- China

- /

- Metals and Mining

- /

- SHSE:603028

Not Many Are Piling Into Jiangsu Safety Group Co.,Ltd. (SHSE:603028) Stock Yet As It Plummets 25%

To the annoyance of some shareholders, Jiangsu Safety Group Co.,Ltd. (SHSE:603028) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 50% share price drop.

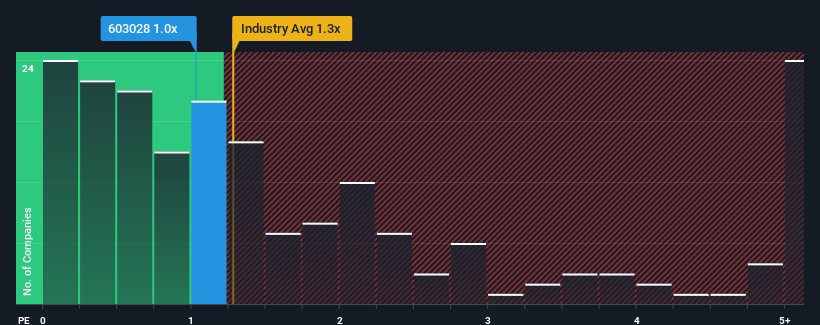

In spite of the heavy fall in price, there still wouldn't be many who think Jiangsu Safety GroupLtd's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in China's Metals and Mining industry is similar at about 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Jiangsu Safety GroupLtd

How Jiangsu Safety GroupLtd Has Been Performing

With revenue growth that's exceedingly strong of late, Jiangsu Safety GroupLtd has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Jiangsu Safety GroupLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Jiangsu Safety GroupLtd?

In order to justify its P/S ratio, Jiangsu Safety GroupLtd would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 63% last year. The strong recent performance means it was also able to grow revenue by 91% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 15%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Jiangsu Safety GroupLtd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Following Jiangsu Safety GroupLtd's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Jiangsu Safety GroupLtd currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Jiangsu Safety GroupLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Jiangsu Safety GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603028

Jiangsu Safety GroupLtd

Engages in the research, development, production, and sales of wire ropes for elevators and cranes in China and internationally.

Low and overvalued.

Market Insights

Community Narratives