- China

- /

- Metals and Mining

- /

- SHSE:603028

Jiangsu Safety Group Co.,Ltd. (SHSE:603028) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Jiangsu Safety Group Co.,Ltd. (SHSE:603028) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 50% share price drop.

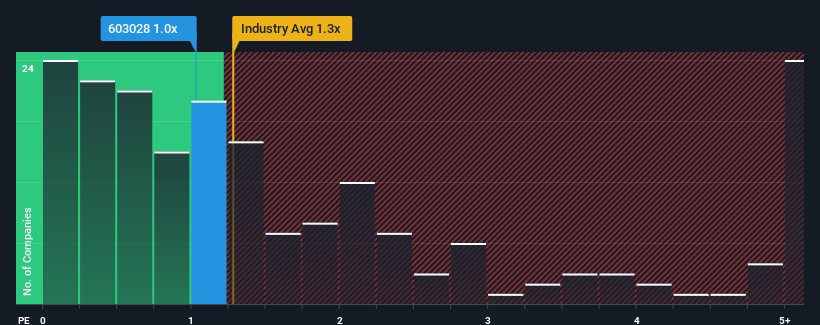

In spite of the heavy fall in price, it's still not a stretch to say that Jiangsu Safety GroupLtd's price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in China, where the median P/S ratio is around 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Jiangsu Safety GroupLtd

How Has Jiangsu Safety GroupLtd Performed Recently?

Recent times have been quite advantageous for Jiangsu Safety GroupLtd as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Jiangsu Safety GroupLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Safety GroupLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Jiangsu Safety GroupLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 63% gain to the company's top line. Pleasingly, revenue has also lifted 91% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 15% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Jiangsu Safety GroupLtd's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Jiangsu Safety GroupLtd's P/S Mean For Investors?

Jiangsu Safety GroupLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't quite envision Jiangsu Safety GroupLtd's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You always need to take note of risks, for example - Jiangsu Safety GroupLtd has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Jiangsu Safety GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603028

Jiangsu Safety GroupLtd

Engages in the research, development, production, and sales of wire ropes for elevators and cranes in China and internationally.

Low and overvalued.

Market Insights

Community Narratives