- China

- /

- Basic Materials

- /

- SHSE:600539

With A 28% Price Drop For Lionhead Technology Development Co., Ltd. (SHSE:600539) You'll Still Get What You Pay For

Lionhead Technology Development Co., Ltd. (SHSE:600539) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

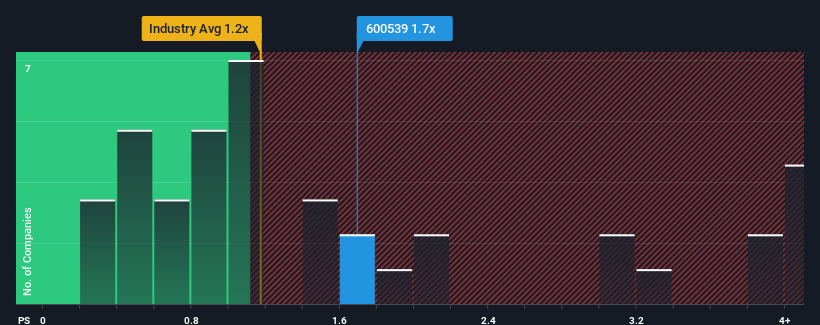

In spite of the heavy fall in price, given close to half the companies operating in China's Basic Materials industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Lionhead Technology Development as a stock to potentially avoid with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Lionhead Technology Development

What Does Lionhead Technology Development's P/S Mean For Shareholders?

For example, consider that Lionhead Technology Development's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lionhead Technology Development will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Lionhead Technology Development's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Still, the latest three year period has seen an excellent 69% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Lionhead Technology Development is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Lionhead Technology Development's P/S?

There's still some elevation in Lionhead Technology Development's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lionhead Technology Development maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Lionhead Technology Development (1 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Lionhead Technology Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600539

Lionhead Technology DevelopmentLtd

Provides e-commerce services in China.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.