- China

- /

- Metals and Mining

- /

- SHSE:600768

Ningbo Fubang Jingye GroupLtd (SHSE:600768) shareholders have lost 28% over 5 years, earnings decline likely the culprit

While not a mind-blowing move, it is good to see that the Ningbo Fubang Jingye Group Co.,Ltd (SHSE:600768) share price has gained 20% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 28%, which falls well short of the return you could get by buying an index fund.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Ningbo Fubang Jingye GroupLtd

While Ningbo Fubang Jingye GroupLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last five years Ningbo Fubang Jingye GroupLtd saw its revenue shrink by 11% per year. That puts it in an unattractive cohort, to put it mildly. It seems pretty reasonable to us that the share price dipped 5% per year in that time. This loss means the stock shareholders are probably pretty annoyed. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

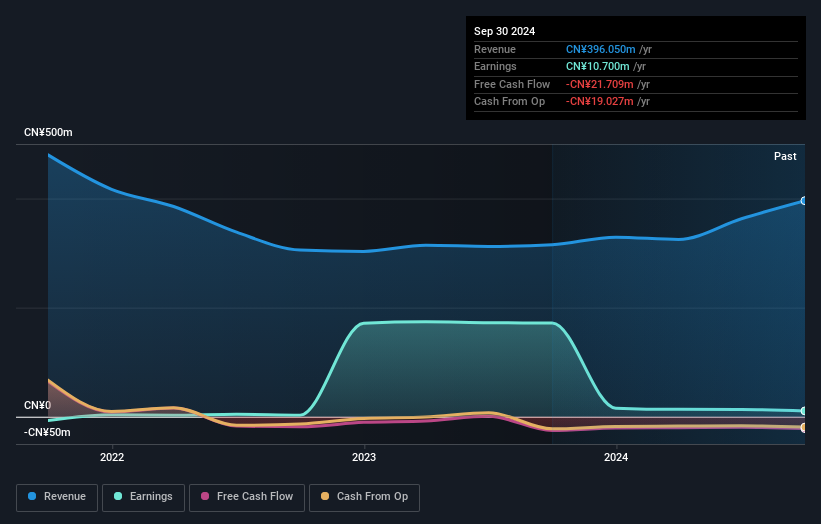

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Ningbo Fubang Jingye GroupLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Ningbo Fubang Jingye GroupLtd shareholders are down 20% for the year (even including dividends), but the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Ningbo Fubang Jingye GroupLtd (including 1 which is concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Fubang Jingye GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600768

Ningbo Fubang Jingye GroupLtd

Engages in the production, processing, and sale of industrial aluminum plates, strips, and aluminum profiles in China and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives