- Germany

- /

- Medical Equipment

- /

- XTRA:SBS

3 Growth Companies With High Insider Ownership Expecting Up To 55% Earnings Growth

Reviewed by Simply Wall St

As global markets rally with U.S. stocks reaching record highs, driven by optimism around AI advancements and potential trade resolutions, growth stocks have notably outperformed their value counterparts. In such a buoyant environment, companies that combine robust insider ownership with strong earnings growth potential can be particularly appealing to investors seeking alignment of interests and confidence in future performance.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Let's uncover some gems from our specialized screener.

Plejd (NGM:PLEJD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plejd AB (publ) is a technology company that develops smart lighting control products and services, operating in Sweden, Norway, Finland, the Netherlands, Germany, and internationally with a market cap of SEK4.19 billion.

Operations: The company's revenue segment is focused on Electronic Security Devices, generating SEK726.23 million.

Insider Ownership: 38.1%

Earnings Growth Forecast: 37.8% p.a.

Plejd shows promising growth potential with earnings having grown by 104.4% over the past year and forecasted to increase at 37.8% annually, outpacing the Swedish market's growth rate of 13.9%. Despite no substantial insider buying recently, insider ownership remains high with more shares bought than sold in the last quarter. Revenue is expected to grow at 18% per year, significantly faster than the Swedish market's average of 1.1%.

- Click here to discover the nuances of Plejd with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Plejd is priced higher than what may be justified by its financials.

Chongqing Zaisheng Technology (SHSE:603601)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chongqing Zaisheng Technology Co., Ltd. specializes in researching, manufacturing, and marketing glass microfiber products for purification and energy-saving markets in China, with a market cap of CN¥3.42 billion.

Operations: Chongqing Zaisheng Technology Co., Ltd. generates revenue through its focus on glass microfiber products tailored for purification and energy-saving applications within the Chinese market.

Insider Ownership: 37%

Earnings Growth Forecast: 55.9% p.a.

Chongqing Zaisheng Technology's earnings are projected to grow significantly at 55.92% annually, surpassing the Chinese market average of 25%, although revenue growth is expected at a slower pace of 18.4%. Despite no recent insider trading activity, insider ownership remains substantial. However, profit margins have declined from last year’s 7.4% to 0.8%, and the dividend yield of 1.79% is not well covered by earnings or free cash flows, indicating potential financial challenges ahead.

- Delve into the full analysis future growth report here for a deeper understanding of Chongqing Zaisheng Technology.

- Our valuation report unveils the possibility Chongqing Zaisheng Technology's shares may be trading at a premium.

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

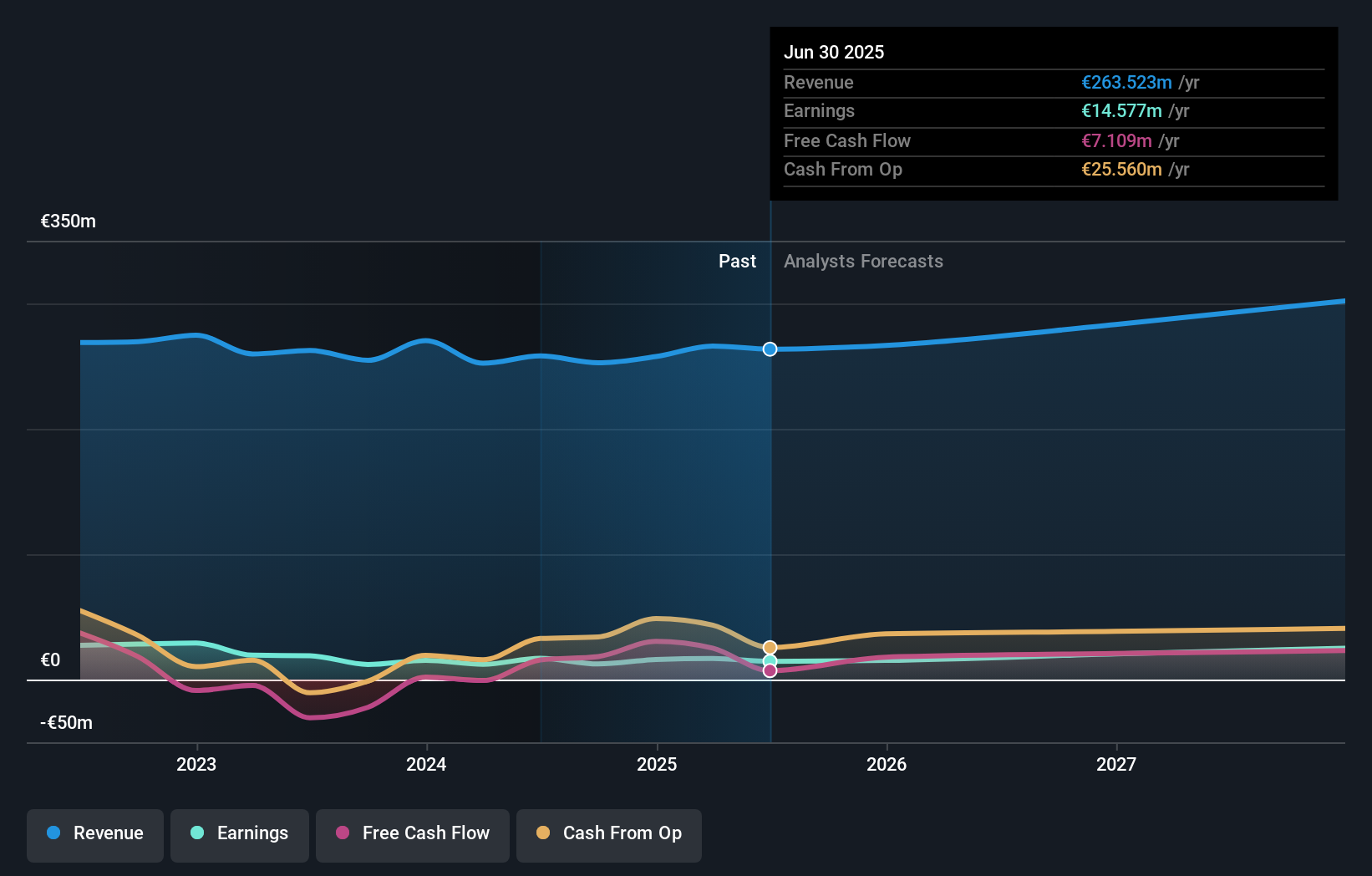

Overview: Stratec SE, with a market cap of €425.46 million, designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences in Germany, the European Union, and internationally.

Operations: The company's revenue segment includes Automation Solutions for Highly Regulated Laboratory, generating €250.54 million.

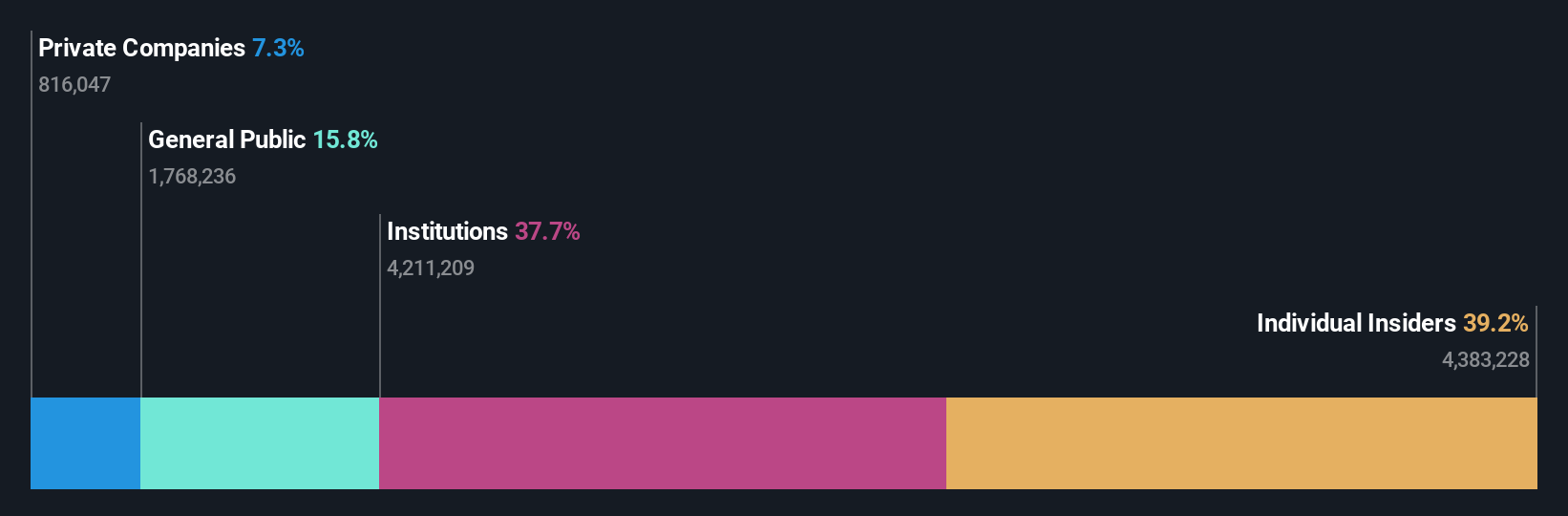

Insider Ownership: 30.9%

Earnings Growth Forecast: 25.1% p.a.

Stratec SE's earnings are expected to grow significantly at 25.1% annually, outpacing the German market average of 19.3%, though revenue growth is slower at 6.1%. Despite trading at a substantial discount to its estimated fair value, Stratec faces challenges with high debt and volatile share prices over the past three months. Recent conference presentations indicate active engagement with investors, but there has been no substantial insider buying or selling activity reported in the last three months.

- Get an in-depth perspective on Stratec's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Stratec implies its share price may be too high.

Taking Advantage

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1475 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SBS

Stratec

Designs and manufactures automation and instrumentation solutions in the fields of in-vitro diagnostics and life sciences in Germany, European Union, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives