Nanjing Chemical Fiber (SHSE:600889) delivers shareholders enviable 40% CAGR over 5 years, surging 21% in the last week alone

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. To wit, the Nanjing Chemical Fiber Co., Ltd. (SHSE:600889) share price has soared 437% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 378% over the last quarter.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Nanjing Chemical Fiber

Because Nanjing Chemical Fiber made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade Nanjing Chemical Fiber's revenue has actually been trending down at about 1.4% per year. This is in stark contrast to the strong share price growth of 40%, compound, per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. I think it's fair to say there is probably a fair bit of excitement in the price.

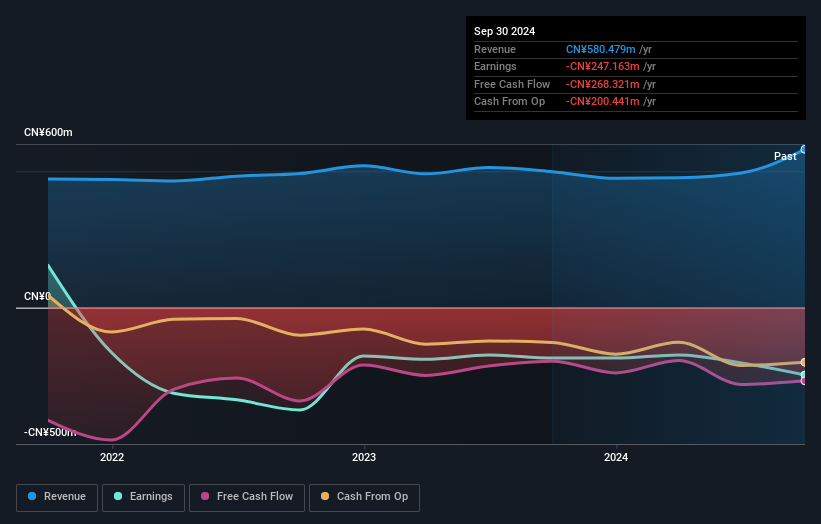

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Nanjing Chemical Fiber's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Nanjing Chemical Fiber shareholders have received a total shareholder return of 333% over the last year. That gain is better than the annual TSR over five years, which is 40%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Nanjing Chemical Fiber better, we need to consider many other factors. Even so, be aware that Nanjing Chemical Fiber is showing 2 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Chemical Fiber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600889

Nanjing Chemical Fiber

Engages in the viscose fiber production in China and internationally.

Mediocre balance sheet very low.