- China

- /

- Metals and Mining

- /

- SHSE:600888

Here's What To Make Of Xinjiang Joinworld's (SHSE:600888) Decelerating Rates Of Return

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at Xinjiang Joinworld (SHSE:600888) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Xinjiang Joinworld is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.04 = CN¥531m ÷ (CN¥17b - CN¥3.9b) (Based on the trailing twelve months to June 2024).

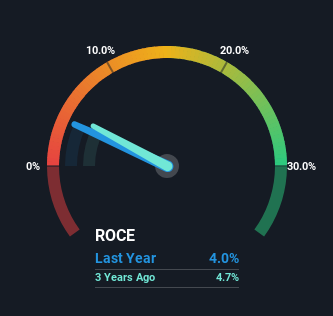

So, Xinjiang Joinworld has an ROCE of 4.0%. Ultimately, that's a low return and it under-performs the Metals and Mining industry average of 7.2%.

View our latest analysis for Xinjiang Joinworld

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Xinjiang Joinworld's past further, check out this free graph covering Xinjiang Joinworld's past earnings, revenue and cash flow.

What Does the ROCE Trend For Xinjiang Joinworld Tell Us?

The returns on capital haven't changed much for Xinjiang Joinworld in recent years. The company has consistently earned 4.0% for the last five years, and the capital employed within the business has risen 78% in that time. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 23% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Bottom Line On Xinjiang Joinworld's ROCE

In conclusion, Xinjiang Joinworld has been investing more capital into the business, but returns on that capital haven't increased. Since the stock has gained an impressive 69% over the last five years, investors must think there's better things to come. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

On a final note, we've found 1 warning sign for Xinjiang Joinworld that we think you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600888

Xinjiang Joinworld

Engages in the research and development, production, and sale of aluminum products in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives