3 Asian Stocks Estimated To Be Trading Below Intrinsic Value By Up To 47.6%

Reviewed by Simply Wall St

Amidst growing global trade concerns and economic uncertainty fueled by recent tariff announcements, Asian markets have faced significant volatility, reflecting broader apprehensions about potential impacts on growth and inflation. In this environment, identifying stocks that are trading below their intrinsic value can offer investors opportunities to potentially capitalize on market mispricing.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.32 | CN¥54.07 | 49.5% |

| Future (TSE:4722) | ¥1688.00 | ¥3372.26 | 49.9% |

| Sichuan Injet Electric (SZSE:300820) | CN¥49.27 | CN¥96.54 | 49% |

| Cosel (TSE:6905) | ¥999.00 | ¥1934.50 | 48.4% |

| BuySell TechnologiesLtd (TSE:7685) | ¥2547.00 | ¥5068.23 | 49.7% |

| EVE Energy (SZSE:300014) | CN¥45.77 | CN¥89.85 | 49.1% |

| Eternal Hospitality GroupLtd (TSE:3193) | ¥2608.00 | ¥5053.77 | 48.4% |

| Kokusai Electric (TSE:6525) | ¥2105.50 | ¥4168.62 | 49.5% |

| Sunstone Development (SHSE:603612) | CN¥17.17 | CN¥33.32 | 48.5% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.91 | HK$1.76 | 48.4% |

Here's a peek at a few of the choices from the screener.

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on developing and commercializing monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China, with a market cap of approximately HK$82.32 billion.

Operations: The company generates revenue from its biotechnology segment, amounting to CN¥9.42 billion.

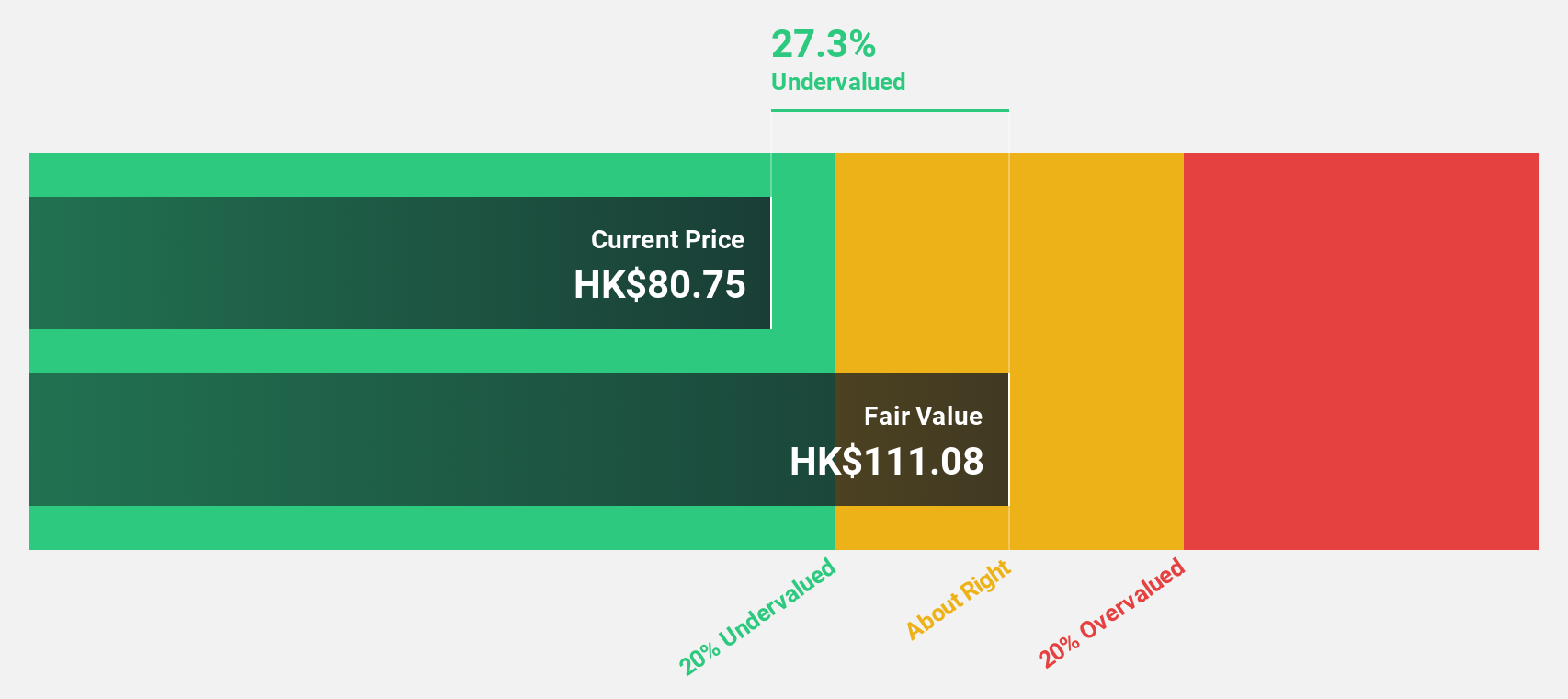

Estimated Discount To Fair Value: 47.6%

Innovent Biologics is trading at HK$50.25, significantly below its estimated fair value of HK$95.92, suggesting it may be undervalued based on cash flows. Despite a current net loss, the company has reported strong revenue growth and is expected to become profitable within three years. Recent strategic alliances and product approvals bolster its oncology pipeline, potentially enhancing future cash flows and supporting its valuation relative to peers in the industry.

- The growth report we've compiled suggests that Innovent Biologics' future prospects could be on the up.

- Get an in-depth perspective on Innovent Biologics' balance sheet by reading our health report here.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs for unmet medical needs in China and internationally, with a market cap of approximately HK$70.23 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling CN¥1.93 billion.

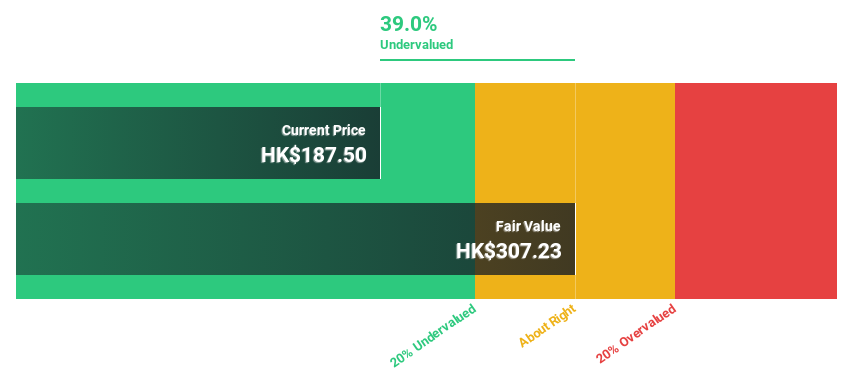

Estimated Discount To Fair Value: 19%

Sichuan Kelun-Biotech Biopharmaceutical is trading at HK$309, slightly below its estimated fair value of HK$381.39, indicating potential undervaluation based on cash flows. The company reported a narrowing net loss with robust revenue growth of 25.5% last year and forecasts suggest continued high revenue growth at 28.7% annually, outpacing the Hong Kong market average. Recent product approvals and clinical advancements further strengthen its position in the biopharmaceutical sector, potentially enhancing future financial performance.

- Upon reviewing our latest growth report, Sichuan Kelun-Biotech Biopharmaceutical's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Sichuan Kelun-Biotech Biopharmaceutical with our comprehensive financial health report here.

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. is involved in the production, processing, and sale of coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin products with a market cap of CN¥112.86 billion.

Operations: The company's revenue segments include Coking Products at CN¥14.09 billion, Olefin Products at CN¥22.96 billion, and Fine Chemical Products at CN¥3.84 billion.

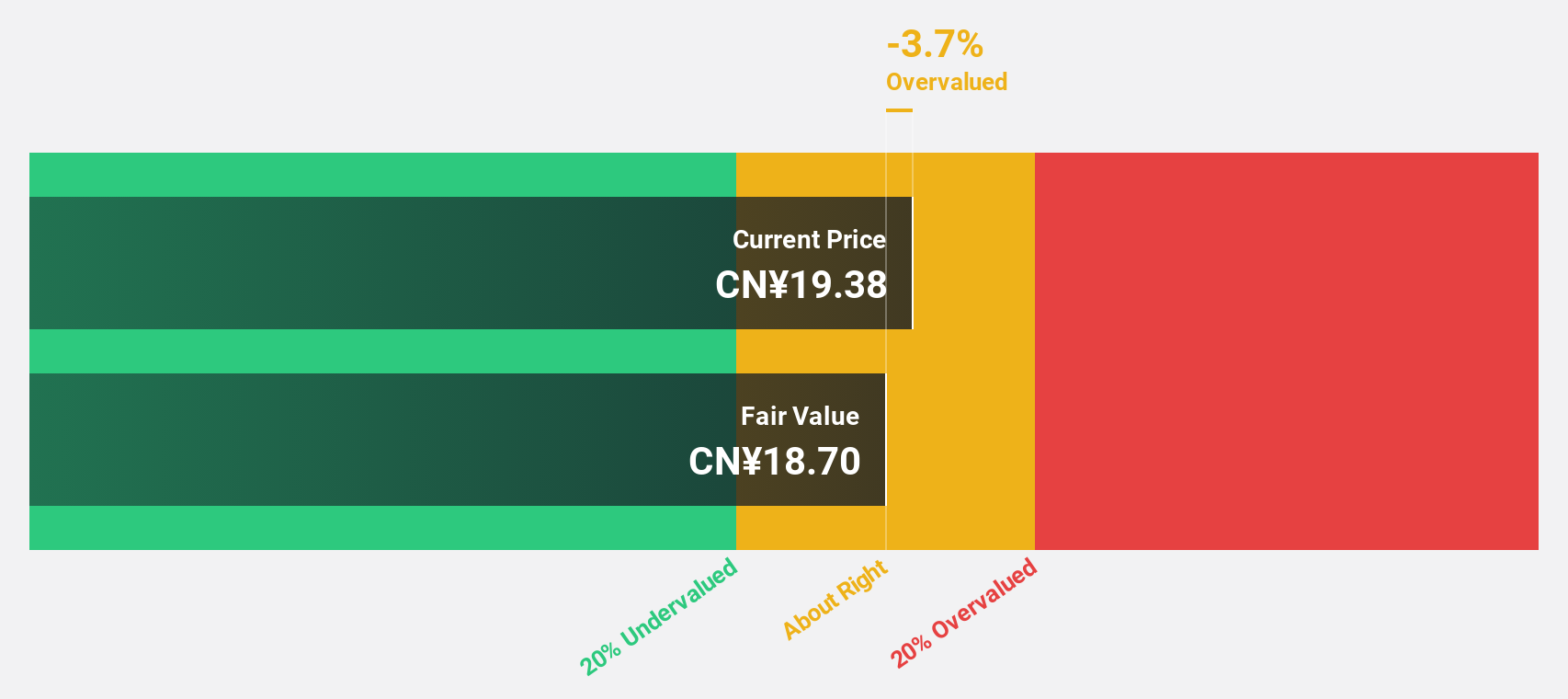

Estimated Discount To Fair Value: 10.6%

Ningxia Baofeng Energy Group, trading at CN¥15.39, is below its fair value estimate of CN¥17.22, highlighting potential undervaluation based on cash flows. Recent earnings showed revenue growth to CN¥32.98 billion from CN¥29.14 billion and net income increased to CN¥6.34 billion from the previous year's CN¥5.65 billion, despite high debt levels and a dividend not fully covered by free cash flows. Earnings are projected to grow significantly over the next three years.

- Insights from our recent growth report point to a promising forecast for Ningxia Baofeng Energy Group's business outlook.

- Take a closer look at Ningxia Baofeng Energy Group's balance sheet health here in our report.

Where To Now?

- Click here to access our complete index of 271 Undervalued Asian Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, develops and commercializes monoclonal antibodies and other drug assets in the fields of oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in the People’s Republic of China.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives