- China

- /

- Metals and Mining

- /

- SHSE:601020

Tibet Huayu Mining Co., Ltd.'s (SHSE:601020) P/S Is Still On The Mark Following 28% Share Price Bounce

Tibet Huayu Mining Co., Ltd. (SHSE:601020) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

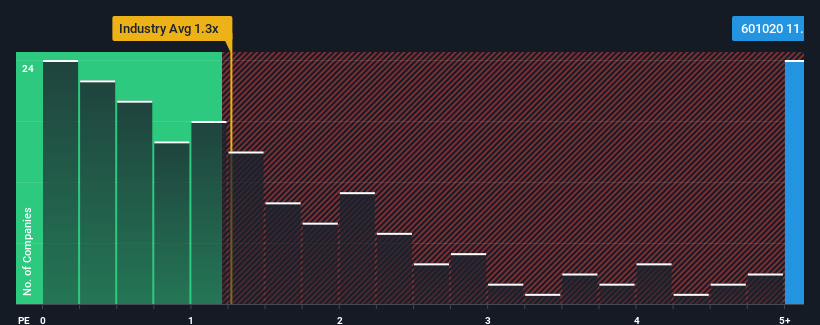

Since its price has surged higher, given around half the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Tibet Huayu Mining as a stock to avoid entirely with its 11.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tibet Huayu Mining

What Does Tibet Huayu Mining's P/S Mean For Shareholders?

Tibet Huayu Mining certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tibet Huayu Mining.How Is Tibet Huayu Mining's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Tibet Huayu Mining's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 54% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 51% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 79% over the next year. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Tibet Huayu Mining's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Tibet Huayu Mining's P/S

Tibet Huayu Mining's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Tibet Huayu Mining's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Tibet Huayu Mining (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Tibet Huayu Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Huayu Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601020

Tibet Huayu Mining

Engages in mining, processing, exploration, and sale of lead, zinc, copper, and other nonferrous metals in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.