- China

- /

- Metals and Mining

- /

- SHSE:603577

Earnings growth of 24% over 1 year hasn't been enough to translate into positive returns for Qingdao Huijintong Power EquipmentLtd (SHSE:603577) shareholders

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Investors in Qingdao Huijintong Power Equipment Co.,Ltd. (SHSE:603577) have tasted that bitter downside in the last year, as the share price dropped 24%. That's well below the market decline of 9.6%. Taking the longer term view, the stock fell 24% over the last three years. And the share price decline continued over the last week, dropping some 13%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Qingdao Huijintong Power EquipmentLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Qingdao Huijintong Power EquipmentLtd share price fell, it actually saw its earnings per share (EPS) improve by 24%. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

Qingdao Huijintong Power EquipmentLtd managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

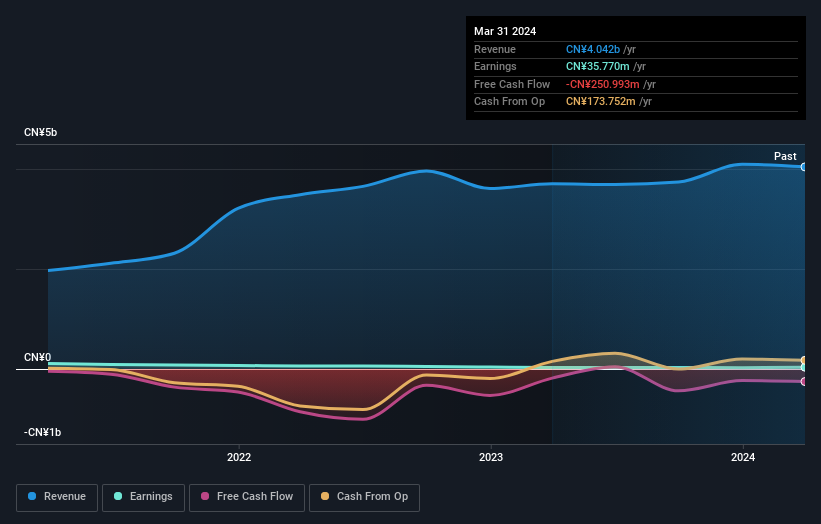

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 9.6% in the twelve months, Qingdao Huijintong Power EquipmentLtd shareholders did even worse, losing 24%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Qingdao Huijintong Power EquipmentLtd is showing 3 warning signs in our investment analysis , and 2 of those are significant...

We will like Qingdao Huijintong Power EquipmentLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Huijintong Power EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603577

Qingdao Huijintong Power EquipmentLtd

Engages in the manufacture and sale of various galvanized and painted steel structures in China.

Proven track record slight.

Market Insights

Community Narratives