Ningxia Baofeng Energy Group And 2 More Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by geopolitical tensions, consumer spending concerns, and fluctuating economic indicators, investors are increasingly seeking opportunities in stocks that may be trading below their estimated value. In this environment, identifying undervalued stocks can offer potential for growth when market sentiment shifts positively; companies like Ningxia Baofeng Energy Group present intriguing possibilities for those looking to capitalize on such opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.29 | CN¥52.35 | 49.8% |

| MINISO Group Holding (NYSE:MNSO) | US$20.68 | US$41.04 | 49.6% |

| KG Mobilians (KOSDAQ:A046440) | ₩4515.00 | ₩8963.80 | 49.6% |

| Vimi Fasteners (BIT:VIM) | €0.96 | €1.91 | 49.8% |

| Power Wind Health Industry (TWSE:8462) | NT$113.00 | NT$225.71 | 49.9% |

| CD Projekt (WSE:CDR) | PLN220.70 | PLN441.19 | 50% |

| Vestas Wind Systems (CPSE:VWS) | DKK102.40 | DKK204.54 | 49.9% |

| Thunderbird Entertainment Group (TSXV:TBRD) | CA$1.69 | CA$3.36 | 49.6% |

| Sung Kwang BendLtd (KOSDAQ:A014620) | ₩27950.00 | ₩55879.35 | 50% |

| Sandfire Resources (ASX:SFR) | A$10.58 | A$21.10 | 49.9% |

Here's a peek at a few of the choices from the screener.

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. is involved in the production, processing, and sale of coal mining and related products such as coking, coal tar, crude benzene, methanol, and olefin products with a market capitalization of approximately CN¥115.87 billion.

Operations: The company's revenue segments include the production, processing, and sale of coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin products.

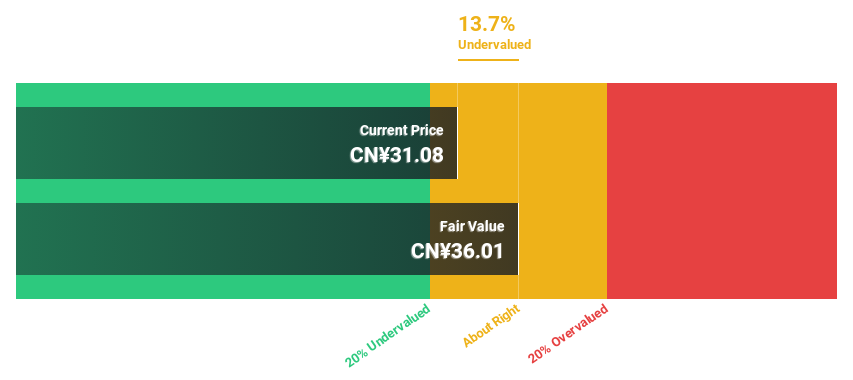

Estimated Discount To Fair Value: 33.7%

Ningxia Baofeng Energy Group is trading at CN¥16.2, significantly below its estimated fair value of CN¥24.44, making it undervalued based on cash flows. Earnings are forecast to grow 38.5% annually, outpacing the broader market, while revenue growth is expected at 27.5% per year. Despite a high debt level and a dividend not fully covered by free cash flows, strong profit growth prospects offer potential upside in valuation terms.

- According our earnings growth report, there's an indication that Ningxia Baofeng Energy Group might be ready to expand.

- Dive into the specifics of Ningxia Baofeng Energy Group here with our thorough financial health report.

Servyou Software Group (SHSE:603171)

Overview: Servyou Software Group Co., Ltd., along with its subsidiaries, offers financial and tax information services in China and has a market cap of CN¥17.84 billion.

Operations: Revenue Segments (in millions of CN¥): Servyou Software Group Co., Ltd. generates its revenue primarily through the provision of financial and tax information services in China.

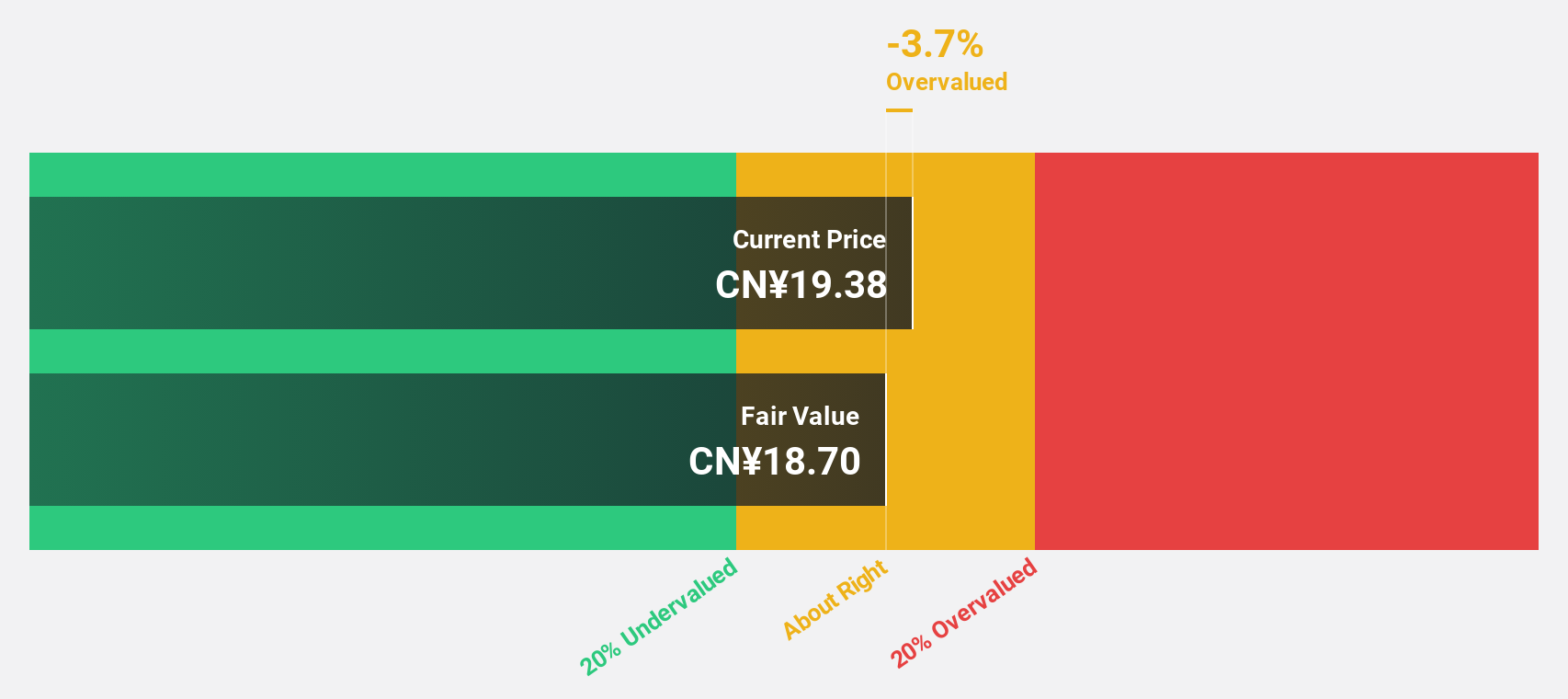

Estimated Discount To Fair Value: 18.7%

Servyou Software Group is trading at CN¥45.5, below its estimated fair value of CN¥55.94, indicating undervaluation based on cash flows. Revenue is projected to grow 20.8% per year, surpassing the market's growth rate, while earnings are expected to increase significantly at 57.5% annually. Despite a recent decline in profit margins and share price volatility, strong growth forecasts provide potential for increased valuation over time amid these challenges.

- Our comprehensive growth report raises the possibility that Servyou Software Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Servyou Software Group stock in this financial health report.

Nancal TechnologyLtd (SHSE:603859)

Overview: Nancal Technology Co., Ltd offers digital transformation solutions both in China and internationally, with a market cap of CN¥8.23 billion.

Operations: Nancal Technology Co., Ltd's revenue is derived from its provision of digital transformation solutions in both domestic and international markets.

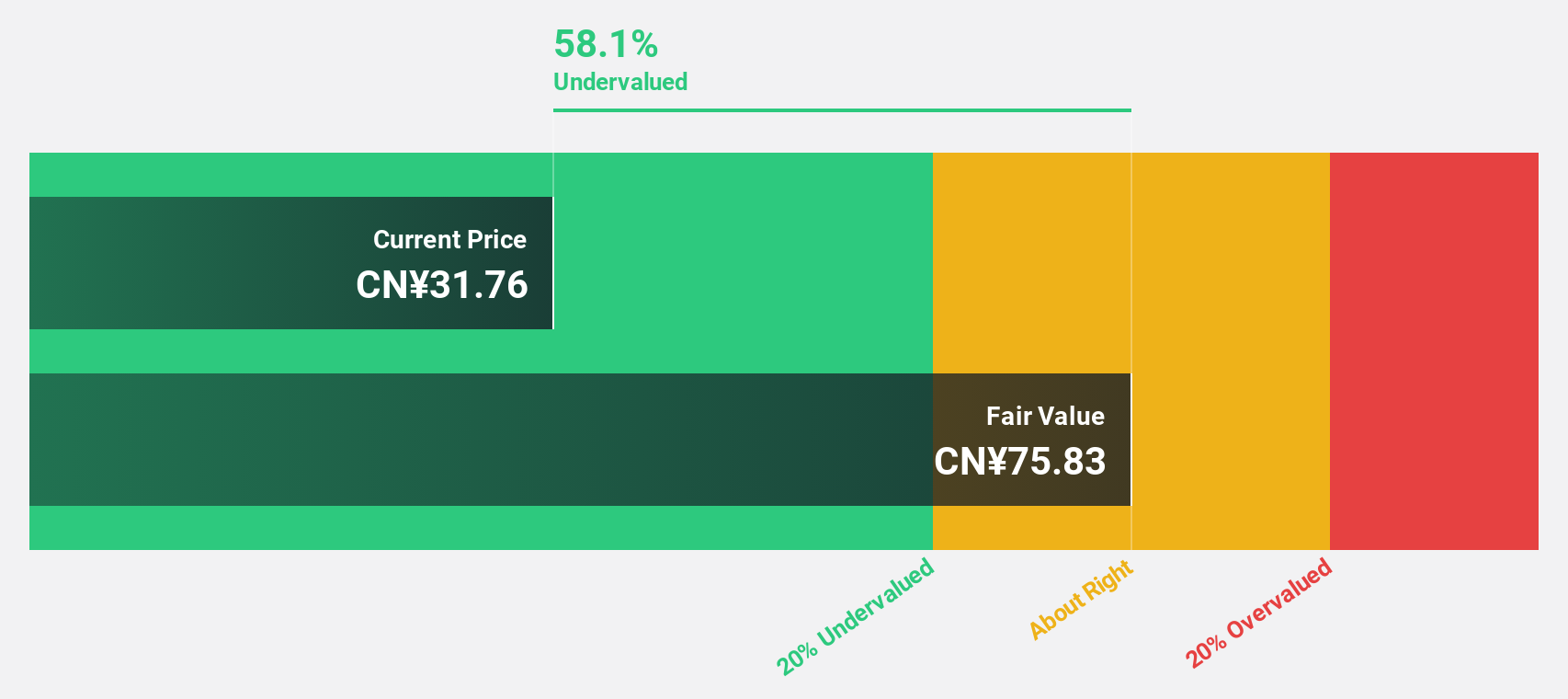

Estimated Discount To Fair Value: 48.7%

Nancal Technology Ltd. is trading at CN¥37.02, significantly below its estimated fair value of CN¥72.23, highlighting undervaluation based on cash flows. Revenue is forecast to grow 24% annually, outpacing the market's growth rate, while earnings are expected to rise significantly at 36.6% per year. Despite a low projected return on equity and recent share price volatility, these strong growth forecasts suggest potential for valuation improvement over time.

- Insights from our recent growth report point to a promising forecast for Nancal TechnologyLtd's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Nancal TechnologyLtd.

Where To Now?

- Delve into our full catalog of 925 Undervalued Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603171

Servyou Software Group

Provides financial and tax information services in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives