- China

- /

- Metals and Mining

- /

- SHSE:600507

3 Promising Penny Stocks With Market Caps Up To US$2B

Reviewed by Simply Wall St

Global markets have recently experienced fluctuations, with U.S. stocks ending the week lower due to tariff uncertainties and mixed economic indicators. Amidst these market dynamics, investors often seek opportunities in lesser-known areas like penny stocks, a term that may seem outdated but still holds relevance for those interested in smaller or newer companies. These stocks can offer potential growth at lower price points when backed by strong financials and sound fundamentals, making them an intriguing option for those looking to explore beyond traditional investments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.00 | £322.74M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.24M | ★★★★★☆ |

Click here to see the full list of 5,703 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Fangda Special Steel Technology (SHSE:600507)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fangda Special Steel Technology Co., Ltd. operates in the steel manufacturing industry, focusing on producing high-quality special steel products, with a market cap of approximately CN¥9.77 billion.

Operations: Fangda Special Steel Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥9.77B

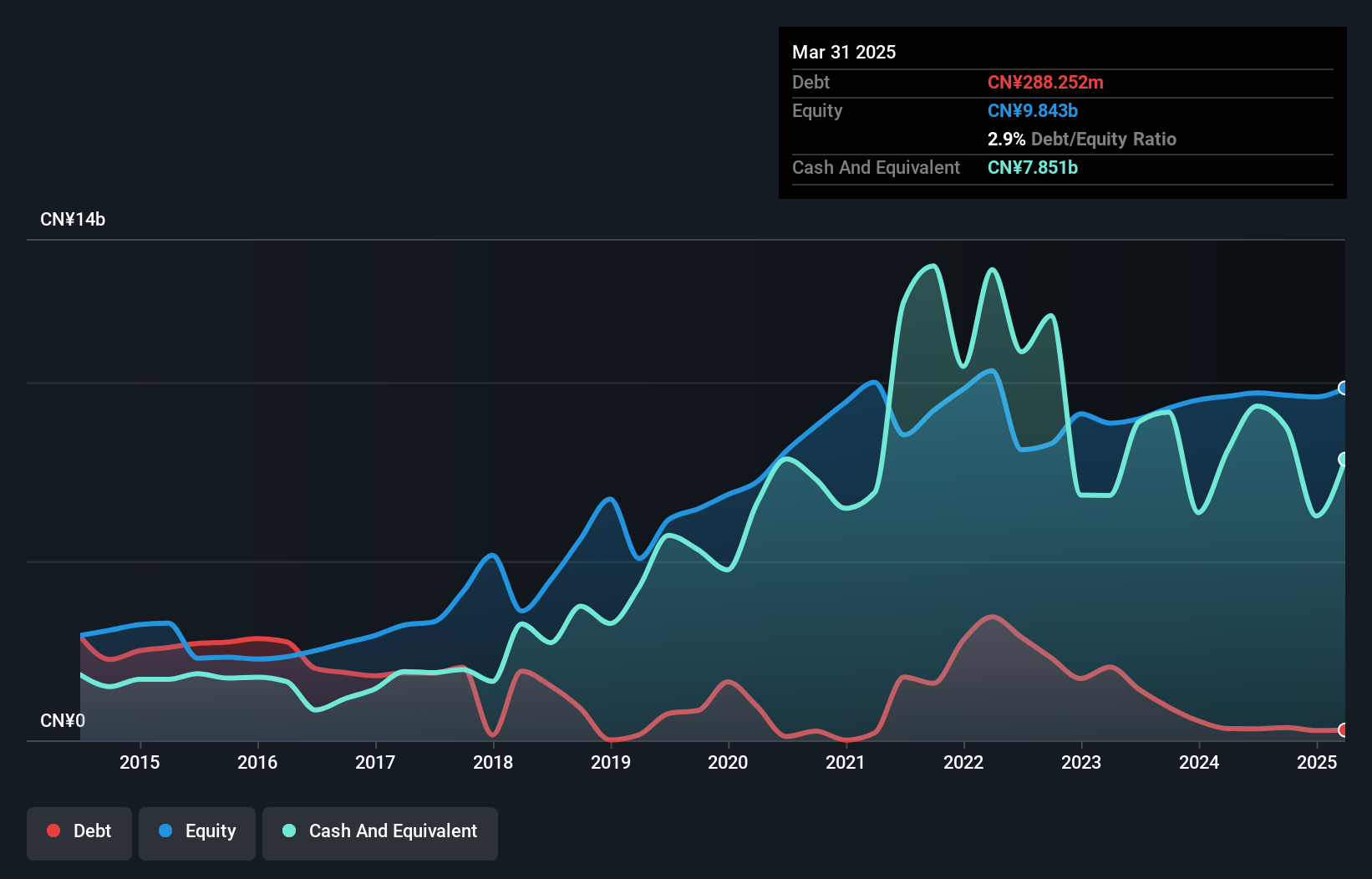

Fangda Special Steel Technology faces challenges with declining earnings, showing a 23.6% annual decrease over the past five years and negative growth in the last year. Despite this, its financial position remains stable with short-term assets exceeding liabilities and more cash than total debt. The company has also reduced its debt-to-equity ratio significantly over five years. However, profitability is low with a Return on Equity of 3.1%, and profit margins have decreased from 1.8% to 1.1%. Recently, Fangda completed a share buyback program worth CN¥109.97 million, repurchasing approximately 1.12% of its shares.

- Click here to discover the nuances of Fangda Special Steel Technology with our detailed analytical financial health report.

- Examine Fangda Special Steel Technology's past performance report to understand how it has performed in prior years.

Cosmos Group (SZSE:002133)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cosmos Group Co., Ltd. operates in the real estate development sector in China with a market cap of CN¥1.98 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥5.13 billion.

Market Cap: CN¥1.98B

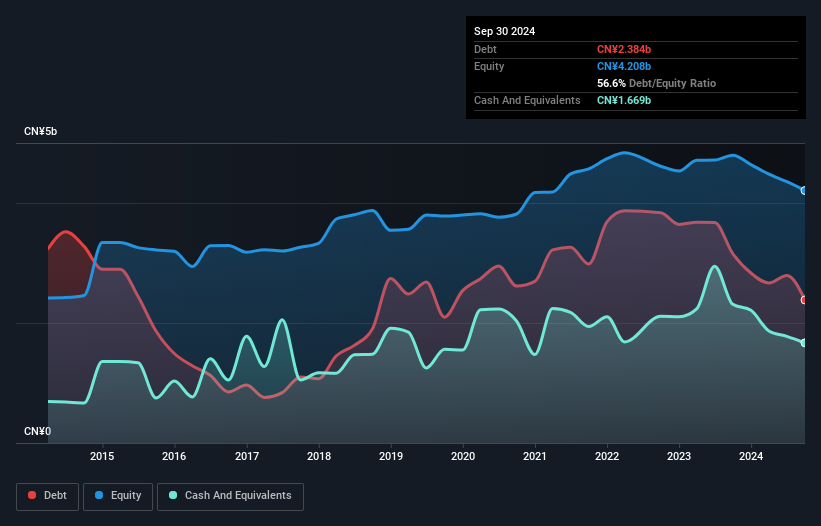

Cosmos Group Co., Ltd. exhibits a complex financial profile, with its seasoned management and board providing stability amidst challenges. Despite trading significantly below estimated fair value, the company struggles with profitability, evidenced by a negative Return on Equity of -6.6% and increasing losses over five years at 33.1% annually. While short-term assets of CN¥9.7 billion comfortably cover both short-term and long-term liabilities, the company's debt-to-equity ratio has slightly increased to 56.6%. Recent shareholder meetings indicate strategic considerations for financial guarantees and wealth management investments, reflecting ongoing efforts to optimize capital use amidst operational difficulties in China's real estate sector.

- Take a closer look at Cosmos Group's potential here in our financial health report.

- Assess Cosmos Group's previous results with our detailed historical performance reports.

Zhejiang Kaier New MaterialsLtd (SZSE:300234)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Kaier New Materials Co., Ltd. specializes in the design, research, development, manufacture, promotion, and sale of functional enamel materials in China and has a market cap of CN¥2.42 billion.

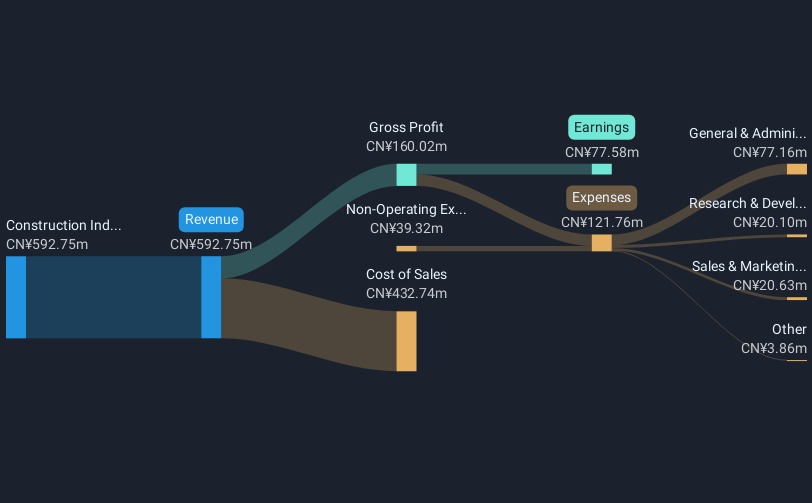

Operations: The company's revenue is derived entirely from the construction industry, amounting to CN¥592.75 million.

Market Cap: CN¥2.42B

Zhejiang Kaier New Materials Co., Ltd. presents a mixed financial picture within the penny stock landscape. The company has transitioned to profitability over the past five years, with earnings growing by 8.5% annually. Its debt-to-equity ratio has improved significantly, and it boasts more cash than total debt, indicating strong financial management. However, its Return on Equity remains low at 6.6%, and recent earnings were impacted by a large one-off gain of CN¥39.7 million, suggesting potential volatility in profit quality. While short-term assets comfortably cover liabilities, the board's inexperience may pose governance challenges moving forward.

- Navigate through the intricacies of Zhejiang Kaier New MaterialsLtd with our comprehensive balance sheet health report here.

- Explore historical data to track Zhejiang Kaier New MaterialsLtd's performance over time in our past results report.

Next Steps

- Unlock more gems! Our Penny Stocks screener has unearthed 5,700 more companies for you to explore.Click here to unveil our expertly curated list of 5,703 Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600507

Fangda Special Steel Technology

Fangda Special Steel Technology Co., Ltd.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives