As global markets navigate economic uncertainties and inflationary pressures, with consumer sentiment hitting a 12-year low and trade policy concerns weighing heavily on stocks, investors are increasingly looking towards Asia for opportunities. In this challenging environment, identifying promising small-cap stocks that demonstrate resilience and potential growth can offer diversification benefits and the chance to capitalize on emerging market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Chongqing Machinery & Electric | 25.84% | 7.97% | 18.73% | ★★★★★★ |

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Konishi | 0.16% | -0.13% | 13.54% | ★★★★★★ |

| Hunan Hansen Pharmaceutical | 3.80% | 3.54% | 8.79% | ★★★★★★ |

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★☆ |

| Shanghai SK Automation TechnologyLtd | 42.24% | 36.10% | 2.28% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Yibin City Commercial Bank | 136.73% | 11.29% | 20.39% | ★★★★★☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

OSL Group (SEHK:863)

Simply Wall St Value Rating: ★★★★★☆

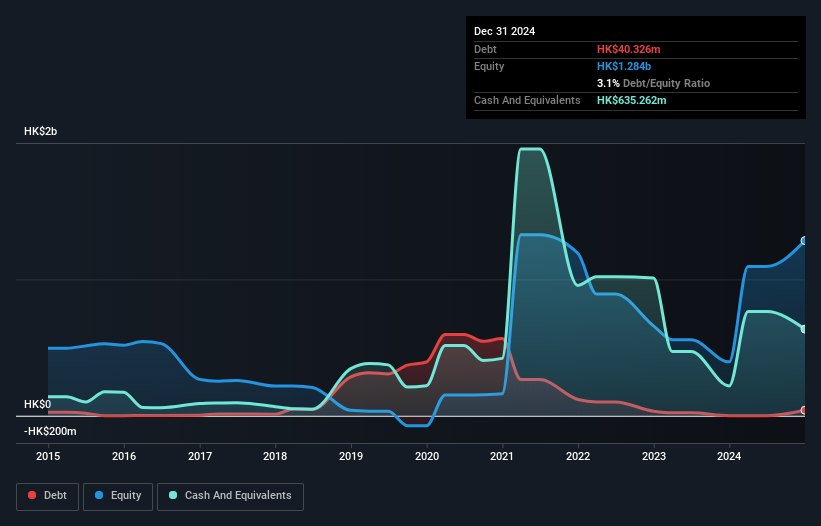

Overview: OSL Group Limited is an investment holding company that operates in the digital assets and blockchain platform sector across Hong Kong and Singapore, with a market capitalization of approximately HK$6.15 billion.

Operations: The company generates revenue primarily from its digital assets and blockchain platform business, amounting to HK$374.75 million.

OSL Group, a burgeoning player in the digital asset space, recently reported a significant turnaround with net income of HK$47.65 million for 2024, contrasting sharply with a loss of HK$263.86 million the previous year. This shift is largely driven by increased demand for digital asset trading and ETFs, alongside strategic team expansion and operational efficiency improvements. The company's balance sheet has strengthened over time, moving from negative to positive shareholder equity within five years. OSL's new wealth management platform in Hong Kong positions it well within the growing digital assets market, enhancing its appeal to institutional investors globally.

- Take a closer look at OSL Group's potential here in our health report.

Gain insights into OSL Group's past trends and performance with our Past report.

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Value Rating: ★★★★★★

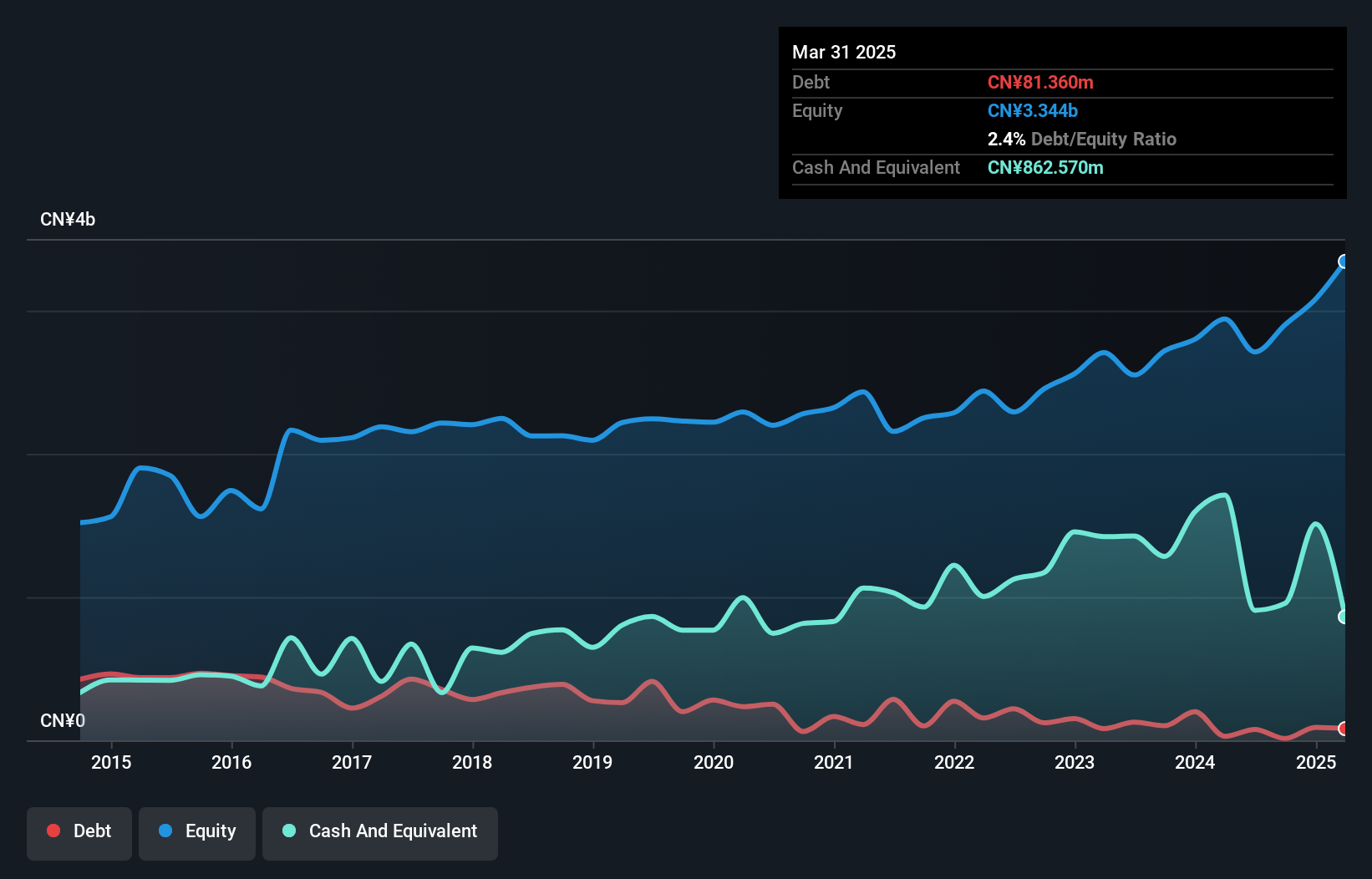

Overview: Henan Lingrui Pharmaceutical Co., Ltd. is engaged in the production and sale of medicines in China, with a market capitalization of approximately CN¥12.73 billion.

Operations: Henan Lingrui Pharmaceutical generates revenue primarily from the production and sale of medicines within China. The company has a market capitalization of approximately CN¥12.73 billion.

Henan Lingrui Pharmaceutical, a nimble player in the pharma sector, shows promising financial health with earnings surging 28.4% over the past year, outpacing the industry's -0.05%. The company trades at a notable 35.1% discount to its estimated fair value, suggesting potential upside for investors. With high-quality earnings and a debt-to-equity ratio slashed from 9% to just 0.4% over five years, it boasts robust financial management. Its free cash flow is positive and cash exceeds total debt, indicating solid liquidity and operational efficiency likely underpinning its growth trajectory in an evolving market landscape.

Shanghai Sunglow Packaging TechnologyLtd (SHSE:603499)

