As global markets navigate the impact of rising U.S. Treasury yields, investors are increasingly seeking opportunities in diverse sectors. Penny stocks, though an older term, continue to draw attention for their potential value and growth prospects within smaller or newer companies. By focusing on those with strong financials and promising growth paths, investors can uncover significant opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.585 | MYR2.91B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.85 | £176.31M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.735 | MYR127.31M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.39 | CN¥2.15B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.95 | £474.22M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £304.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,809 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Danhua Chemical TechnologyLtd (SHSE:600844)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Danhua Chemical Technology Co., Ltd, along with its subsidiaries, is involved in the production and sale of coal chemical products in China, with a market capitalization of approximately CN¥2.37 billion.

Operations: The company generates revenue of CN¥761.73 million from its operations in the chemical industry.

Market Cap: CN¥2.37B

Danhua Chemical Technology Co., Ltd has faced challenges with declining revenues, reporting CN¥399.57 million for H1 2024, down from CN¥498.91 million the previous year, and a net loss of CN¥111.82 million. The company has not diluted shareholders recently but struggles with liquidity, having raised additional capital to extend its cash runway beyond the initial one-month estimate based on free cash flow. Despite a seasoned management team and satisfactory net debt to equity ratio of 32.1%, short-term liabilities exceed assets significantly, highlighting financial pressure amidst ongoing unprofitability and increased losses over five years at 4% annually.

- Take a closer look at Danhua Chemical TechnologyLtd's potential here in our financial health report.

- Understand Danhua Chemical TechnologyLtd's track record by examining our performance history report.

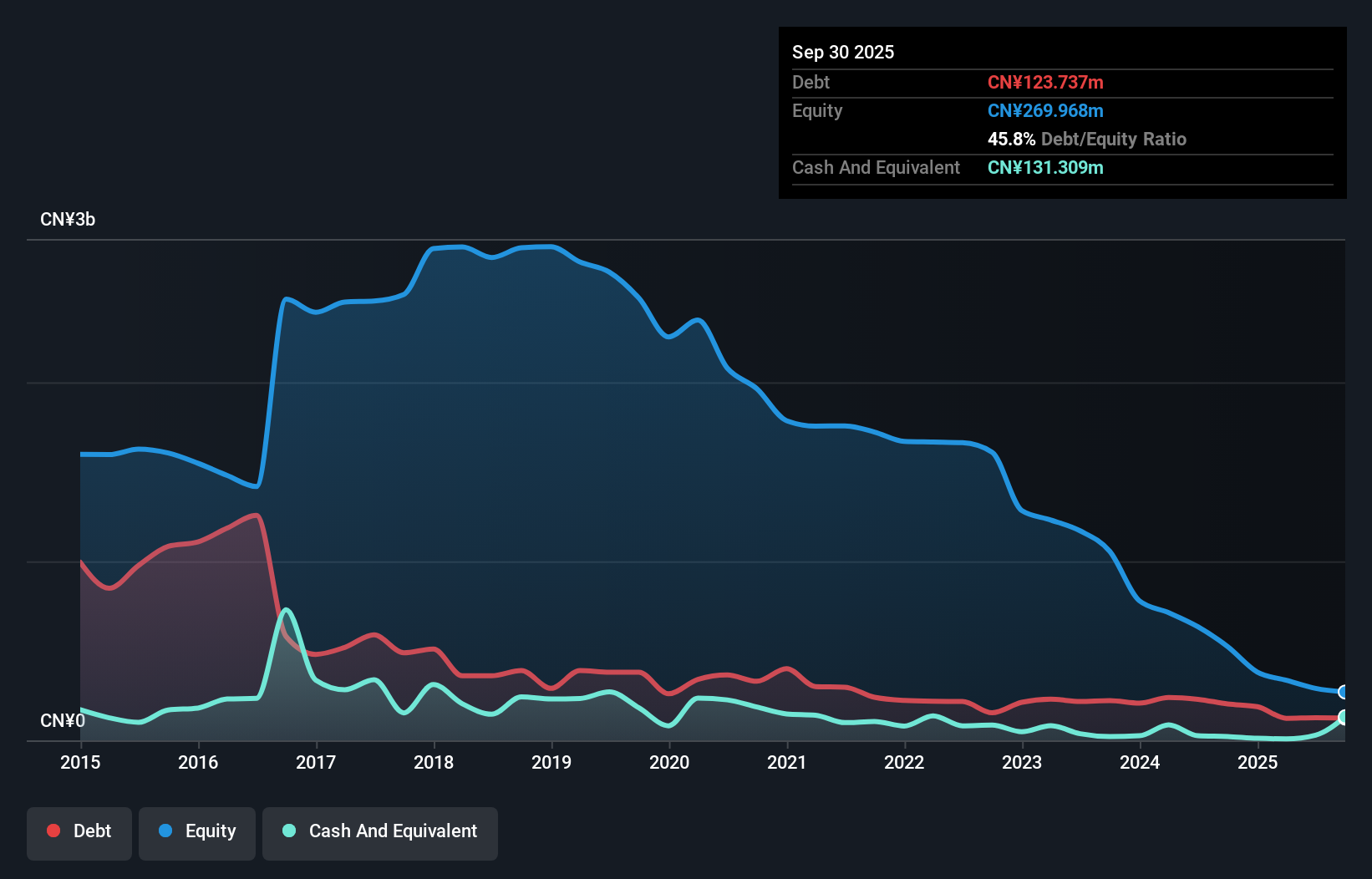

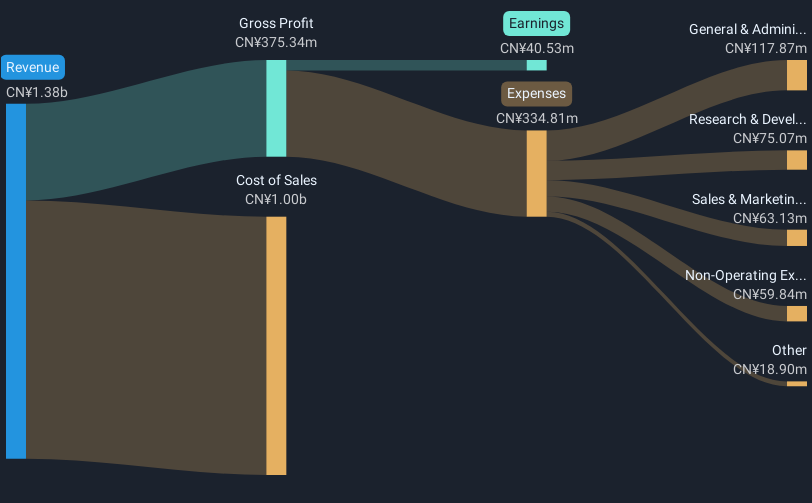

Jiangsu AMER New Material (SZSE:002201)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu AMER New Material Co., Ltd. specializes in the production and sale of glass fiber yarn, fabrics, and FRP products in China, with a market capitalization of CN¥3.22 billion.

Operations: The company's revenue primarily comes from its fiberglass and FRP product manufacturing segment, which generated CN¥1.33 billion.

Market Cap: CN¥3.22B

Jiangsu AMER New Material Co., Ltd. has shown strong earnings growth, with a 31.8% increase over the past year, surpassing its five-year average of 7.2%. The company's financial health appears stable, with interest payments well covered by EBIT and a satisfactory net debt to equity ratio of 30.3%. Recent developments include Jiangsu Jiuding Group acquiring an additional stake in the company, indicating potential investor confidence. Despite a revenue decline to CN¥569.22 million for H1 2024 from CN¥907.15 million the previous year, net income improved slightly to CN¥18.07 million from CN¥16.45 million, suggesting resilience in profitability amidst market challenges.

- Jump into the full analysis health report here for a deeper understanding of Jiangsu AMER New Material.

- Examine Jiangsu AMER New Material's past performance report to understand how it has performed in prior years.

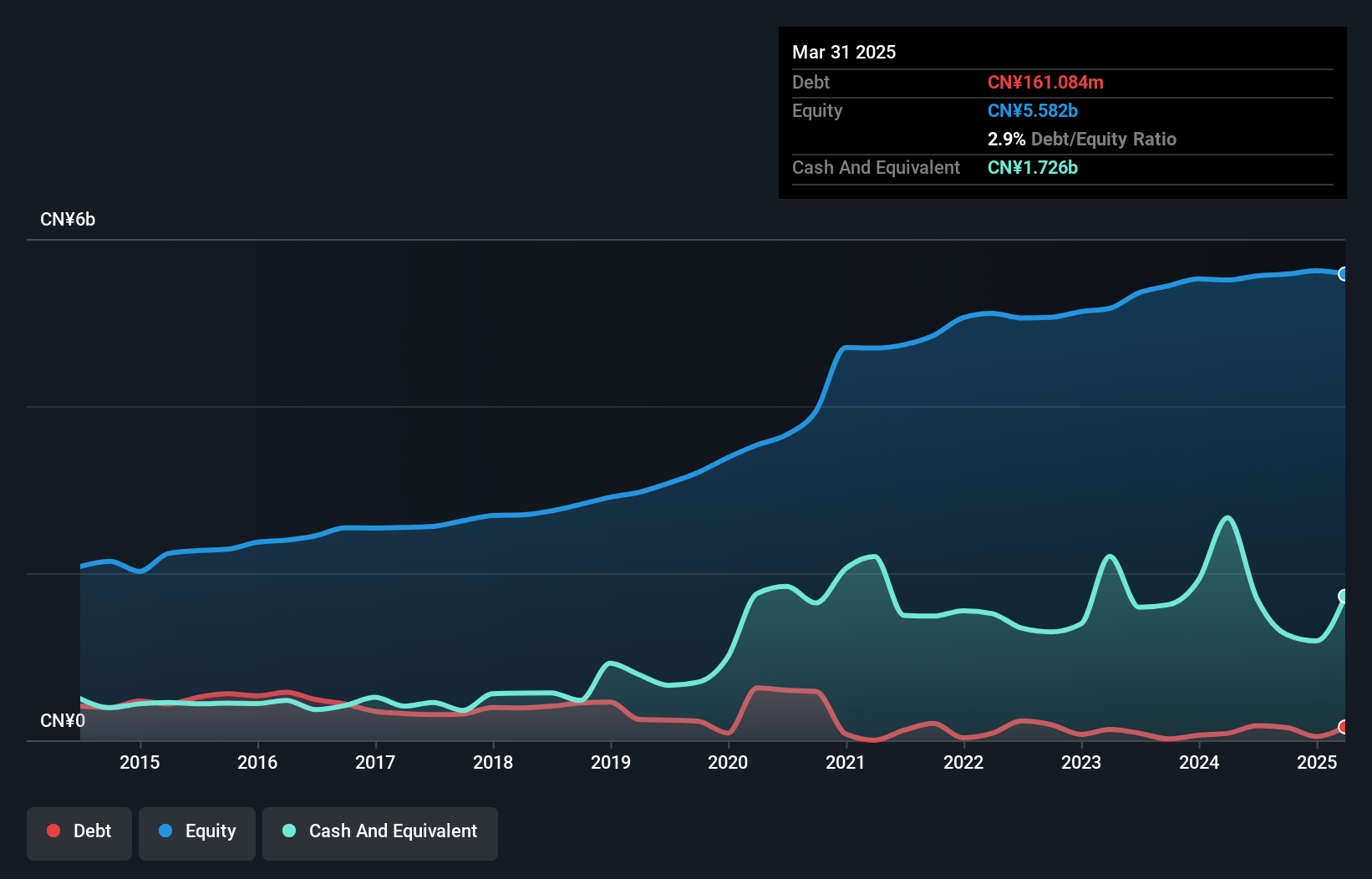

Era (SZSE:002641)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Era Co., Ltd. is engaged in the research, development, production, and sale of plastic pipe products in China with a market cap of CN¥5.58 billion.

Operations: The company generates revenue primarily from its Manufacturing Industry segment, which accounts for CN¥6.63 billion.

Market Cap: CN¥5.58B

Era Co., Ltd. demonstrates financial stability with short-term assets exceeding both short and long-term liabilities, and operating cash flow significantly covering its debt. Despite a 71% earnings growth over the past year, surpassing industry averages, the company faces challenges such as a declining sales trend, evidenced by H1 2024 revenues of CN¥3.15 billion compared to CN¥3.64 billion in the previous year. The company's Return on Equity remains low at 5.9%, and its dividend history is unstable. However, Era's valuation appears attractive as it trades well below estimated fair value without significant shareholder dilution recently.

- Unlock comprehensive insights into our analysis of Era stock in this financial health report.

- Assess Era's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Reveal the 5,809 hidden gems among our Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Jiangsu Jiuding New Material, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002201

Jiangsu Jiuding New Material

Produces and sells glass fiber yarn, fabrics, and FRP products in China.

Adequate balance sheet with acceptable track record.