3 Asian Penny Stocks With Market Caps Under US$700M To Consider

Reviewed by Simply Wall St

As global markets continue to navigate a complex economic landscape, Asian indices have shown resilience, with investor interest in technology and AI sectors remaining robust. Amid these broader trends, penny stocks—often smaller or newer companies—remain an intriguing area for investors seeking growth at lower price points. Despite the term feeling somewhat outdated, these stocks can offer significant opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.81 | HK$2.3B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.05 | SGD425.55M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.096 | SGD50.26M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.40 | SGD13.38B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$252.29M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering services such as stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services with a market capitalization of SGD2.43 billion.

Operations: The company's revenue primarily comes from its Securities and Futures Broking and Other Related Services segment, generating SGD654.91 million.

Market Cap: SGD2.43B

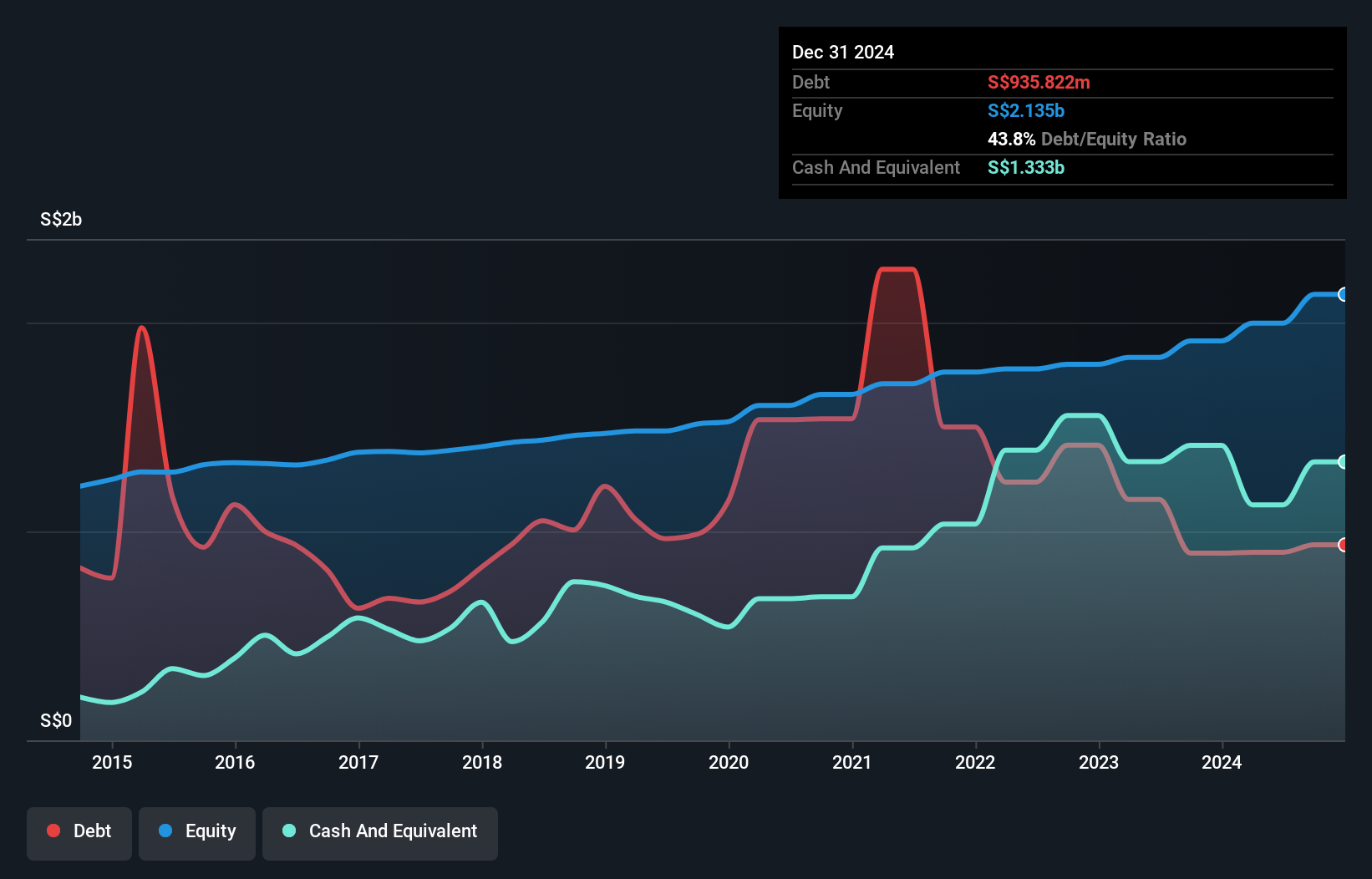

UOB-Kay Hian Holdings, with a market cap of SGD2.43 billion, presents a mixed picture for penny stock investors. Its price-to-earnings ratio of 11.6x is attractive compared to the Singapore market average of 14.8x, and its short-term assets comfortably cover both short and long-term liabilities. However, recent negative earnings growth and a dividend not well-covered by free cash flows raise concerns about profitability sustainability. The company's debt has improved over time but remains inadequately covered by operating cash flow. Recent board changes reflect corporate governance efforts amidst stable weekly volatility in the stock's performance.

- Navigate through the intricacies of UOB-Kay Hian Holdings with our comprehensive balance sheet health report here.

- Evaluate UOB-Kay Hian Holdings' historical performance by accessing our past performance report.

Danhua Chemical TechnologyLtd (SHSE:600844)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Danhua Chemical Technology Co., Ltd, along with its subsidiaries, is involved in the production and sale of coal chemical products in China and has a market capitalization of approximately CN¥3.07 billion.

Operations: The company generates revenue of CN¥870.66 million from its operations in the chemical industry.

Market Cap: CN¥3.07B

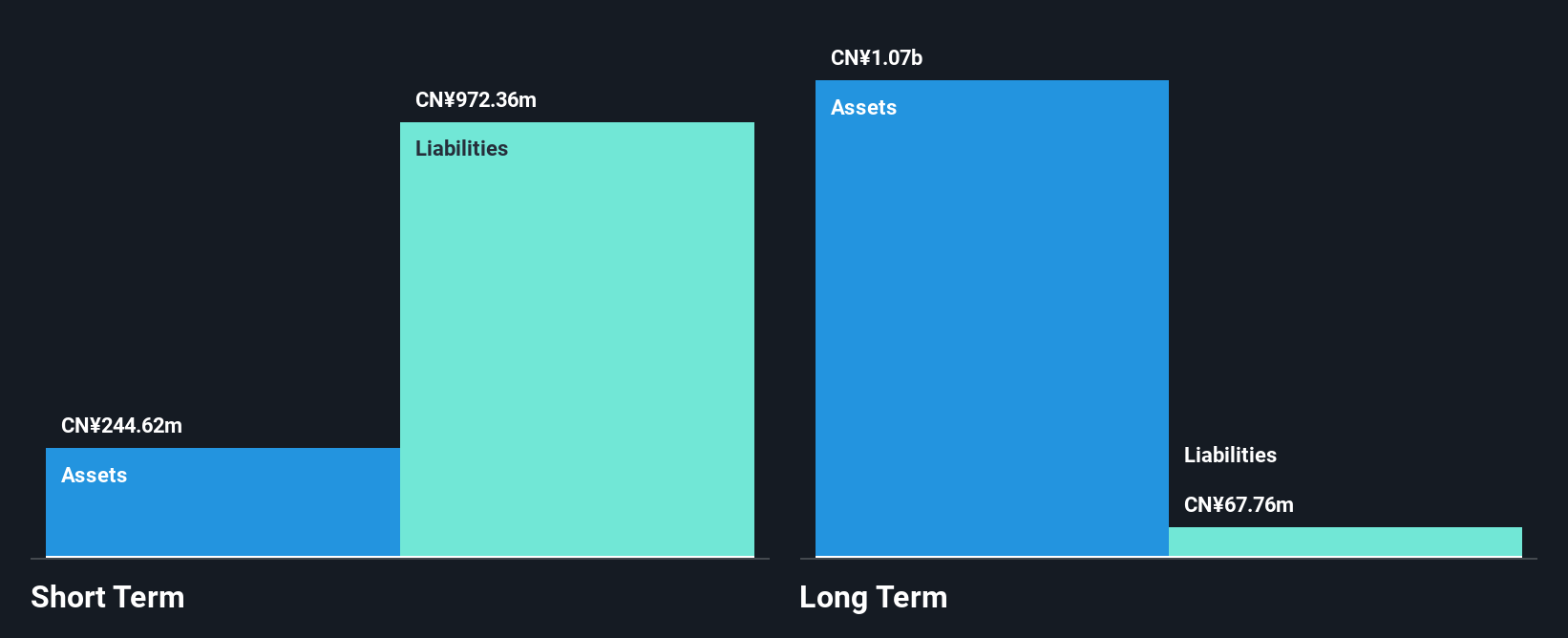

Danhua Chemical Technology Ltd., with a market cap of CN¥3.07 billion, shows a mixed outlook for penny stock investors. Despite reporting revenue growth to CN¥687.59 million for the first nine months of 2025, the company remains unprofitable with a net loss narrowing to CN¥88.8 million from the previous year. The management team is experienced, yet the board's short tenure suggests limited governance stability. While Danhua has more cash than debt and sufficient cash runway exceeding three years at historical outflow rates, its increasing debt-to-equity ratio and inability to cover short-term liabilities signal potential financial challenges ahead.

- Unlock comprehensive insights into our analysis of Danhua Chemical TechnologyLtd stock in this financial health report.

- Examine Danhua Chemical TechnologyLtd's past performance report to understand how it has performed in prior years.

Jiangsu Wuyang Automation Control Technology (SZSE:300420)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Wuyang Automation Control Technology Co., Ltd. specializes in automation control systems and has a market cap of CN¥4.62 billion.

