Subdued Growth No Barrier To Cabio Biotech (Wuhan) Co., Ltd. (SHSE:688089) With Shares Advancing 31%

Cabio Biotech (Wuhan) Co., Ltd. (SHSE:688089) shares have continued their recent momentum with a 31% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 3.7% isn't as impressive.

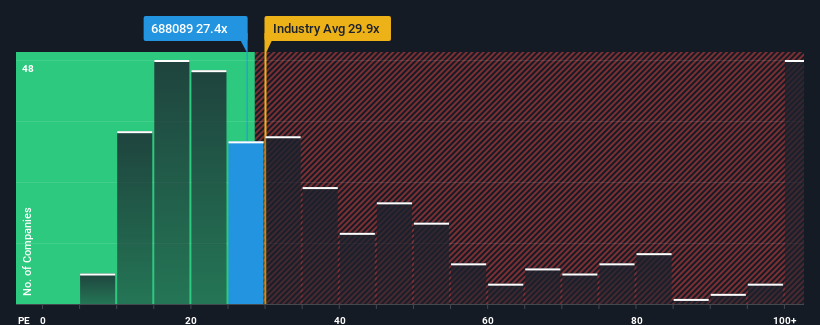

In spite of the firm bounce in price, there still wouldn't be many who think Cabio Biotech (Wuhan)'s price-to-earnings (or "P/E") ratio of 27.4x is worth a mention when the median P/E in China is similar at about 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Cabio Biotech (Wuhan) has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Cabio Biotech (Wuhan)

Is There Some Growth For Cabio Biotech (Wuhan)?

Cabio Biotech (Wuhan)'s P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 150%. Still, incredibly EPS has fallen 2.4% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 13% per annum during the coming three years according to the three analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is noticeably more attractive.

With this information, we find it interesting that Cabio Biotech (Wuhan) is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Cabio Biotech (Wuhan)'s P/E?

Its shares have lifted substantially and now Cabio Biotech (Wuhan)'s P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Cabio Biotech (Wuhan) currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Cabio Biotech (Wuhan) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688089

Cabio Biotech (Wuhan)

Develops, produces, and markets arachidonic and docosahexaenoic acids, and beta-carotene for domestic and foreign infant formula, and healthy food manufacturers.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives