- China

- /

- Metals and Mining

- /

- SHSE:603028

Shareholders in Jiangsu Safety GroupLtd (SHSE:603028) have lost 53%, as stock drops 12% this past week

While it may not be enough for some shareholders, we think it is good to see the Jiangsu Safety Group Co.,Ltd. (SHSE:603028) share price up 12% in a single quarter. Meanwhile over the last three years the stock has dropped hard. Indeed, the share price is down a tragic 54% in the last three years. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Jiangsu Safety GroupLtd

Jiangsu Safety GroupLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years, Jiangsu Safety GroupLtd saw its revenue grow by 22% per year, compound. That is faster than most pre-profit companies. In contrast, the share price is down 15% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

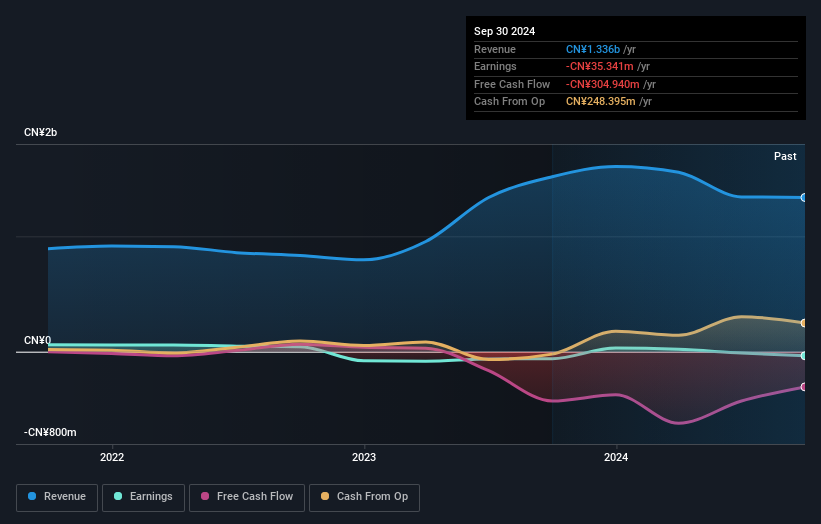

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Jiangsu Safety GroupLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Jiangsu Safety GroupLtd had a tough year, with a total loss of 38% (including dividends), against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Jiangsu Safety GroupLtd has 2 warning signs (and 1 which is concerning) we think you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603028

Jiangsu Safety GroupLtd

Engages in the research, development, production, and sales of wire ropes for elevators and cranes in China and internationally.

Slightly overvalued with imperfect balance sheet.