Simply Wall St Value Rating: ★★★★★☆

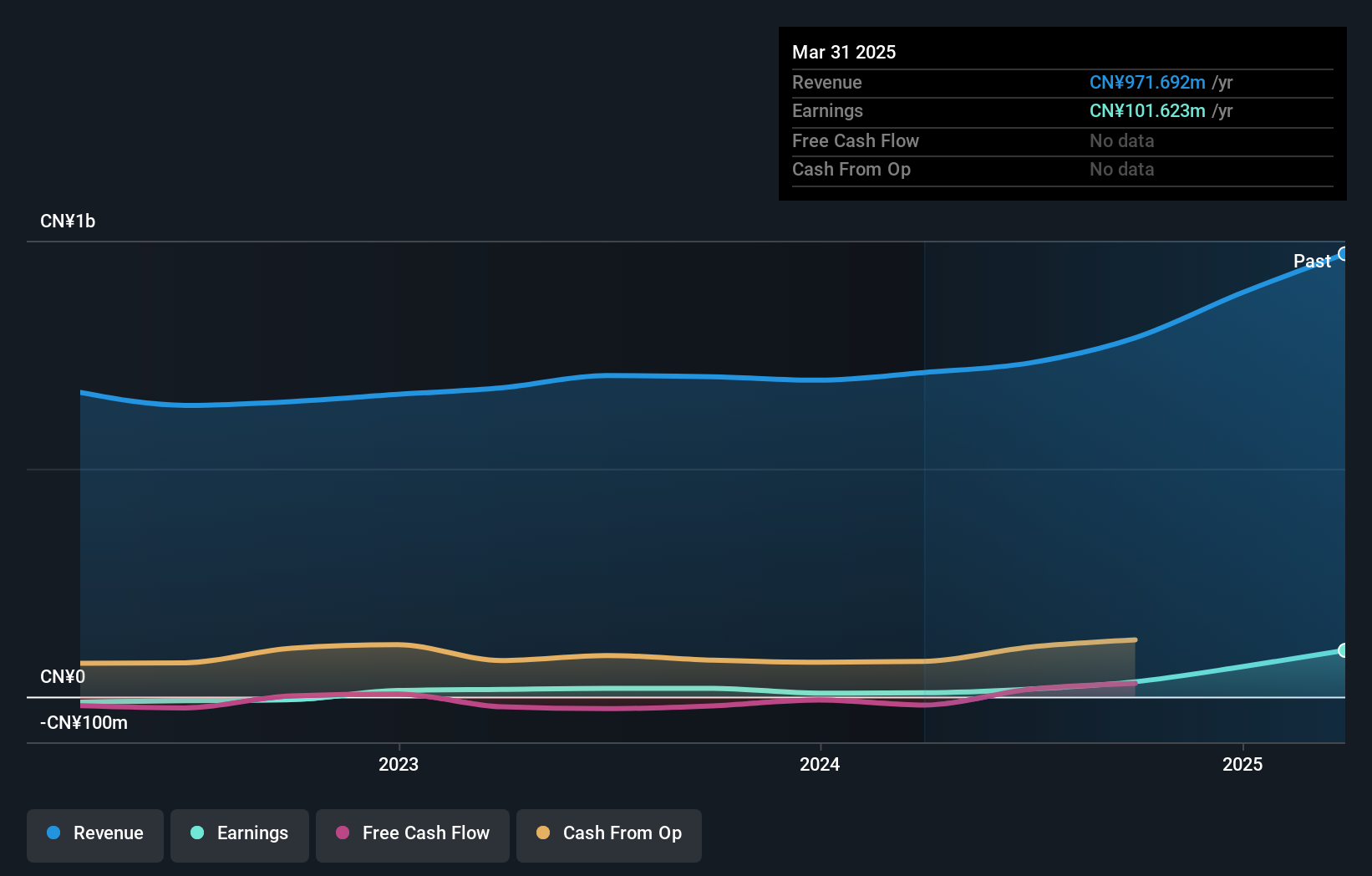

Overview: Shanghai Sunglow Packaging Technology Co., Ltd focuses on the research, development, manufacture, and sale of packaging and printing products in China with a market capitalization of CN¥5.77 billion.

Operations: Shanghai Sunglow generates revenue primarily from the sale of packaging and printing products. The company's financial performance is reflected in its market capitalization of CN¥5.77 billion.

Sunglow Packaging, a nimble player in the packaging sector, has demonstrated impressive earnings growth of 78% over the past year, outpacing the industry average of 20%. The company's net debt to equity ratio stands at a satisfactory 22.6%, indicating prudent financial management. Additionally, interest obligations are well-covered with EBIT covering interest payments 4.2 times over. Despite an increase in debt to equity from 0% to 35.4% over five years, Sunglow's high-quality earnings and positive free cash flow suggest robust operational efficiency and potential for sustained performance in its niche market segment.

- Get an in-depth perspective on Shanghai Sunglow Packaging TechnologyLtd's performance by reading our health report here.

Learn about Shanghai Sunglow Packaging TechnologyLtd's historical performance.

Turning Ideas Into Actions

- Reveal the 2624 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603499

Shanghai Sunglow Packaging TechnologyLtd

Engages in the research, development, manufacture, and sale of packaging and printing products in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives