Undiscovered Gems In Global Featuring 3 Promising Small Cap Stocks

Reviewed by Simply Wall St

In the face of ongoing recession worries and trade policy uncertainties, global markets have experienced notable declines, with key indices like the S&P 500 and Russell 2000 posting consecutive weeks of losses. Despite these challenges, easing inflation in the U.S. offers a glimmer of hope for investors seeking opportunities in small-cap stocks that can potentially thrive under such volatile conditions. Identifying promising small-cap stocks often involves looking for companies with strong fundamentals and growth potential that may be overlooked amid broader market turbulence.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Yibin City Commercial Bank | 94.70% | 10.75% | 23.87% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Liaoning Fu-An Heavy IndustryLtd (SHSE:603315)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Liaoning Fu-An Heavy Industry Co., Ltd specializes in the production and sale of steel castings within China, with a market capitalization of approximately CN¥5.13 billion.

Operations: The company generates revenue primarily from the production and sale of steel castings. It has a market capitalization of approximately CN¥5.13 billion.

Liaoning Fu-An Heavy Industry Ltd. has shown impressive earnings growth of 59.5% over the past year, outpacing the broader Metals and Mining industry, which saw a decline of 1.1%. Despite this robust performance, its earnings have decreased by an average of 13.1% annually over the last five years. The company's debt-to-equity ratio increased to 33%, up from 18.4% five years ago, yet it maintains a satisfactory net debt-to-equity ratio of 22.6%. While free cash flow remains negative, its profitability ensures that interest coverage isn't a concern for now amidst share price volatility in recent months.

Shenyang Xingqi PharmaceuticalLtd (SZSE:300573)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyang Xingqi Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of ophthalmic drugs in China with a market capitalization of CN¥12.95 billion.

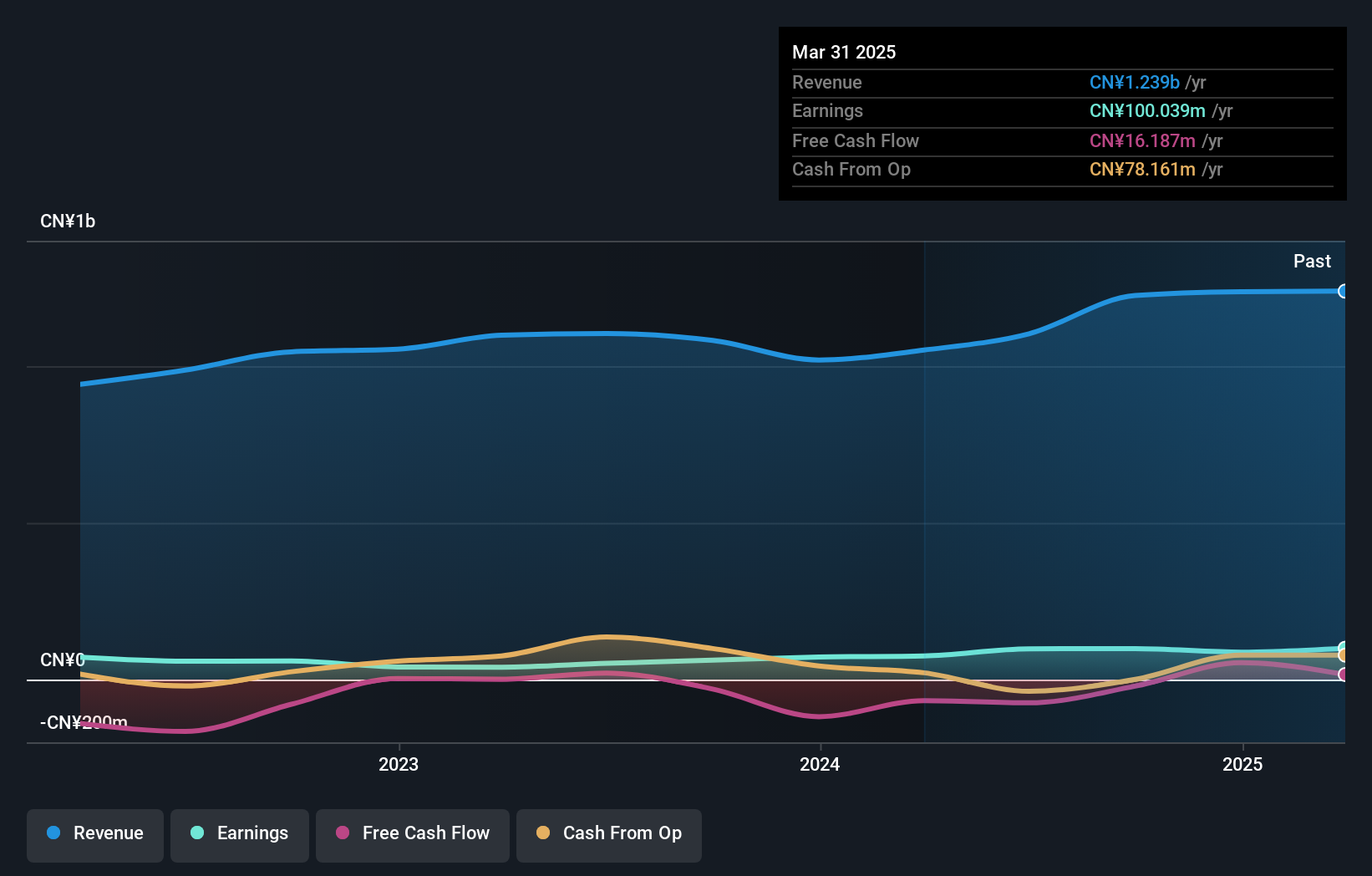

Operations: Xingqi Pharmaceutical generates revenue primarily through the sale of ophthalmic drugs. The company's financial performance includes a gross profit margin that has shown variability, reflecting changes in production costs and pricing strategies.

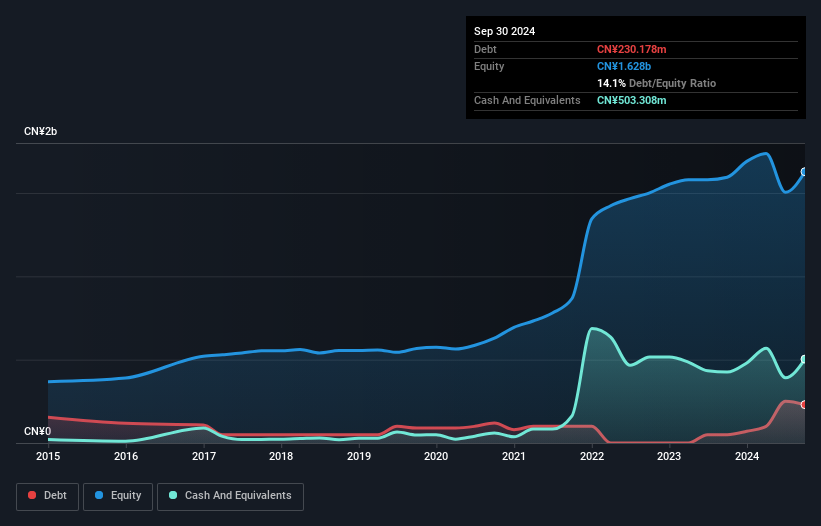

With a remarkable earnings growth of 82.3% over the past year, Shenyang Xingqi Pharmaceutical Ltd. is making waves in the pharmaceuticals sector, outpacing an industry average decline of 2.8%. The company has high-quality earnings and more cash than its total debt, which suggests financial stability. Over five years, its debt-to-equity ratio improved from 15.9% to 14.1%, indicating prudent financial management. Free cash flow remains positive, reinforcing operational efficiency and potential for reinvestment or expansion initiatives in the future. This small player seems well-positioned within its industry landscape despite broader challenges faced by peers.

Shanghai Hajime Advanced Material Technology (SZSE:301000)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Hajime Advanced Material Technology Co., Ltd. operates in the advanced materials sector with a focus on machinery and industrial equipment, and has a market capitalization of CN¥9.47 billion.

Operations: Shanghai Hajime Advanced Material Technology generates revenue primarily from its machinery and industrial equipment segment, totaling CN¥688.37 million.

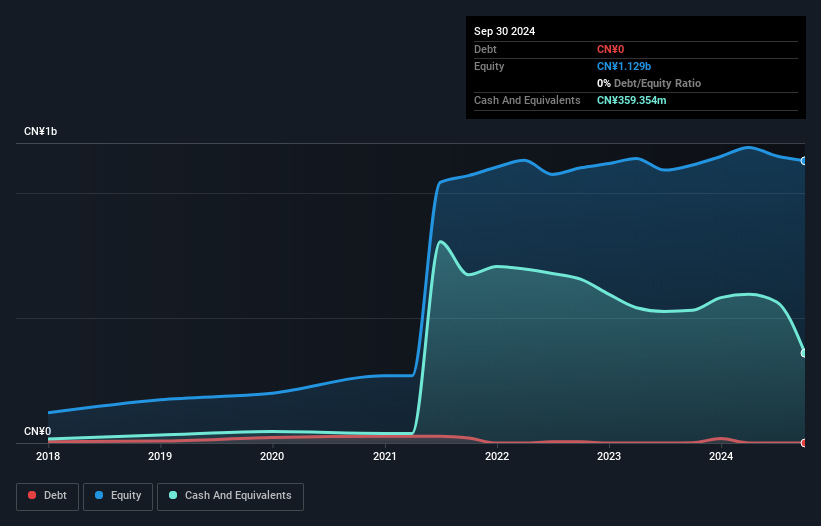

Hajime Advanced Material Technology stands out with impressive earnings growth of 58.8% over the past year, surpassing the Chemicals industry's -5.5%. The company shows a high level of non-cash earnings and is completely debt-free, a notable improvement from five years ago when its debt to equity ratio was 9.5%. Despite its highly volatile share price in recent months, Hajime's forecasted annual earnings growth of 28.67% suggests potential for future value creation within its sector. However, it's worth noting that free cash flow remains negative, indicating areas needing attention as the company navigates expansion opportunities.

Make It Happen

- Explore the 3237 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301000

Shanghai Hajime Advanced Material Technology

Shanghai Hajime Advanced Material Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives