- China

- /

- Basic Materials

- /

- SHSE:600801

Benign Growth For Huaxin Cement Co., Ltd. (SHSE:600801) Underpins Stock's 26% Plummet

Huaxin Cement Co., Ltd. (SHSE:600801) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

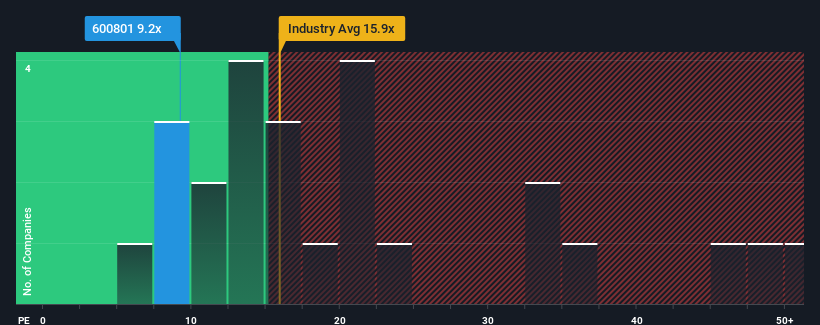

Even after such a large drop in price, Huaxin Cement may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.2x, since almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 51x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

There hasn't been much to differentiate Huaxin Cement's and the market's retreating earnings lately. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

See our latest analysis for Huaxin Cement

How Is Huaxin Cement's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Huaxin Cement's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. The last three years don't look nice either as the company has shrunk EPS by 60% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 11% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 20% per year, which is noticeably more attractive.

In light of this, it's understandable that Huaxin Cement's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Huaxin Cement's P/E

Having almost fallen off a cliff, Huaxin Cement's share price has pulled its P/E way down as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Huaxin Cement's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Huaxin Cement that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Huaxin Cement, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huaxin Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600801

Huaxin Cement

Manufactures and sells cement in China and internationally.

Very undervalued established dividend payer.