Some Confidence Is Lacking In Zhejiang Great Shengda Packaging Co.,Ltd. (SHSE:603687) As Shares Slide 26%

Zhejiang Great Shengda Packaging Co.,Ltd. (SHSE:603687) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 7.0% in the last year.

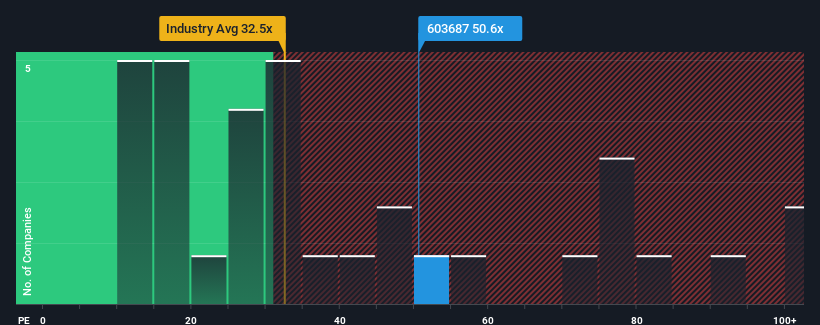

Although its price has dipped substantially, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 31x, you may still consider Zhejiang Great Shengda PackagingLtd as a stock to avoid entirely with its 50.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Zhejiang Great Shengda PackagingLtd's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Zhejiang Great Shengda PackagingLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Zhejiang Great Shengda PackagingLtd would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. This means it has also seen a slide in earnings over the longer-term as EPS is down 75% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 26% per annum during the coming three years according to the lone analyst following the company. That's shaping up to be similar to the 25% per annum growth forecast for the broader market.

With this information, we find it interesting that Zhejiang Great Shengda PackagingLtd is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Even after such a strong price drop, Zhejiang Great Shengda PackagingLtd's P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Zhejiang Great Shengda PackagingLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zhejiang Great Shengda PackagingLtd, and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Great Shengda PackagingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603687

Zhejiang Great Shengda PackagingLtd

Zhejiang Great Shengda Packaging Co.,Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives