Wuxi Acryl Technology Co., Ltd. (SHSE:603722) Looks Just Right With A 28% Price Jump

Despite an already strong run, Wuxi Acryl Technology Co., Ltd. (SHSE:603722) shares have been powering on, with a gain of 28% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 4.8% isn't as impressive.

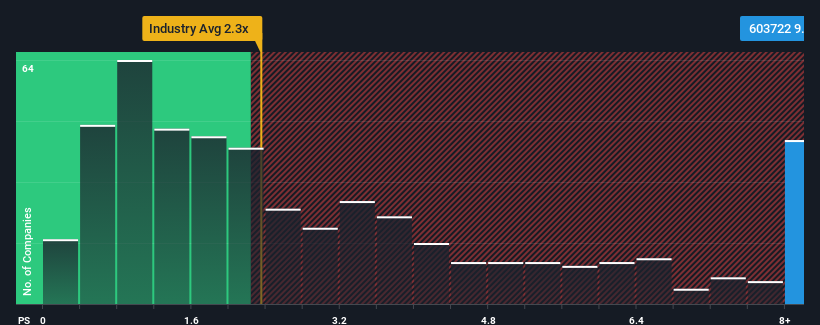

Since its price has surged higher, you could be forgiven for thinking Wuxi Acryl Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.8x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Wuxi Acryl Technology

What Does Wuxi Acryl Technology's Recent Performance Look Like?

Wuxi Acryl Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Wuxi Acryl Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Wuxi Acryl Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Wuxi Acryl Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. As a result, revenue from three years ago have also fallen 41% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 36% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

In light of this, it's understandable that Wuxi Acryl Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Wuxi Acryl Technology's P/S?

Shares in Wuxi Acryl Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Wuxi Acryl Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Wuxi Acryl Technology that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Acryl Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603722

Wuxi Acryl Technology

Produces and sells polyester, acrylic, polyurethane, high-performance epoxy, and special application resins in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives