- China

- /

- Metals and Mining

- /

- SHSE:601969

Exploring Hidden Opportunities With Three Undiscovered Gems

Reviewed by Simply Wall St

In the current climate, global markets are experiencing volatility with major indices like the S&P 500 facing declines amid geopolitical tensions and consumer spending concerns. Despite these challenges, small-cap stocks often present unique opportunities as they can be less impacted by broader market sentiment and offer potential growth through innovation and niche market positions. In this environment, a good stock might be characterized by strong fundamentals, resilience in uncertain economic conditions, and the ability to capitalize on emerging trends or sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallantt Ispat | 15.54% | 34.24% | 41.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Bengal & Assam | 4.72% | -3.69% | 46.32% | ★★★★★☆ |

| Rir Power Electronics | 21.19% | 21.54% | 38.94% | ★★★★★☆ |

| Kalyani Investment | NA | 25.45% | 12.48% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Monarch Networth Capital | 8.98% | 32.34% | 49.29% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Launch Tech (SEHK:2488)

Simply Wall St Value Rating: ★★★★★☆

Overview: Launch Tech Company Limited, along with its subsidiaries, offers products and services to the automotive aftermarket and automobile industry both in China and internationally, with a market cap of HK$3.91 billion.

Operations: Launch Tech generates revenue primarily from the automotive aftermarket and automobile industry. The company's financial performance is reflected in its market cap of HK$3.91 billion.

Launch Tech, a small cap player in the auto components sector, is navigating challenging waters with a net profit margin of 13.7%, down from last year's 26.1%. Despite this setback, it earns more interest than it pays, indicating solid coverage of interest payments. The company's debt to equity ratio rose from 24.1% to 31.2% over five years, yet it holds more cash than total debt—an encouraging sign of financial stability. Recently initiating share repurchases for up to 16 million class H shares aims to boost earnings per share and net asset value per share using surplus funds and undistributed profits.

- Click to explore a detailed breakdown of our findings in Launch Tech's health report.

Assess Launch Tech's past performance with our detailed historical performance reports.

Hainan Mining (SHSE:601969)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hainan Mining Co., Ltd. is engaged in the mining, processing, and sale of iron ore in China with a market capitalization of CN¥13.15 billion.

