Cabio Biotech (Wuhan) Co., Ltd. (SHSE:688089) Stock Rockets 32% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Cabio Biotech (Wuhan) Co., Ltd. (SHSE:688089) shares have been powering on, with a gain of 32% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

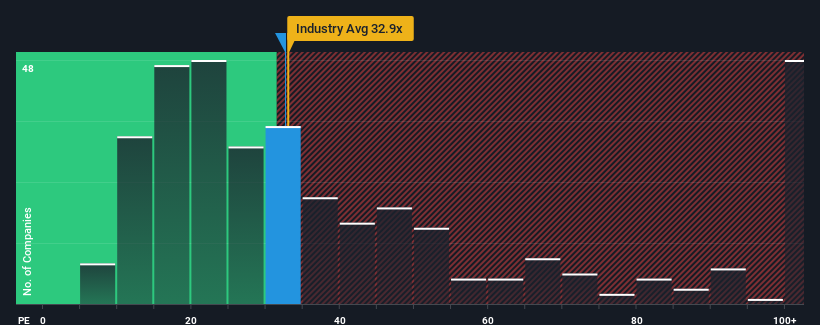

In spite of the firm bounce in price, there still wouldn't be many who think Cabio Biotech (Wuhan)'s price-to-earnings (or "P/E") ratio of 32.6x is worth a mention when the median P/E in China is similar at about 32x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Cabio Biotech (Wuhan) as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Cabio Biotech (Wuhan)

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Cabio Biotech (Wuhan)'s is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 75% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 27% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 20% each year over the next three years. With the market predicted to deliver 24% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Cabio Biotech (Wuhan) is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Cabio Biotech (Wuhan)'s P/E

Cabio Biotech (Wuhan)'s stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Cabio Biotech (Wuhan)'s analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Cabio Biotech (Wuhan) (1 shouldn't be ignored!) that you should be aware of.

If you're unsure about the strength of Cabio Biotech (Wuhan)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688089

Cabio Biotech (Wuhan)

Develops, produces, and markets arachidonic and docosahexaenoic acids, and beta-carotene for domestic and foreign infant formula, and healthy food manufacturers.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026