March 2025's Leading Asian Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

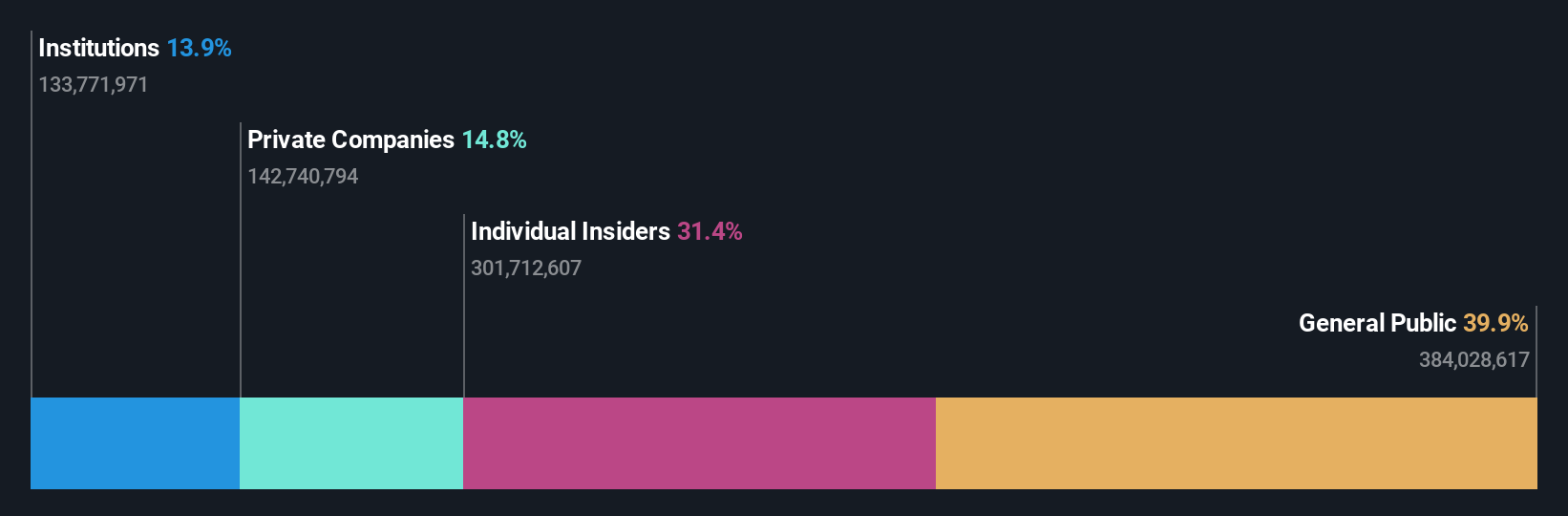

As global markets face uncertainties with trade policies and economic transitions, the Asian market has shown resilience, particularly in areas where local economies are taking proactive steps to bolster growth. In this environment, companies with strong insider ownership often stand out as they tend to align management's interests with those of shareholders, potentially leading to more stable and focused growth strategies.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| NEXTIN (KOSDAQ:A348210) | 12.4% | 27% |

| Laopu Gold (SEHK:6181) | 36.4% | 44.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 92.8% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

We're going to check out a few of the best picks from our screener tool.

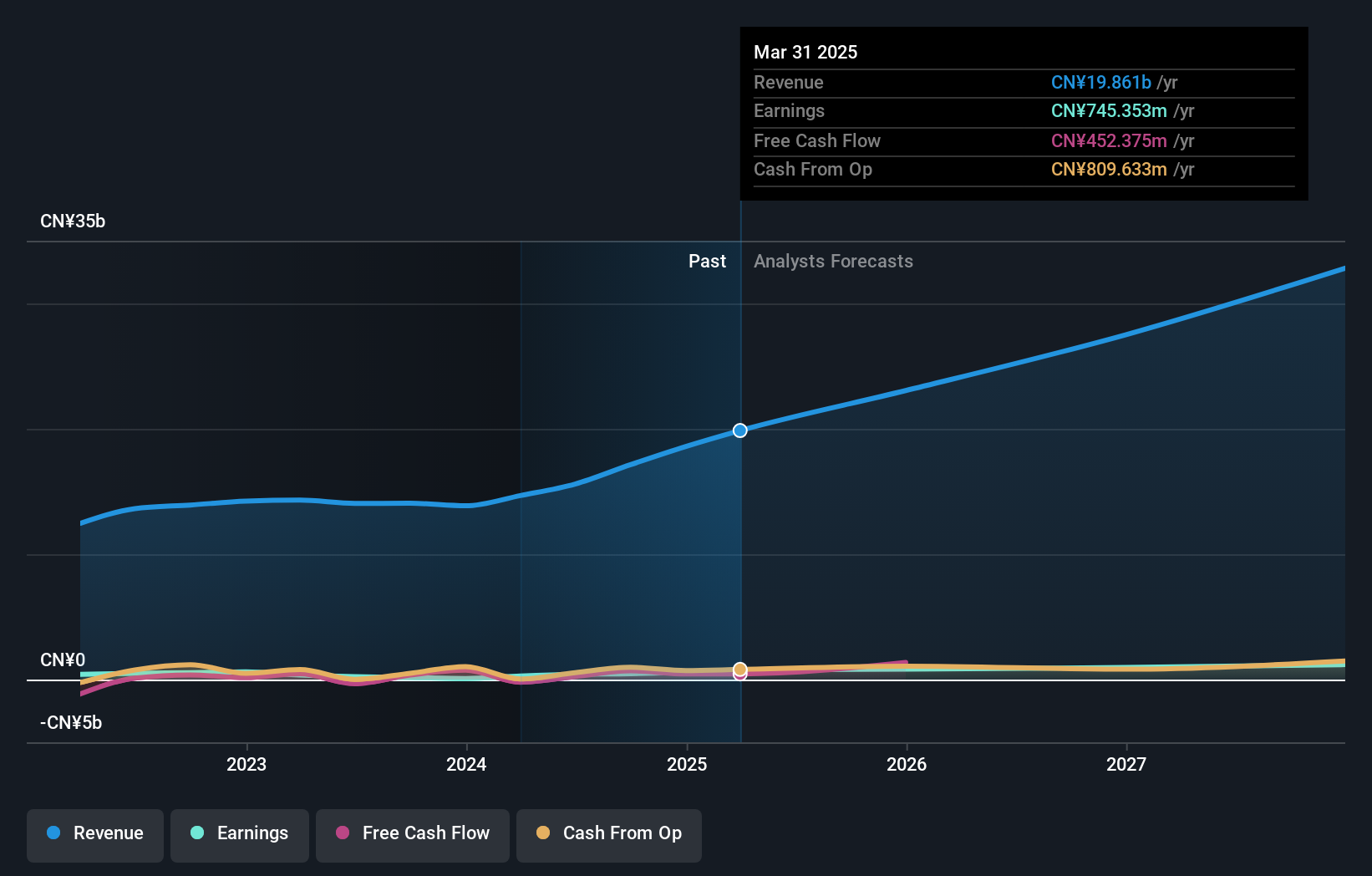

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quectel Wireless Solutions Co., Ltd. is involved in the research, development, design, production, and sales of wireless communication modules and solutions globally, with a market cap of CN¥22.50 billion.

Operations: Quectel Wireless Solutions Co., Ltd. generates revenue through its global operations in the research, development, design, production, and sales of wireless communication modules and solutions.

Insider Ownership: 18.5%

Earnings Growth Forecast: 31.2% p.a.

Quectel Wireless Solutions demonstrates strong growth potential with its earnings forecasted to grow significantly at 31.2% annually, surpassing the broader Chinese market's expected growth. Despite a highly volatile share price recently, Quectel is trading at a substantial discount compared to its estimated fair value. The company has been actively launching innovative products, such as advanced antennas and GNSS modules, enhancing its position in IoT and wireless connectivity markets without significant insider trading activities over recent months.

- Click here to discover the nuances of Quectel Wireless Solutions with our detailed analytical future growth report.

- Our expertly prepared valuation report Quectel Wireless Solutions implies its share price may be lower than expected.

Hoshine Silicon Industry (SHSE:603260)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hoshine Silicon Industry Co., Ltd. is involved in the production and sale of silicon-based materials both in China and internationally, with a market cap of CN¥65.12 billion.

Operations: The company generates revenue through the production and sale of silicon-based materials across domestic and international markets.

Insider Ownership: 32.6%

Earnings Growth Forecast: 32.8% p.a.

Hoshine Silicon Industry is poised for growth, with earnings expected to grow significantly at 32.8% annually, outpacing the broader Chinese market. Despite a lower profit margin of 7% compared to last year and a high P/E ratio of 34.4x, it remains below the CN market average. Recent inclusion in major indices like SSE 180 highlights its growing prominence. However, its dividend yield is not well covered by free cash flows and debt coverage by operating cash flow is inadequate.

- Unlock comprehensive insights into our analysis of Hoshine Silicon Industry stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hoshine Silicon Industry shares in the market.

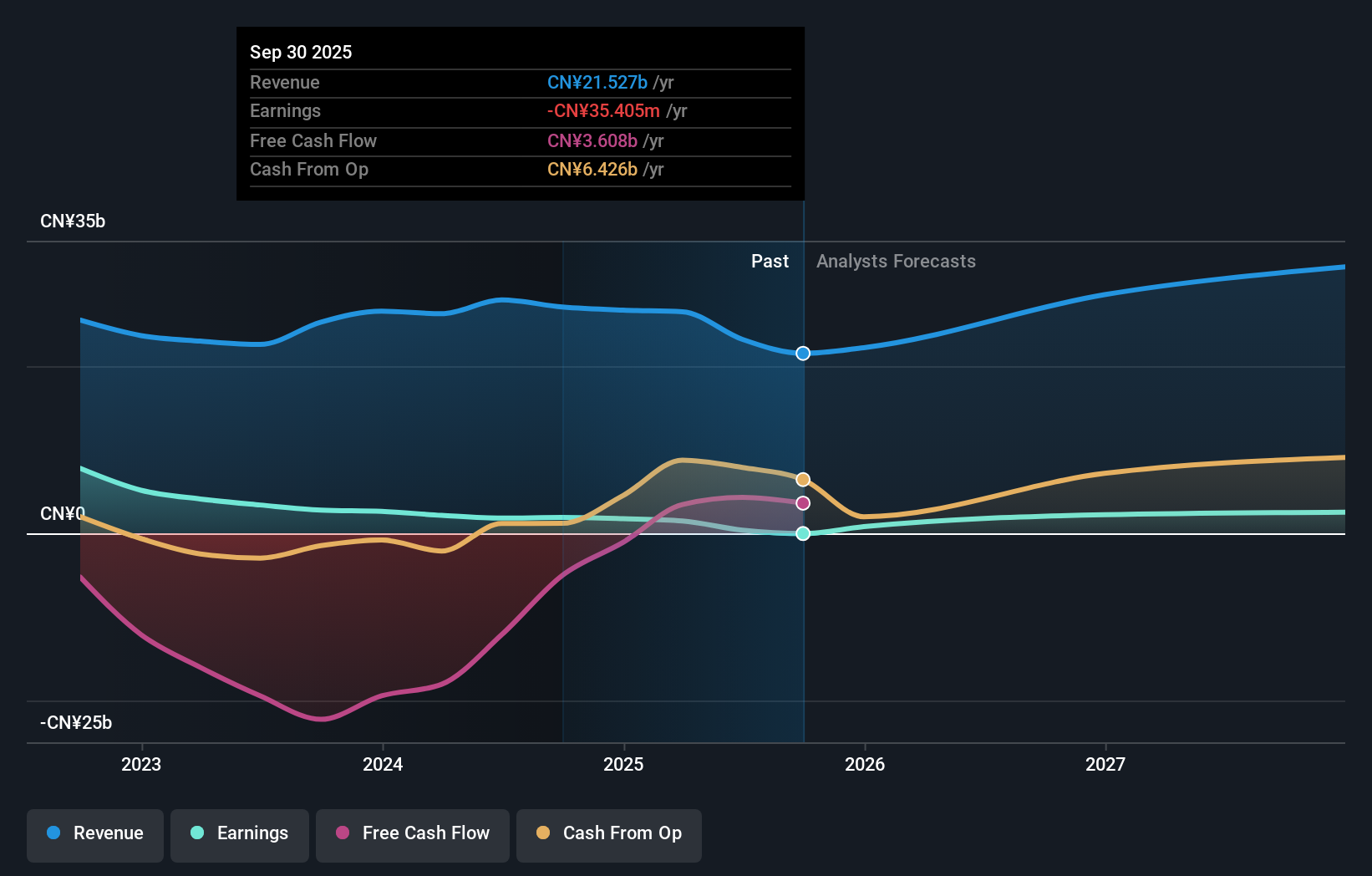

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, provides film products both in China and internationally, with a market cap of CN¥32.67 billion.

Operations: The company generates revenue from its film products segment, both domestically and internationally.

Insider Ownership: 30.8%

Earnings Growth Forecast: 43.2% p.a.

Yunnan Energy New Material shows potential for growth with earnings projected to increase significantly at 43.2% annually, surpassing the broader CN market. However, its return on equity is expected to remain low at 5.3%, and profit margins have decreased from last year’s 23.6% to 7.8%. The stock trades at a discount of 20.6% below estimated fair value, but debt coverage by operating cash flow is weak, posing financial challenges despite high insider ownership stability.

- Navigate through the intricacies of Yunnan Energy New Material with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Yunnan Energy New Material is priced lower than what may be justified by its financials.

Next Steps

- Click this link to deep-dive into the 640 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002812

Yunnan Energy New Material

Offers film products in China and internationally.

Reasonable growth potential with adequate balance sheet.