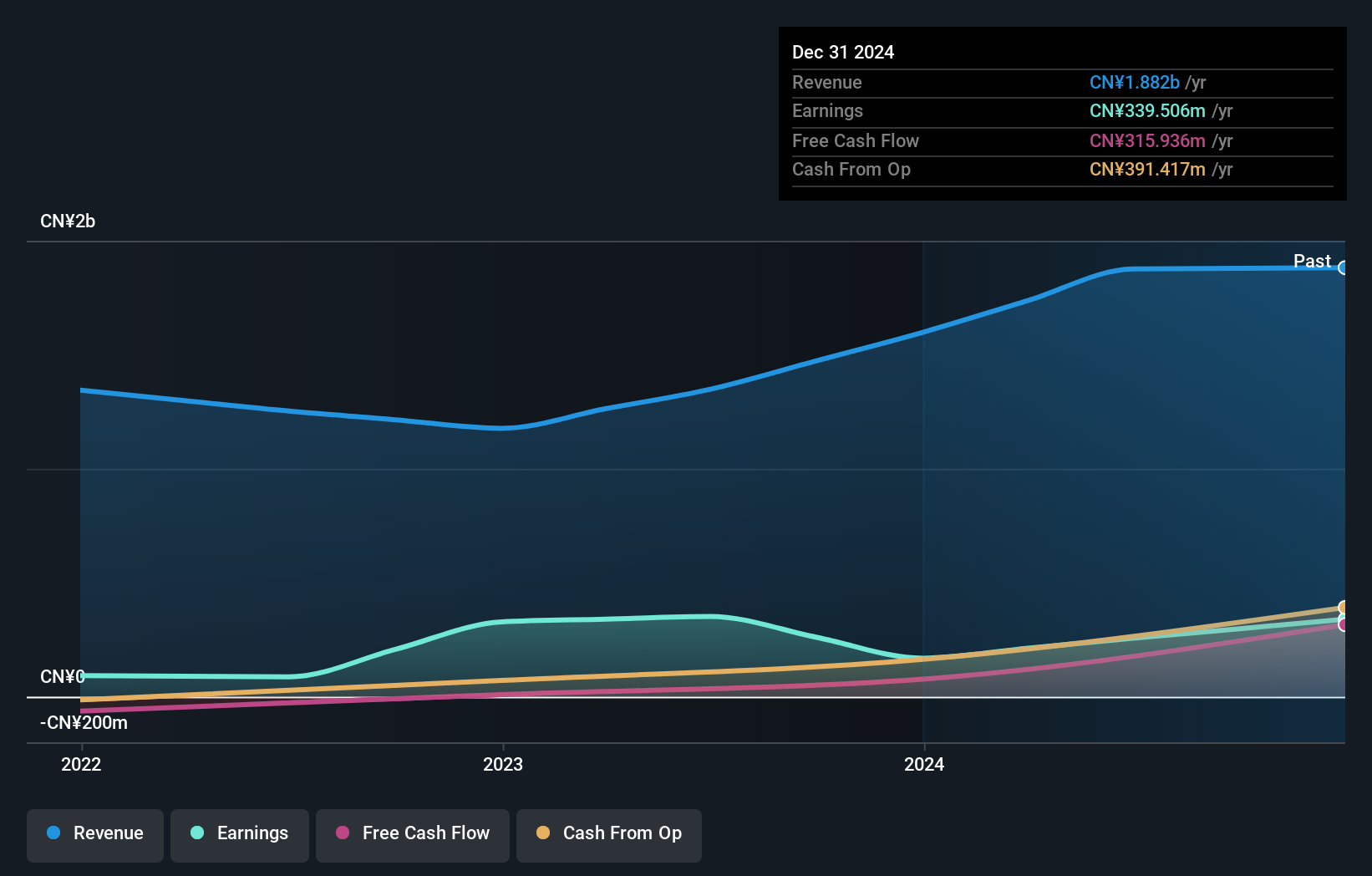

Operations: The primary revenue stream for Hainan Mining comes from the sale of iron ore. The company's net profit margin has shown significant fluctuations over recent periods.

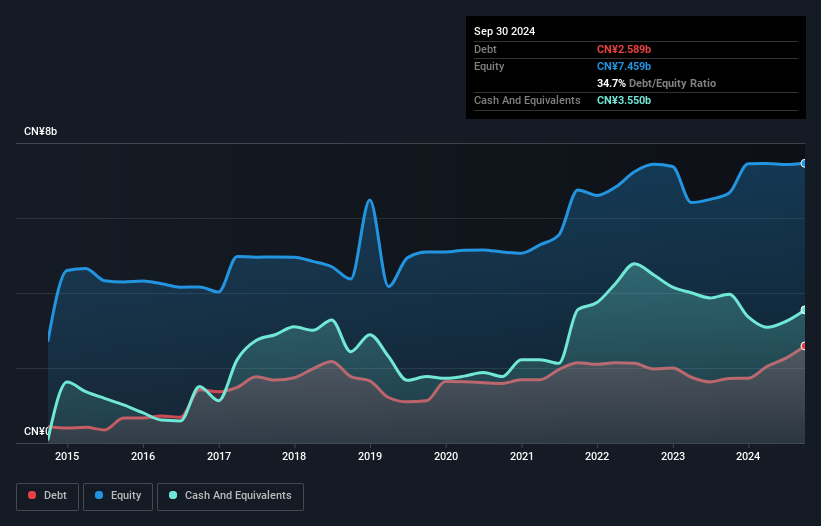

Hainan Mining, a smaller player in the metals and mining sector, has shown impressive growth with earnings up 39% last year, outpacing the industry average. The company's debt to equity ratio rose from 22.1% to 34.7% over five years, but it holds more cash than total debt, offering some financial stability. Its price-to-earnings ratio of 19.7x is attractive compared to the broader CN market's 38x. Recently, Hainan Mining announced a buyback program worth CNY 150 million to reduce capital while planning further repurchases pending shareholder approval in March 2025.

- Click here to discover the nuances of Hainan Mining with our detailed analytical health report.

Evaluate Hainan Mining's historical performance by accessing our past performance report.

Kontour (Xi'an) Medical Technology (SHSE:688314)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kontour (Xi'an) Medical Technology Co., Ltd. operates in the medical technology sector, focusing on innovative healthcare solutions, with a market cap of CN¥2.30 billion.

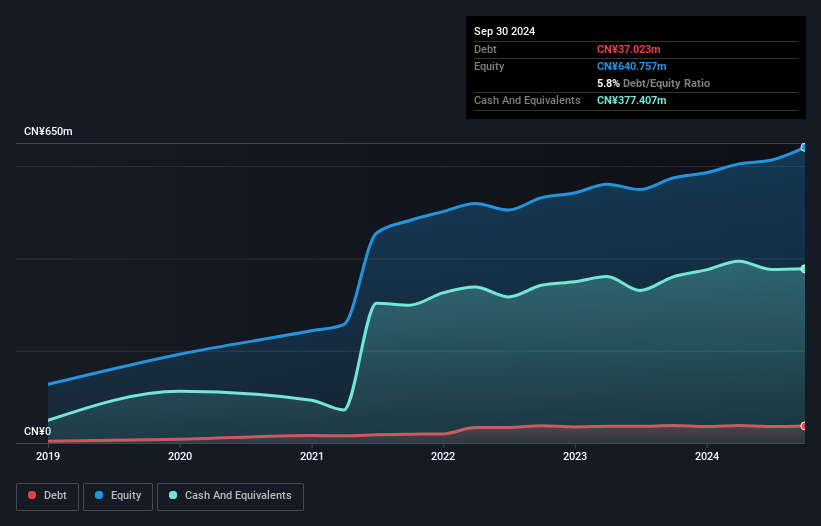

Operations: Kontour generates revenue primarily from its medical technology products, contributing to a market cap of CN¥2.30 billion.

Kontour Medical Technology, a small player in the medical equipment sector, reported sales of CN¥32K for 2024, up slightly from CN¥27.5K the previous year. Despite having negative earnings growth at -100%, its high-quality earnings and positive free cash flow are noteworthy. The company seems financially stable with more cash than total debt and interest coverage not being a concern. However, revenue remains below US$1 million, indicating room for growth but also highlighting challenges in scaling operations within an industry that saw an average decline of 8.9%.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4760 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601969

Hainan Mining

Hainan Mining Co., Ltd. mines, processes, and sells iron ore in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives