- China

- /

- Metals and Mining

- /

- SHSE:601168

Western Mining Co.,Ltd.'s (SHSE:601168) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

Despite an already strong run, Western Mining Co.,Ltd. (SHSE:601168) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

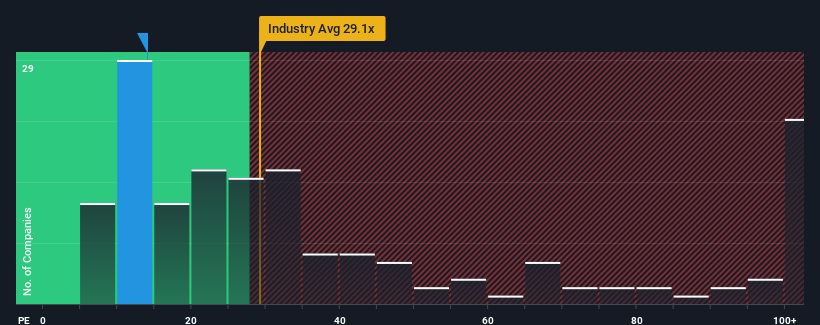

Although its price has surged higher, Western MiningLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14x, since almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 58x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Western MiningLtd has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Western MiningLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Western MiningLtd would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 7.0% gain to the company's bottom line. Pleasingly, EPS has also lifted 219% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 12% over the next year. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

In light of this, it's understandable that Western MiningLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Western MiningLtd's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Western MiningLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Western MiningLtd, and understanding these should be part of your investment process.

If you're unsure about the strength of Western MiningLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Western MiningLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601168

Western MiningLtd

Engages in the mining, smelting, and trading of metals in Mainland China and internationally.

Very undervalued established dividend payer.