- China

- /

- Metals and Mining

- /

- SHSE:600490

Pengxin International MiningLtd (SHSE:600490) Is Carrying A Fair Bit Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Pengxin International Mining Co.,Ltd (SHSE:600490) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Pengxin International MiningLtd

What Is Pengxin International MiningLtd's Net Debt?

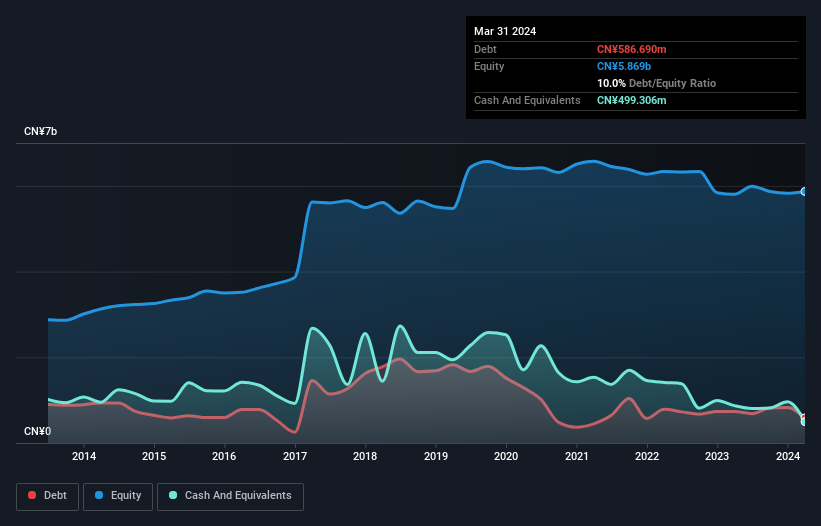

The image below, which you can click on for greater detail, shows that Pengxin International MiningLtd had debt of CN¥586.7m at the end of March 2024, a reduction from CN¥735.9m over a year. However, it also had CN¥499.3m in cash, and so its net debt is CN¥87.4m.

How Strong Is Pengxin International MiningLtd's Balance Sheet?

The latest balance sheet data shows that Pengxin International MiningLtd had liabilities of CN¥1.85b due within a year, and liabilities of CN¥139.5m falling due after that. On the other hand, it had cash of CN¥499.3m and CN¥265.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥1.22b.

Of course, Pengxin International MiningLtd has a market capitalization of CN¥6.17b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, Pengxin International MiningLtd has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But it is Pengxin International MiningLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Pengxin International MiningLtd made a loss at the EBIT level, and saw its revenue drop to CN¥4.0b, which is a fall of 57%. To be frank that doesn't bode well.

Caveat Emptor

Not only did Pengxin International MiningLtd's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost CN¥121m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled CN¥314m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with Pengxin International MiningLtd (including 1 which can't be ignored) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600490

Pengxin International MiningLtd

Operates in the non-ferrous metal industry worldwide.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026