Operations: The company's revenue is primarily generated from China, amounting to CN¥998.48 million.

Market Cap: CN¥4.62B

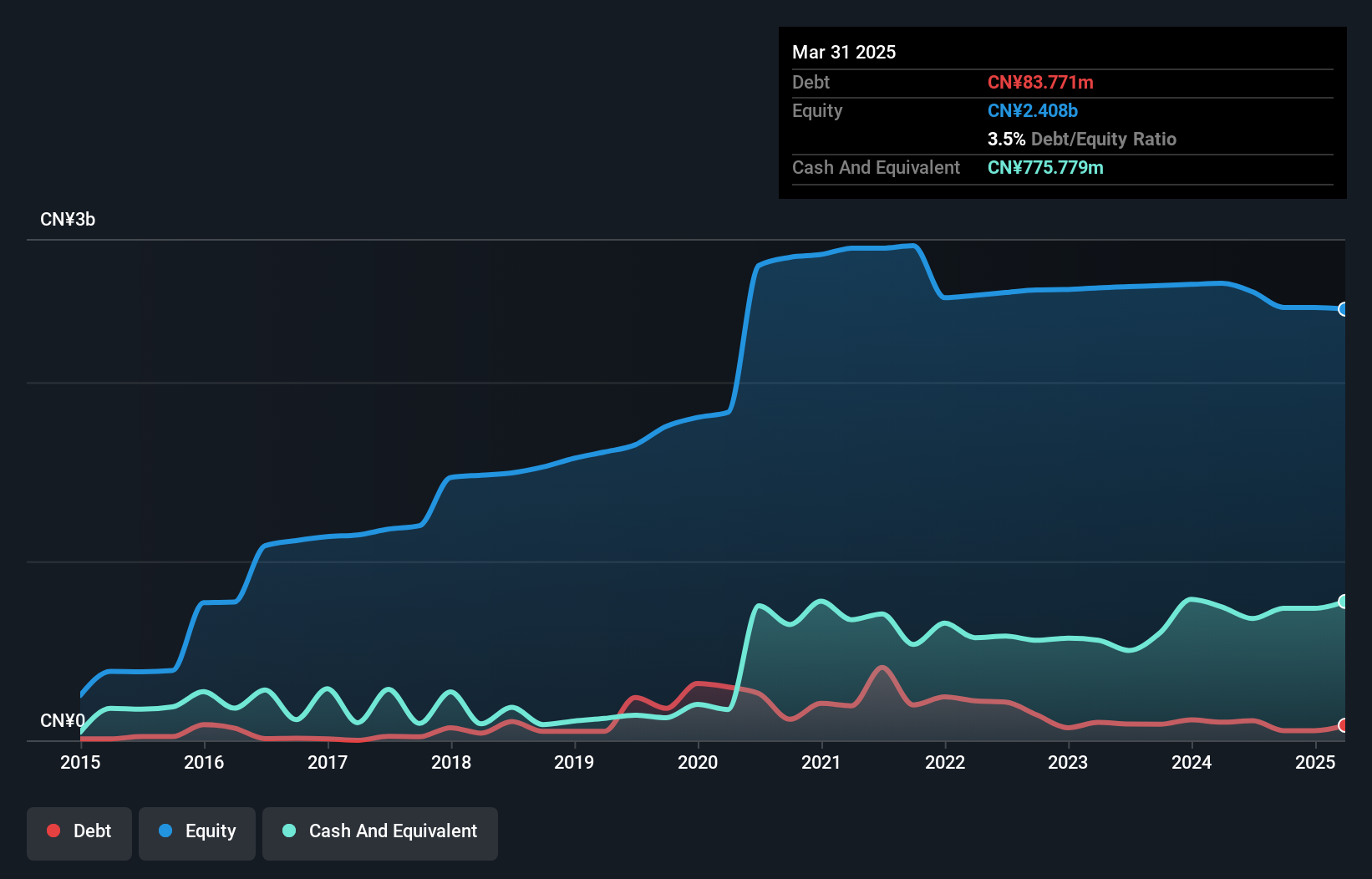

Jiangsu Wuyang Automation Control Technology, with a market cap of CN¥4.62 billion, recently closed a significant transaction where Shenzhen Gaowu Excellence acquired a 15% stake for approximately CN¥670 million. Despite reporting sales of CN¥667.51 million for the first nine months of 2025 and turning profitable with net income of CN¥38.78 million, the company has experienced declining earnings over five years and remains unprofitable overall. Positively, it maintains more cash than debt and its short-term assets significantly exceed both long-term liabilities and short-term obligations, suggesting solid financial positioning amidst volatility challenges in the penny stock landscape.

- Take a closer look at Jiangsu Wuyang Automation Control Technology's potential here in our financial health report.

- Learn about Jiangsu Wuyang Automation Control Technology's historical performance here.

Seize The Opportunity

- Unlock our comprehensive list of 959 Asian Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300420

Jiangsu Wuyang Automation Control Technology

Jiangsu Wuyang Automation Control Technology Co., Ltd.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026