- China

- /

- Metals and Mining

- /

- SHSE:600608

Risks Still Elevated At These Prices As Shanghai Broadband Technology Co.,Ltd (SHSE:600608) Shares Dive 29%

Unfortunately for some shareholders, the Shanghai Broadband Technology Co.,Ltd (SHSE:600608) share price has dived 29% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

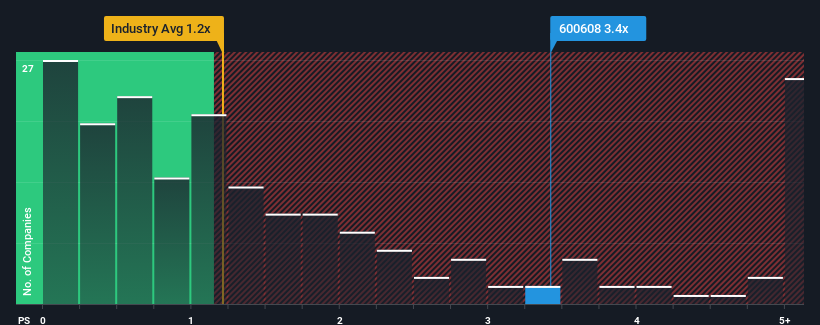

In spite of the heavy fall in price, given around half the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Shanghai Broadband TechnologyLtd as a stock to avoid entirely with its 3.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shanghai Broadband TechnologyLtd

How Shanghai Broadband TechnologyLtd Has Been Performing

As an illustration, revenue has deteriorated at Shanghai Broadband TechnologyLtd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Shanghai Broadband TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai Broadband TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. This means it has also seen a slide in revenue over the longer-term as revenue is down 76% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 14% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Shanghai Broadband TechnologyLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

A significant share price dive has done very little to deflate Shanghai Broadband TechnologyLtd's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanghai Broadband TechnologyLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for Shanghai Broadband TechnologyLtd (2 make us uncomfortable!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600608

Shanghai Broadband TechnologyLtd

Produces and sells communication and metal products in the People's Republic of China.

Mediocre balance sheet very low.

Market Insights

Community Narratives