Amidst a backdrop of easing U.S. inflation and persistent recession worries, global markets have been navigating a complex landscape marked by trade policy uncertainties and fluctuating economic indicators. As major indices like the S&P 500 and Russell 2000 continue to experience negative returns, investors are increasingly seeking opportunities in small-cap stocks that demonstrate resilience and potential for growth despite broader market challenges. Identifying such hidden gems often involves looking for companies with strong fundamentals, innovative strategies, or unique market positions that can thrive even in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiangxi Jiangnan New Material Technology (SHSE:603124)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangxi Jiangnan New Material Technology Co., Ltd. operates in the field of advanced materials, focusing on the production and development of new material technologies, with a market cap of CN¥10.86 billion.

Operations: The company generates revenue through its advanced materials segment, with a focus on new material technologies. Its financial performance is highlighted by a market capitalization of CN¥10.86 billion.

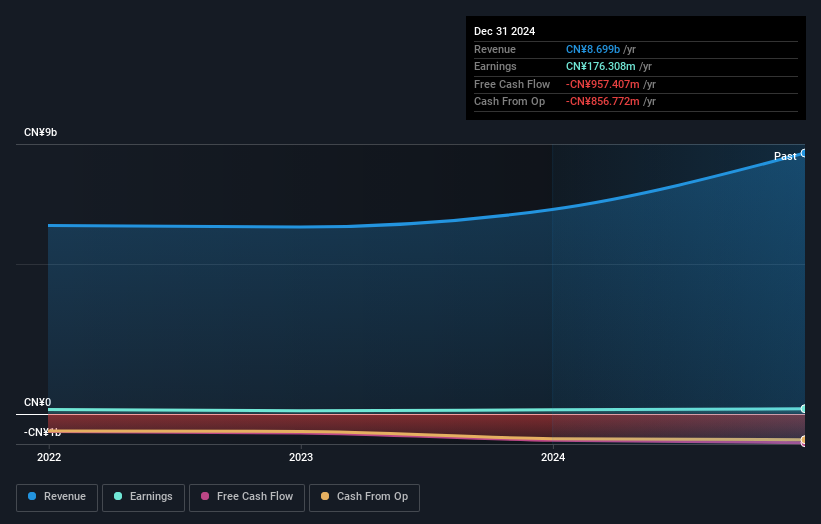

Jiangxi Jiangnan New Material Technology, a small cap player in the metals and mining sector, recently completed an IPO raising CNY 384.04 million. The company reported sales of CNY 8.70 billion for the year ending December 2024 with net income reaching CNY 176.31 million and basic earnings per share at CNY 1.61. Over the past year, earnings grew by a robust 24%, outpacing the industry average of -1%. Its debt to equity ratio improved from 78.9% to a more manageable 65.4% over five years, while interest payments are well covered at a healthy EBIT coverage of 16x, suggesting financial stability despite illiquid shares and negative free cash flow trends.

MITSUI E&S (TSE:7003)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MITSUI E&S Co., Ltd. operates as a provider of marine propulsion systems and other engineering solutions globally, with a market capitalization of ¥195.62 billion.

Operations: MITSUI E&S generates revenue primarily from its Marine Propulsion Systems segment, which contributes ¥133.82 billion, followed by Peripheral Businesses at ¥85.66 billion and Logistics Systems at ¥58.79 billion. The New Business Development segment adds another ¥39.75 billion to the company's revenue streams.

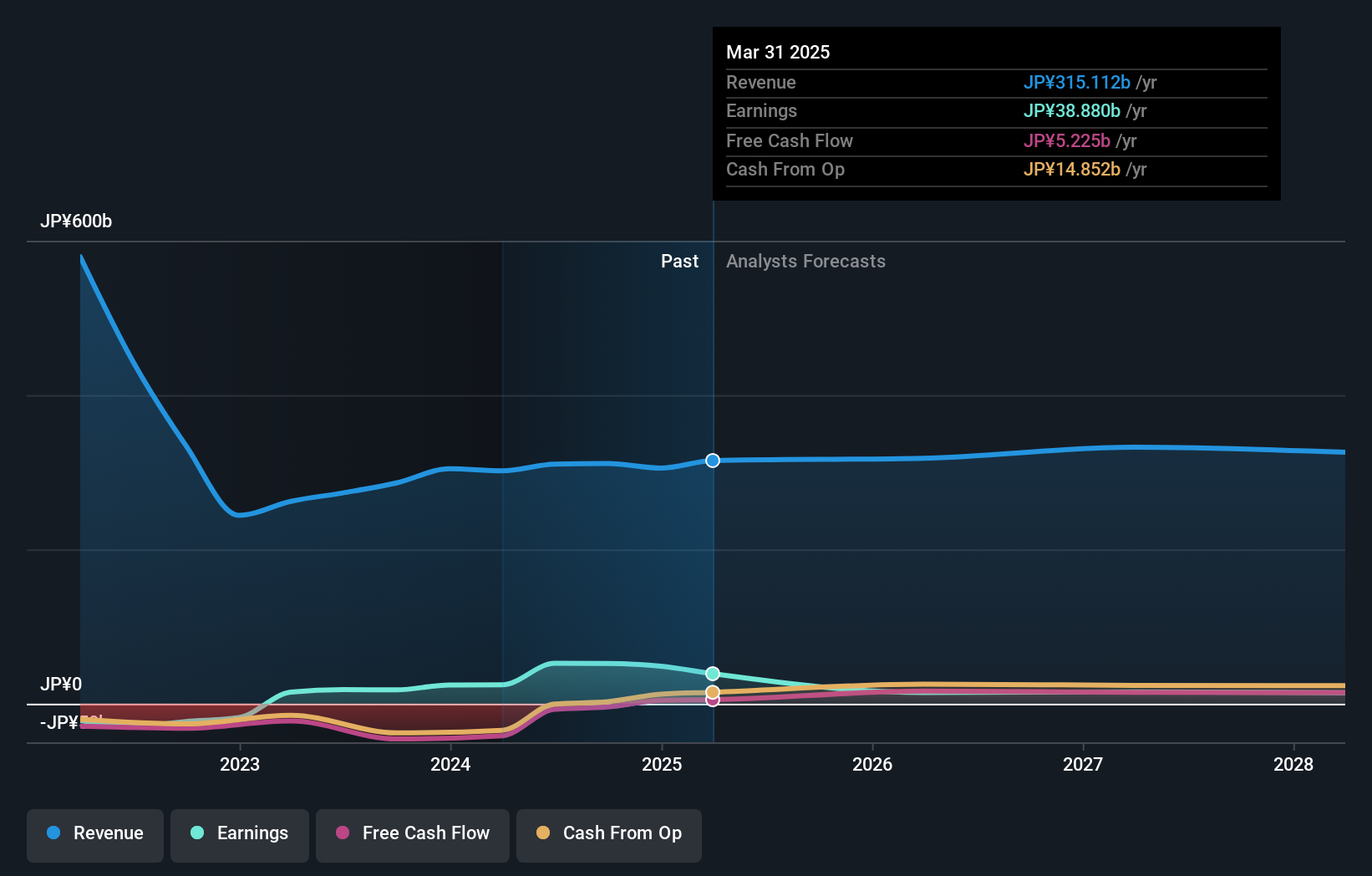

Mitsui E&S, a notable player in the machinery industry, has shown impressive earnings growth of 100% over the past year, significantly outpacing the industry's 4%. Despite a high net debt to equity ratio of 41%, its interest payments are well covered by EBIT at an 8.1x coverage. The company recently revised its profit forecast upwards for fiscal year ending March 2025, expecting ¥38 billion profit attributable to owners compared to previous guidance of ¥35 billion. Additionally, it announced an increased dividend forecast from ¥18 to ¥20 per share due to improved profitability expectations.

Nanto Bank (TSE:8367)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Nanto Bank, Ltd., along with its subsidiaries, operates in banking, securities, leasing, and credit guarantee sectors in Japan and has a market cap of ¥118.87 billion.

Operations: Nanto Bank generates revenue primarily from its banking, securities, leasing, and credit guarantee operations in Japan. The company's net profit margin is a key financial metric to consider when assessing its profitability.

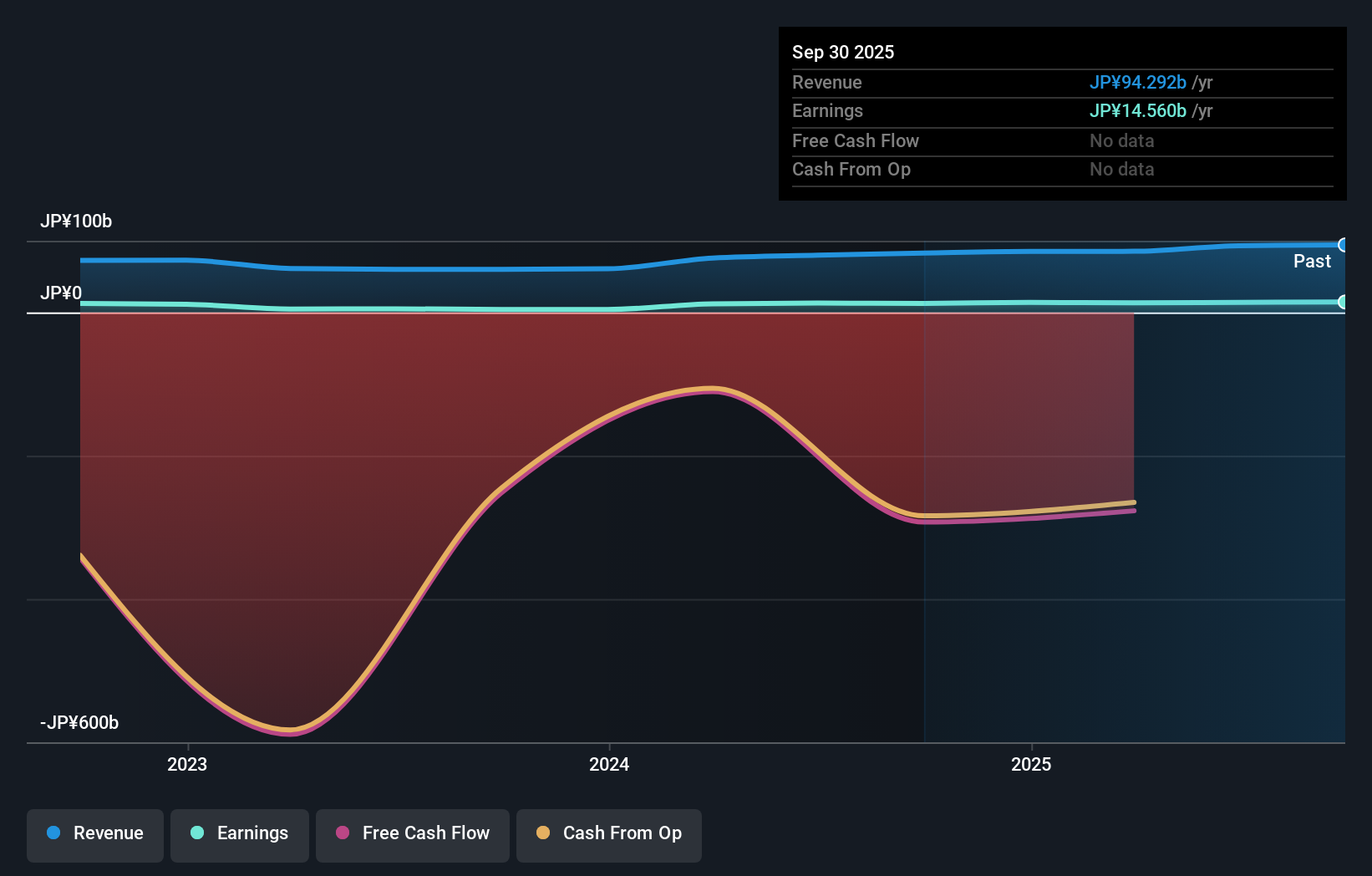

Nanto Bank stands out with total assets of ¥6,844.5 billion and equity of ¥290.8 billion, highlighting its substantial foundation in the banking sector. Deposits reach ¥5,967.3 billion while loans are at ¥4,391.6 billion with a net interest margin of 0.7%. The bank's allowance for bad loans is insufficient at 1.4%, yet it has shown impressive earnings growth of 245% over the past year, significantly surpassing the industry average of 21%. Primarily funded by low-risk customer deposits accounting for 91% of liabilities, Nanto trades at a discount to its estimated fair value by about 28%.

- Dive into the specifics of Nanto Bank here with our thorough health report.

Understand Nanto Bank's track record by examining our Past report.

Where To Now?

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3228 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanto Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8367

Nanto Bank

Engages in banking, securities, leasing, and credit guarantee businesses in Japan.

Solid track record and good value.

Market Insights

Community Narratives