Shida Shinghwa Advanced Material Group Co., Ltd.'s (SHSE:603026) Price Is Right But Growth Is Lacking After Shares Rocket 25%

Shida Shinghwa Advanced Material Group Co., Ltd. (SHSE:603026) shares have continued their recent momentum with a 25% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

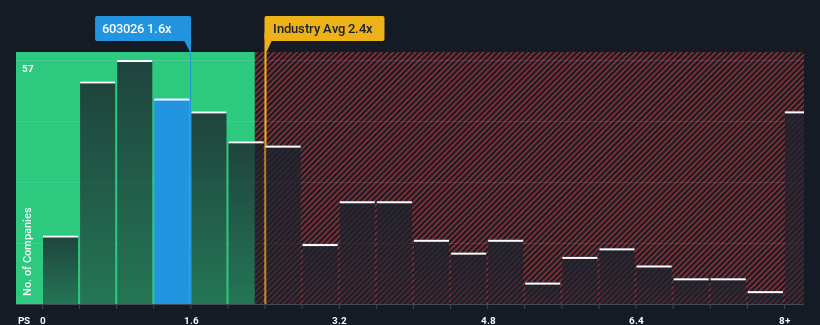

Although its price has surged higher, Shida Shinghwa Advanced Material Group's price-to-sales (or "P/S") ratio of 1.6x might still make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2.4x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shida Shinghwa Advanced Material Group

How Has Shida Shinghwa Advanced Material Group Performed Recently?

Shida Shinghwa Advanced Material Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Shida Shinghwa Advanced Material Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shida Shinghwa Advanced Material Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

In light of this, it's understandable that Shida Shinghwa Advanced Material Group's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Shida Shinghwa Advanced Material Group's P/S

Shida Shinghwa Advanced Material Group's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Shida Shinghwa Advanced Material Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Shida Shinghwa Advanced Material Group with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Shida Shinghwa Advanced Material Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603026

Shida Shinghwa Advanced Material Group

Shida Shinghwa Advanced Material Group Co., Ltd.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026