tethered To Its Strong Fundamentals?

Shaanxi Sirui Advanced Materials (SHSE:688102) has had a great run on the share market with its stock up by a significant 14% over the last three months. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Specifically, we decided to study Shaanxi Sirui Advanced Materials' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Shaanxi Sirui Advanced Materials

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shaanxi Sirui Advanced Materials is:

9.6% = CN¥105m ÷ CN¥1.1b (Based on the trailing twelve months to March 2024).

The 'return' is the yearly profit. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.10.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Shaanxi Sirui Advanced Materials' Earnings Growth And 9.6% ROE

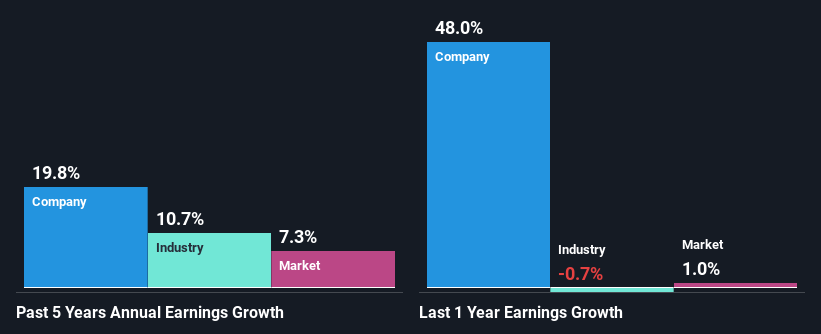

On the face of it, Shaanxi Sirui Advanced Materials' ROE is not much to talk about. However, the fact that the its ROE is quite higher to the industry average of 7.4% doesn't go unnoticed by us. Consequently, this likely laid the ground for the decent growth of 20% seen over the past five years by Shaanxi Sirui Advanced Materials. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. So there might well be other reasons for the earnings to grow. Such as- high earnings retention or the company belonging to a high growth industry.

We then compared Shaanxi Sirui Advanced Materials' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 11% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Shaanxi Sirui Advanced Materials is trading on a high P/E or a low P/E, relative to its industry.

Is Shaanxi Sirui Advanced Materials Making Efficient Use Of Its Profits?

Shaanxi Sirui Advanced Materials has a three-year median payout ratio of 40%, which implies that it retains the remaining 60% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

While Shaanxi Sirui Advanced Materials has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend.

Conclusion

In total, we are pretty happy with Shaanxi Sirui Advanced Materials' performance. In particular, it's great to see that the company has seen significant growth in its earnings backed by a respectable ROE and a high reinvestment rate. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688102

Shaanxi Sirui Advanced Materials

Shaanxi Sirui Advanced Materials Co., Ltd.

High growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026