- Hong Kong

- /

- Specialty Stores

- /

- SEHK:709

October 2024's Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the complexities of rising Treasury yields and shifting monetary policies, investors are seeking opportunities that align with their risk tolerance and growth expectations. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or newer companies with potential for significant returns. Despite their historical association with speculation, these stocks can offer value when backed by strong financials and clear growth trajectories.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.575 | MYR2.86B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.72 | MYR124.72M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.38 | CN¥2.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$145.87M | ★★★★☆☆ |

Click here to see the full list of 5,814 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, along with its subsidiaries, invests in companies within the education and healthcare sectors and has a market capitalization of approximately AED2.73 billion.

Operations: The company generates revenue from two main segments: Education, which contributes AED384.96 million, and Healthcare, accounting for AED397.13 million.

Market Cap: AED2.73B

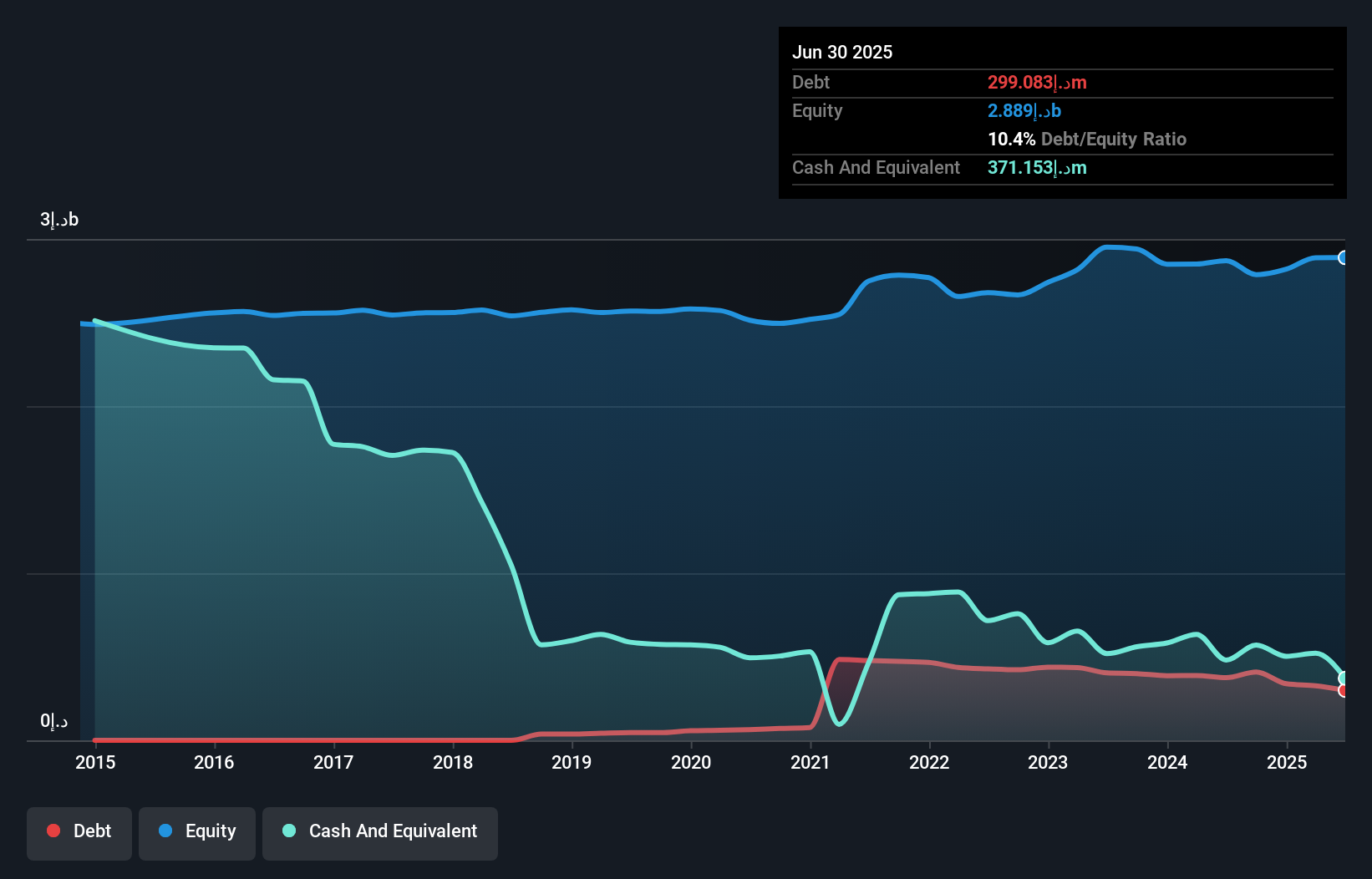

Amanat Holdings PJSC, with a market cap of AED2.73 billion, invests in the education and healthcare sectors. Despite having short-term assets of AED833.7 million that exceed both its short-term and long-term liabilities, the company remains unprofitable with increasing losses over five years at 4.3% annually. Its debt-to-equity ratio has risen to 13%, though it maintains more cash than total debt and covers interest payments comfortably. Recent earnings reports show slight sales growth but declining net income year-over-year for Q2 2024, indicating challenges in improving profitability despite stable revenue streams from its two main segments.

- Unlock comprehensive insights into our analysis of Amanat Holdings PJSC stock in this financial health report.

- Learn about Amanat Holdings PJSC's historical performance here.

Giordano International (SEHK:709)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Giordano International Limited is an investment holding company that operates in the retail and distribution of fashion apparel and accessories for men, women, and children across Mainland China, Hong Kong, Macau, Taiwan, Southeast Asia and Australia, Gulf Cooperation Council, and internationally with a market cap of HK$2.78 billion.

Operations: The company's revenue is primarily derived from its operations in Southeast Asia and Australia (HK$1.48 billion), followed by the Gulf Cooperation Council (HK$676 million), Mainland China (HK$631 million), Taiwan (HK$420 million), Hong Kong and Macau (HK$374 million), and wholesale to overseas franchisees (HK$229 million).

Market Cap: HK$2.78B

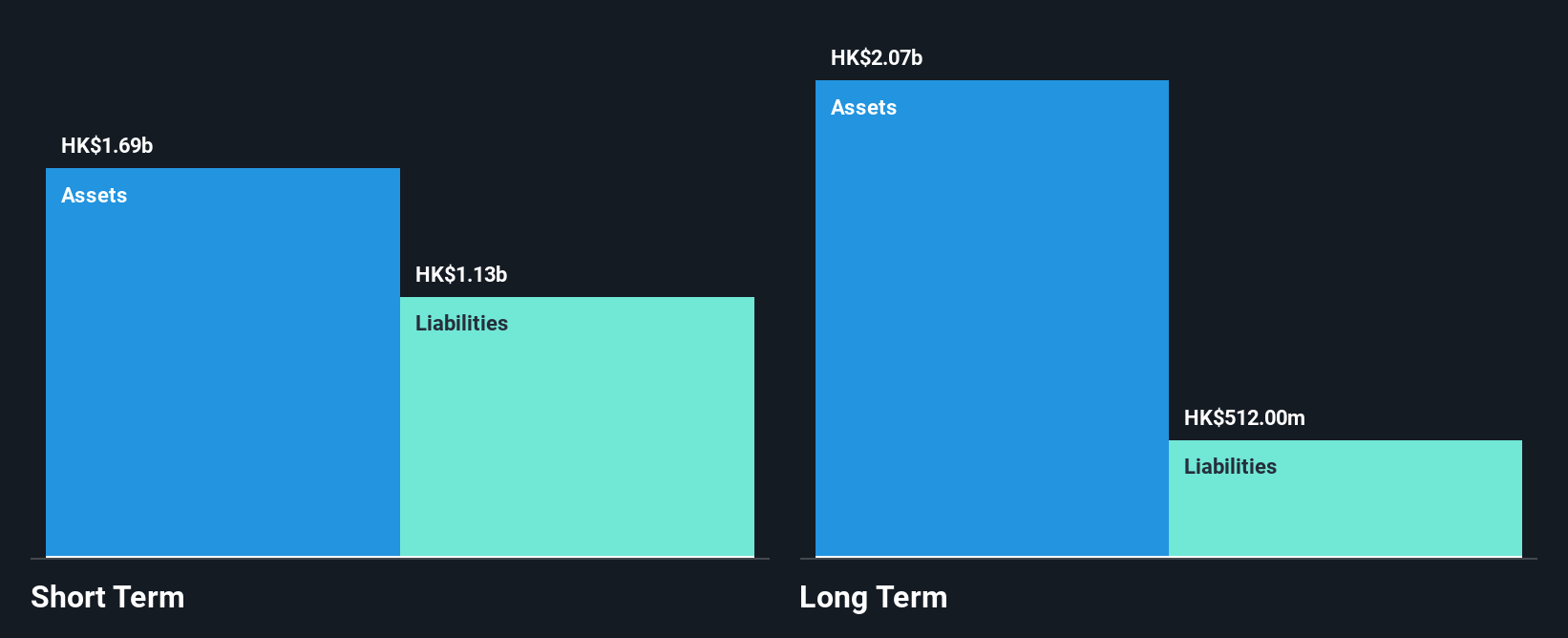

Giordano International, with a market cap of HK$2.78 billion, has shown resilience in its financials despite recent challenges. The company reported stable revenue for the quarter ending September 2024 at HK$907 million, slightly up from the previous year. However, earnings have declined over the past year with net income dropping to HK$120 million for H1 2024 compared to HK$190 million previously. Despite this setback, Giordano maintains strong liquidity with short-term assets of HK$1.6 billion surpassing liabilities and has reduced its debt-to-equity ratio significantly over five years while maintaining high-quality earnings and robust cash flow coverage of debt.

- Jump into the full analysis health report here for a deeper understanding of Giordano International.

- Explore Giordano International's analyst forecasts in our growth report.

Jiangsu Jiangnan High Polymer FiberLtd (SHSE:600527)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Jiangnan High Polymer Fiber Co., Ltd produces and sells composite short-fibers and polyester tops both in China and internationally, with a market cap of CN¥3.05 billion.

Operations: No specific revenue segments are reported for Jiangsu Jiangnan High Polymer Fiber Co., Ltd.

Market Cap: CN¥3.05B

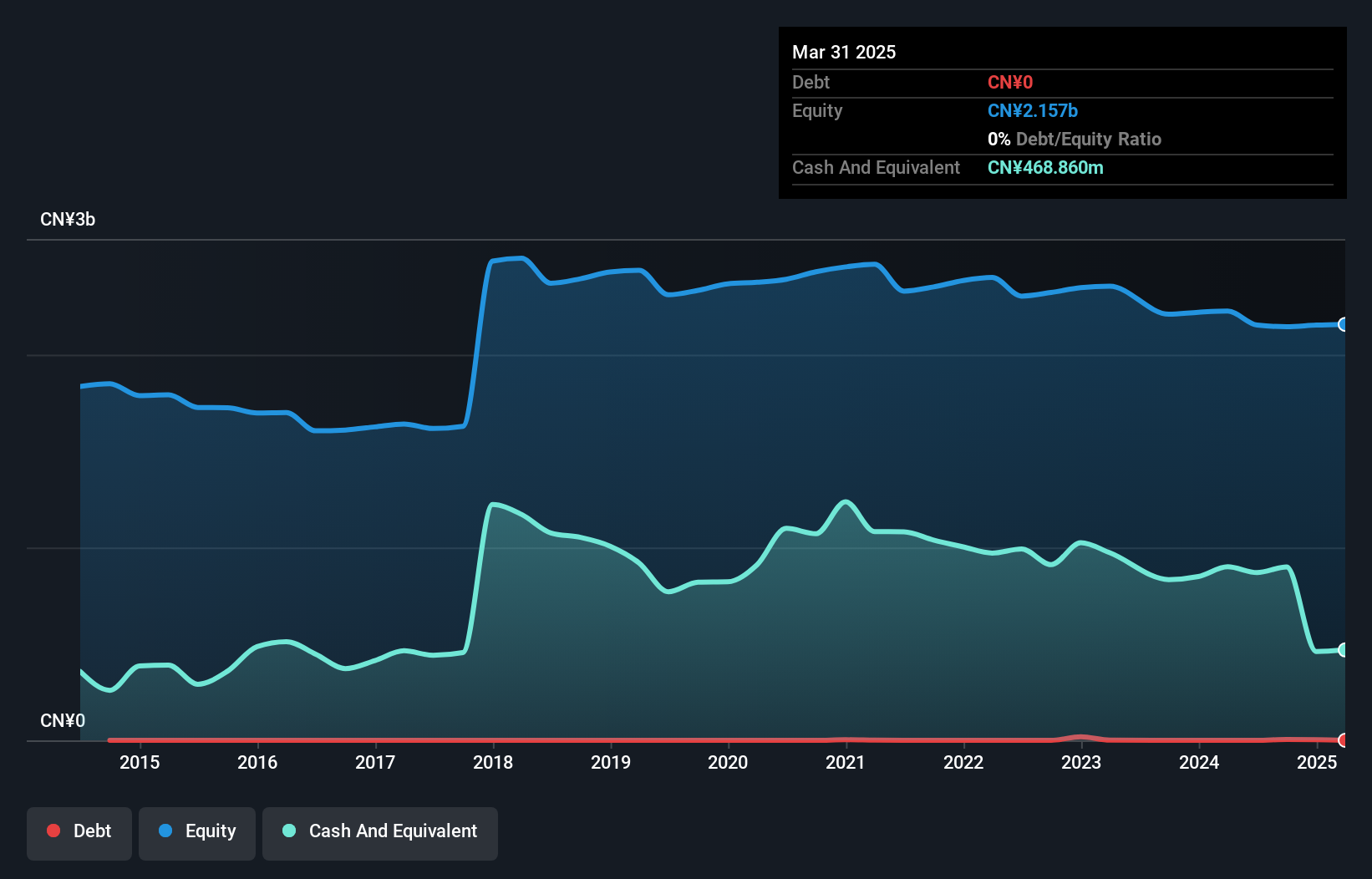

Jiangsu Jiangnan High Polymer Fiber Co., Ltd, with a market cap of CN¥3.05 billion, has faced declining earnings over the past five years. Recent half-year results showed a drop in revenue to CN¥260.05 million from CN¥327.83 million year-on-year and net income slightly decreased to CN¥20.31 million. Despite these challenges, the company is debt-free and maintains strong short-term asset coverage of both long-term (CN¥42.4M) and short-term liabilities (CN¥50.6M). However, its return on equity remains low at 2%, and profit margins have contracted from 8.9% to 5.9%.

- Click to explore a detailed breakdown of our findings in Jiangsu Jiangnan High Polymer FiberLtd's financial health report.

- Understand Jiangsu Jiangnan High Polymer FiberLtd's track record by examining our performance history report.

Key Takeaways

- Navigate through the entire inventory of 5,814 Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:709

Giordano International

An investment holding company, engages in the retail and distribution of men’s, women’s, and children’s fashion apparel and accessories in Mainland China, Hong Kong, Macau, Taiwan, Southeast Asia and Australia, Gulf Cooperation Council, and internationally.

Flawless balance sheet and fair value.