Asian Market Insights: Goodbaby International Holdings And 2 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, the Asian market continues to offer intriguing opportunities for investors. Though the term 'penny stocks' might seem outdated, it still refers to smaller or newer companies that can provide significant growth potential when backed by solid financials. In this article, we explore three such penny stocks in Asia that stand out for their financial strength and potential for long-term value.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.42 | THB2.65B | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.188 | SGD37.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.13 | SGD8.38B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.88 | HK$3.25B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$46.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.10 | HK$694.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.44 | HK$2.4B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.06 | HK$1.72B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,176 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Goodbaby International Holdings (SEHK:1086)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Goodbaby International Holdings Limited is an investment holding company that engages in the research, development, design, manufacturing, marketing, and sale of durable juvenile products across various regions including China, Europe, the Middle East, Africa, the United States, and Asia Pacific with a market cap of HK$2.40 billion.

Operations: The company's revenue is primarily derived from two segments: Car Seats and Accessories, generating HK$3.87 billion, and Wheeled Goods, contributing HK$3.67 billion.

Market Cap: HK$2.4B

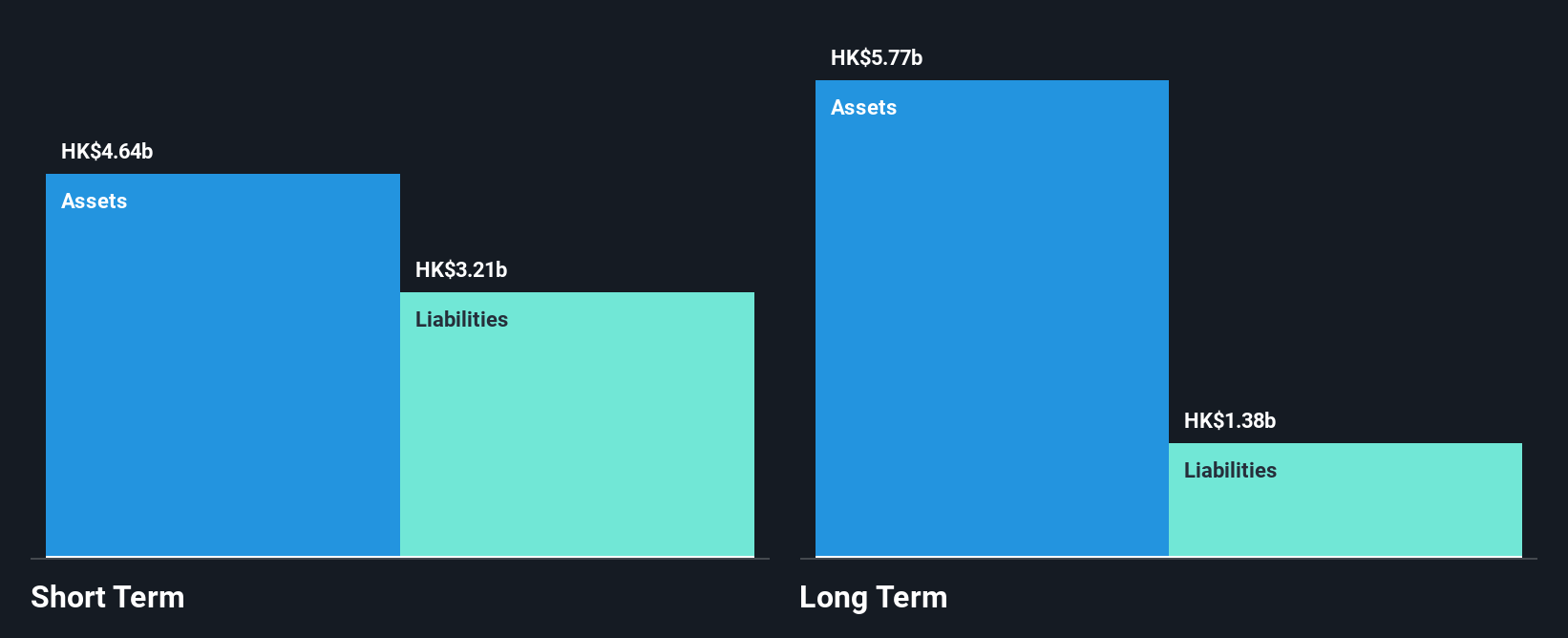

Goodbaby International Holdings has shown substantial growth, with earnings increasing by 74.9% over the past year and a strong revenue performance, reporting HK$8.77 billion for 2024. The company maintains a satisfactory net debt to equity ratio of 6.1%, with debt well covered by operating cash flow at 63.7%. While its net profit margins have improved from last year, the stock remains highly volatile and trades below estimated fair value by 43.5%. Despite an unstable dividend track record, Goodbaby's experienced management team supports its ongoing expansion in juvenile products markets worldwide.

- Navigate through the intricacies of Goodbaby International Holdings with our comprehensive balance sheet health report here.

- Understand Goodbaby International Holdings' earnings outlook by examining our growth report.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market capitalization of approximately HK$22.73 billion.

Operations: The bank's revenue is primarily derived from its Personal Banking segment, which generated CN¥4.39 billion, followed by Corporate Banking at CN¥2.87 billion and Treasury operations contributing CN¥1.82 billion.

Market Cap: HK$22.73B

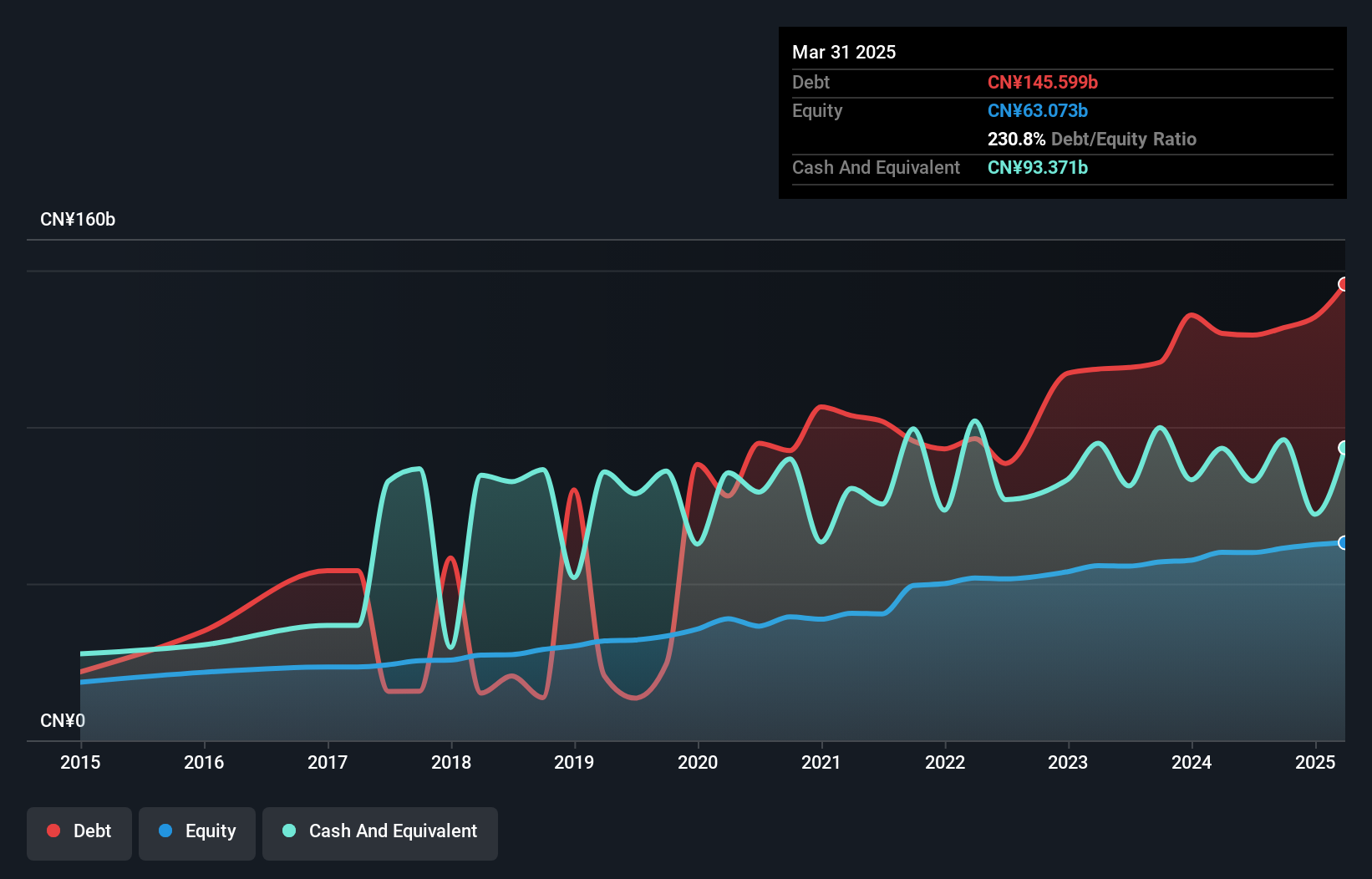

Dongguan Rural Commercial Bank's recent financial performance shows a decline in net income to CN¥1.63 billion for Q1 2025, down from CN¥1.92 billion the previous year, reflecting challenges in earnings growth. Despite this, the bank maintains a strong allowance for bad loans at 207% and an appropriate level of non-performing loans at 1.8%. The bank's revenue is primarily driven by its Personal Banking segment, contributing significantly to its overall income structure. With an experienced board and management team, Dongguan Rural Commercial Bank remains focused on navigating market volatility while leveraging low-risk funding sources like customer deposits.

- Unlock comprehensive insights into our analysis of Dongguan Rural Commercial Bank stock in this financial health report.

- Assess Dongguan Rural Commercial Bank's future earnings estimates with our detailed growth reports.

Yiwu Huading NylonLtd (SHSE:601113)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yiwu Huading Nylon Co., Ltd. focuses on the research, development, manufacture, and sale of nylon filaments primarily in China with a market cap of CN¥4.62 billion.

Operations: Yiwu Huading Nylon Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.62B

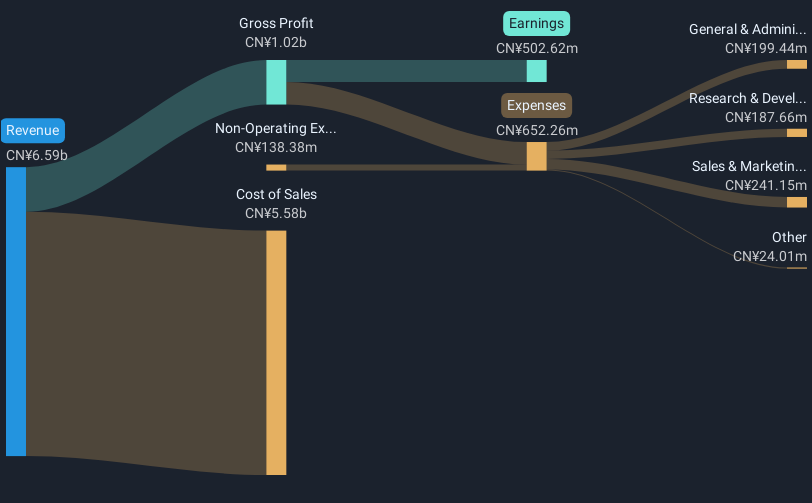

Yiwu Huading Nylon Co., Ltd. has demonstrated significant earnings growth, with a 113.7% increase over the past year, surpassing industry averages. Despite a decline in revenue from CN¥8.72 billion to CN¥7.52 billion in 2024, net income rose substantially to CN¥488.71 million due to improved profit margins and high-quality earnings. The company is financially robust, with short-term assets of CN¥2.7 billion covering both short-term and long-term liabilities comfortably while maintaining more cash than total debt and reducing its debt-to-equity ratio over five years from 31.4% to 19%.

- Dive into the specifics of Yiwu Huading NylonLtd here with our thorough balance sheet health report.

- Assess Yiwu Huading NylonLtd's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Dive into all 1,176 of the Asian Penny Stocks we have identified here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 29 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dongguan Rural Commercial Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9889

Dongguan Rural Commercial Bank

Provides various banking products and services in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives