Global markets have recently experienced fluctuations due to tariff uncertainties and mixed economic indicators, with U.S. stocks ending the week lower despite some recovery in manufacturing activity. Amidst these market dynamics, penny stocks present intriguing possibilities for investors seeking growth opportunities in smaller or newer companies. Though often considered niche, these investments can offer significant potential when backed by strong financial health, as we explore through three promising examples that combine balance sheet resilience with long-term potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,698 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Jilin Jiutai Rural Commercial Bank (SEHK:6122)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jilin Jiutai Rural Commercial Bank Corporation Limited offers commercial banking and financial services to personal, corporate, and small business customers in China, with a market cap of HK$2.31 billion.

Operations: Jilin Jiutai Rural Commercial Bank Corporation Limited has not reported specific revenue segments.

Market Cap: HK$2.31B

Jilin Jiutai Rural Commercial Bank Corporation Limited, with a market cap of HK$2.31 billion, offers commercial banking services in China. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a moderate Assets to Equity ratio of 13.7x and primarily low-risk funding through customer deposits. The bank's bad loans ratio is high at 2.4%, but it has a sufficient allowance for these loans at 154%. Its share price has been highly volatile recently, although its weekly volatility has stabilized over the past year. The management team is experienced with an average tenure of 9.5 years.

- Get an in-depth perspective on Jilin Jiutai Rural Commercial Bank's performance by reading our balance sheet health report here.

- Gain insights into Jilin Jiutai Rural Commercial Bank's historical outcomes by reviewing our past performance report.

Zhejiang Dongwang Times Technology (SHSE:600052)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Dongwang Times Technology Co., Ltd. operates in China, providing energy-saving services and film and television culture solutions, with a market cap of CN¥3.77 billion.

Operations: The company's revenue segment is solely derived from China, amounting to CN¥412.81 million.

Market Cap: CN¥3.77B

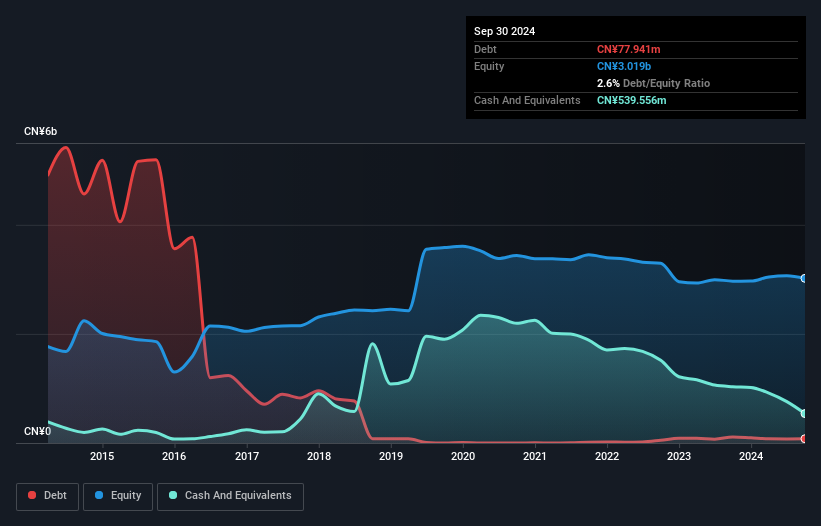

Zhejiang Dongwang Times Technology, with a market cap of CN¥3.77 billion, has recently achieved profitability, though its earnings have been influenced by large one-off gains of CN¥82.8 million. The company's short-term assets (CN¥1.4 billion) comfortably cover both its short and long-term liabilities, reflecting strong liquidity management. Despite a low Return on Equity at 5%, the company holds more cash than debt and effectively covers interest payments with profits. Its Price-to-Earnings ratio of 25.2x is below the Chinese market average, suggesting potential value for investors mindful of its past earnings volatility and dividend sustainability concerns.

- Click to explore a detailed breakdown of our findings in Zhejiang Dongwang Times Technology's financial health report.

- Understand Zhejiang Dongwang Times Technology's track record by examining our performance history report.

Sichuan Hebang Biotechnology (SHSE:603077)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Hebang Biotechnology Corporation Limited operates in the agricultural, chemical, and new material sectors with a market cap of CN¥15.57 billion.

Operations: Revenue Segments: No Revenue Segments Reported

Market Cap: CN¥15.57B

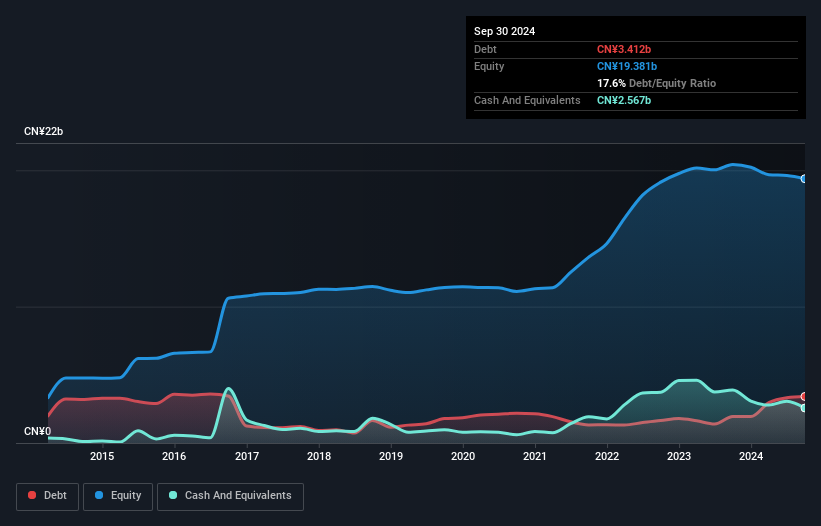

Sichuan Hebang Biotechnology, with a market cap of CN¥15.57 billion, faces challenges due to negative earnings growth over the past year, contrasting with its five-year average growth of 18.7% annually. Despite this, it maintains high-quality earnings and satisfactory debt levels with a net debt to equity ratio of 4.4%. The company's short-term assets (CN¥10.8 billion) exceed both short and long-term liabilities, indicating solid liquidity management. However, its operating cash flow is negative and recent profit margins have decreased from 15.6% to 5.3%. Recent share buybacks totaling CNY100 million suggest confidence in future prospects despite current financial pressures.

- Click here and access our complete financial health analysis report to understand the dynamics of Sichuan Hebang Biotechnology.

- Explore historical data to track Sichuan Hebang Biotechnology's performance over time in our past results report.

Seize The Opportunity

- Unlock more gems! Our Penny Stocks screener has unearthed 5,695 more companies for you to explore.Click here to unveil our expertly curated list of 5,698 Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603077

Sichuan Hebang Biotechnology

Provides agricultural, chemical, and new material products.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives