Would Guizhou Zhongyida (SHSE:600610) Be Better Off With Less Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Guizhou Zhongyida Co., Ltd (SHSE:600610) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Guizhou Zhongyida

How Much Debt Does Guizhou Zhongyida Carry?

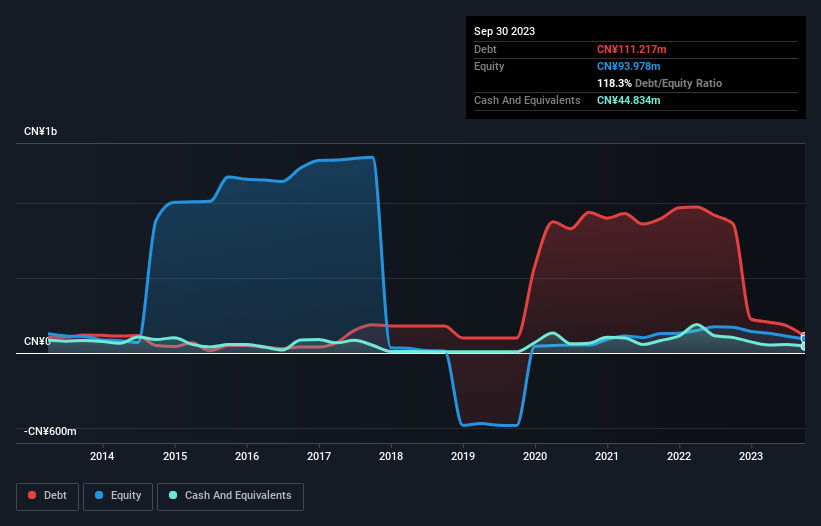

The image below, which you can click on for greater detail, shows that Guizhou Zhongyida had debt of CN¥111.2m at the end of September 2023, a reduction from CN¥861.8m over a year. However, it does have CN¥44.8m in cash offsetting this, leading to net debt of about CN¥66.4m.

How Strong Is Guizhou Zhongyida's Balance Sheet?

The latest balance sheet data shows that Guizhou Zhongyida had liabilities of CN¥989.7m due within a year, and liabilities of CN¥24.5m falling due after that. Offsetting these obligations, it had cash of CN¥44.8m as well as receivables valued at CN¥86.4m due within 12 months. So its liabilities total CN¥883.0m more than the combination of its cash and short-term receivables.

Since publicly traded Guizhou Zhongyida shares are worth a total of CN¥4.72b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, Guizhou Zhongyida has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Guizhou Zhongyida will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Guizhou Zhongyida had a loss before interest and tax, and actually shrunk its revenue by 14%, to CN¥1.2b. We would much prefer see growth.

Caveat Emptor

Not only did Guizhou Zhongyida's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost CN¥47m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled CN¥62m in negative free cash flow over the last twelve months. So to be blunt we think it is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - Guizhou Zhongyida has 1 warning sign we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600610

Guizhou Zhongyida

Produces and sells fine chemical products in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives