- China

- /

- Electrical

- /

- SZSE:002076

Global Penny Stocks: Pengxin International MiningLtd And Two Others To Watch

Reviewed by Simply Wall St

Global markets have recently faced challenges, with U.S. stock indexes experiencing losses due to renewed tariffs and trade policy uncertainties, while economic data points to a cooling labor market. Amid such volatility, investors often seek opportunities that offer potential for growth at lower price points. Penny stocks, though an older term, remain relevant as they typically refer to smaller or newer companies that can present significant upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.05 | A$95.76M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.46 | HK$933.81M | ✅ 4 ⚠️ 1 View Analysis > |

| GTN (ASX:GTN) | A$0.39 | A$69.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.515 | SGD208.72M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.515 | MYR304.7M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.53 | SGD9.96B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.895 | MYR6.89B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £192.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €32.37M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,837 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Pengxin International MiningLtd (SHSE:600490)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pengxin International Mining Co., Ltd operates in the non-ferrous metal industry globally and has a market cap of CN¥9.74 billion.

Operations: Pengxin International Mining Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥9.74B

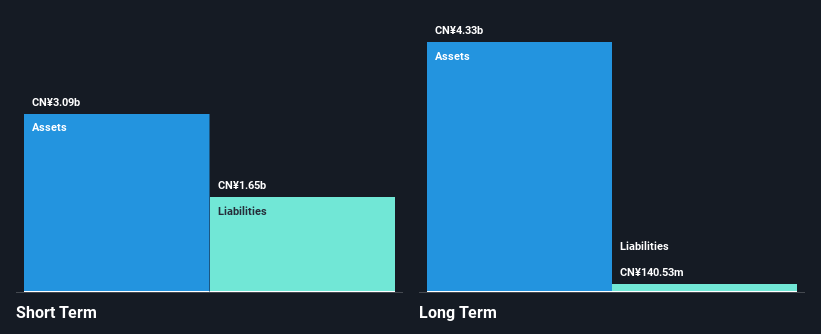

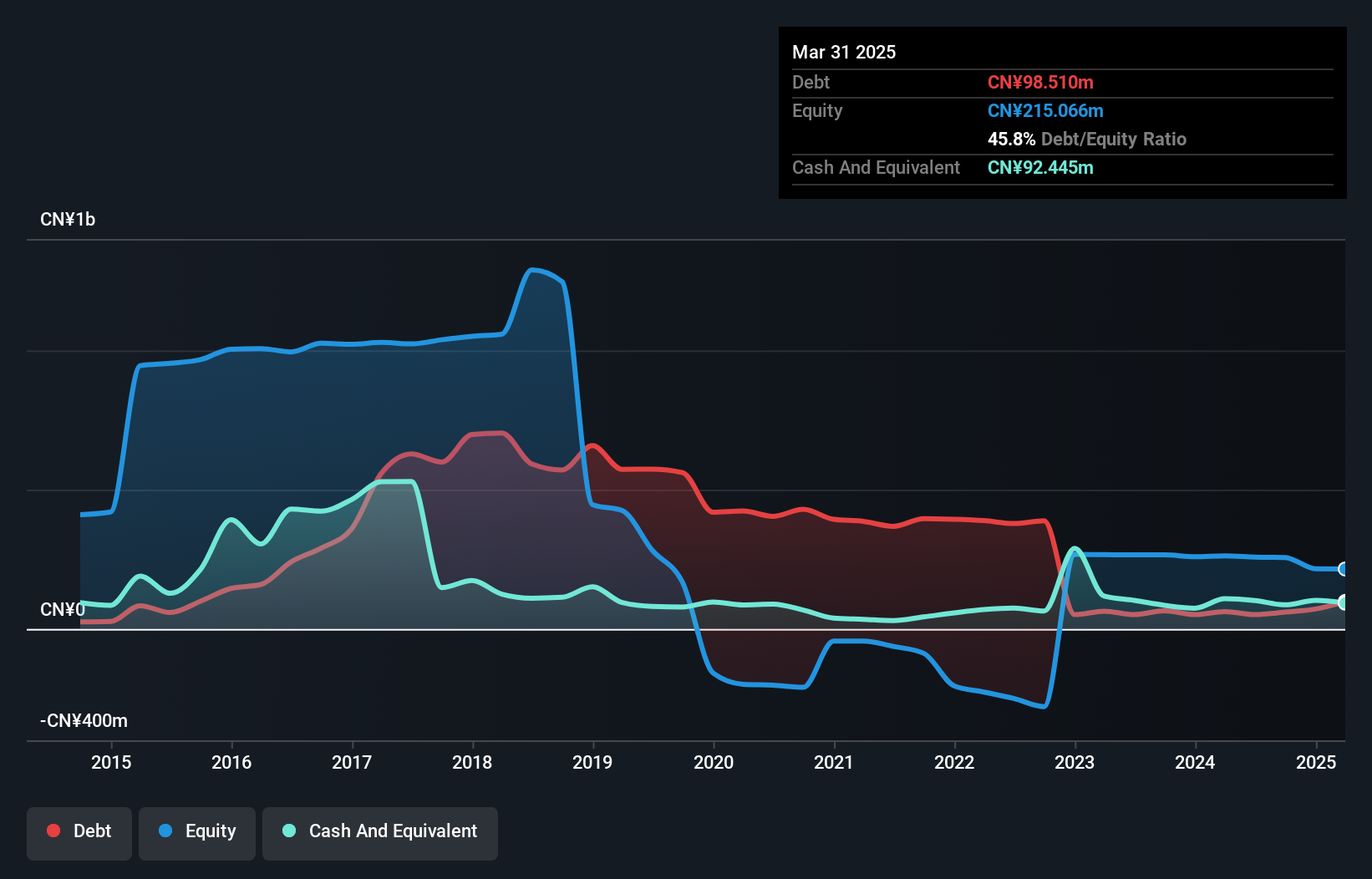

Pengxin International Mining Co., Ltd, with a market cap of CN¥9.74 billion, operates in the non-ferrous metal industry and appears to be pre-revenue. Despite being unprofitable and experiencing increased losses over the past five years, its short-term assets of CN¥3.2 billion comfortably cover both short-term liabilities of CN¥1.6 billion and long-term liabilities of CN¥115.2 million. The company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, indicating prudent financial management amidst challenges in profitability and earnings growth stability.

- Get an in-depth perspective on Pengxin International MiningLtd's performance by reading our balance sheet health report here.

- Examine Pengxin International MiningLtd's past performance report to understand how it has performed in prior years.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cnlight Co., Ltd is a Chinese company that manufactures and sells lighting products, with a market cap of CN¥2.15 billion.

Operations: Cnlight Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥2.15B

Cnlight Co., Ltd, with a market cap of CN¥2.15 billion, is unprofitable but has shown progress by reducing its losses at a substantial rate over the past five years. The company maintains a satisfactory net debt to equity ratio of 2.8% and possesses sufficient cash runway for more than three years, even if free cash flow continues to decline significantly each year. Its short-term assets exceed both short-term and long-term liabilities, reflecting financial stability despite current challenges in profitability. Recent amendments to the company's articles of association suggest strategic shifts that may influence its business trajectory.

- Click here and access our complete financial health analysis report to understand the dynamics of CnlightLtd.

- Gain insights into CnlightLtd's past trends and performance with our report on the company's historical track record.

Jiangsu Wuyang Automation Control Technology (SZSE:300420)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Wuyang Automation Control Technology Co., Ltd. (SZSE:300420) operates in the automation control industry with a market capitalization of CN¥4.03 billion.

Operations: The company's revenue is primarily derived from its operations within China, totaling CN¥992.76 million.

Market Cap: CN¥4.03B

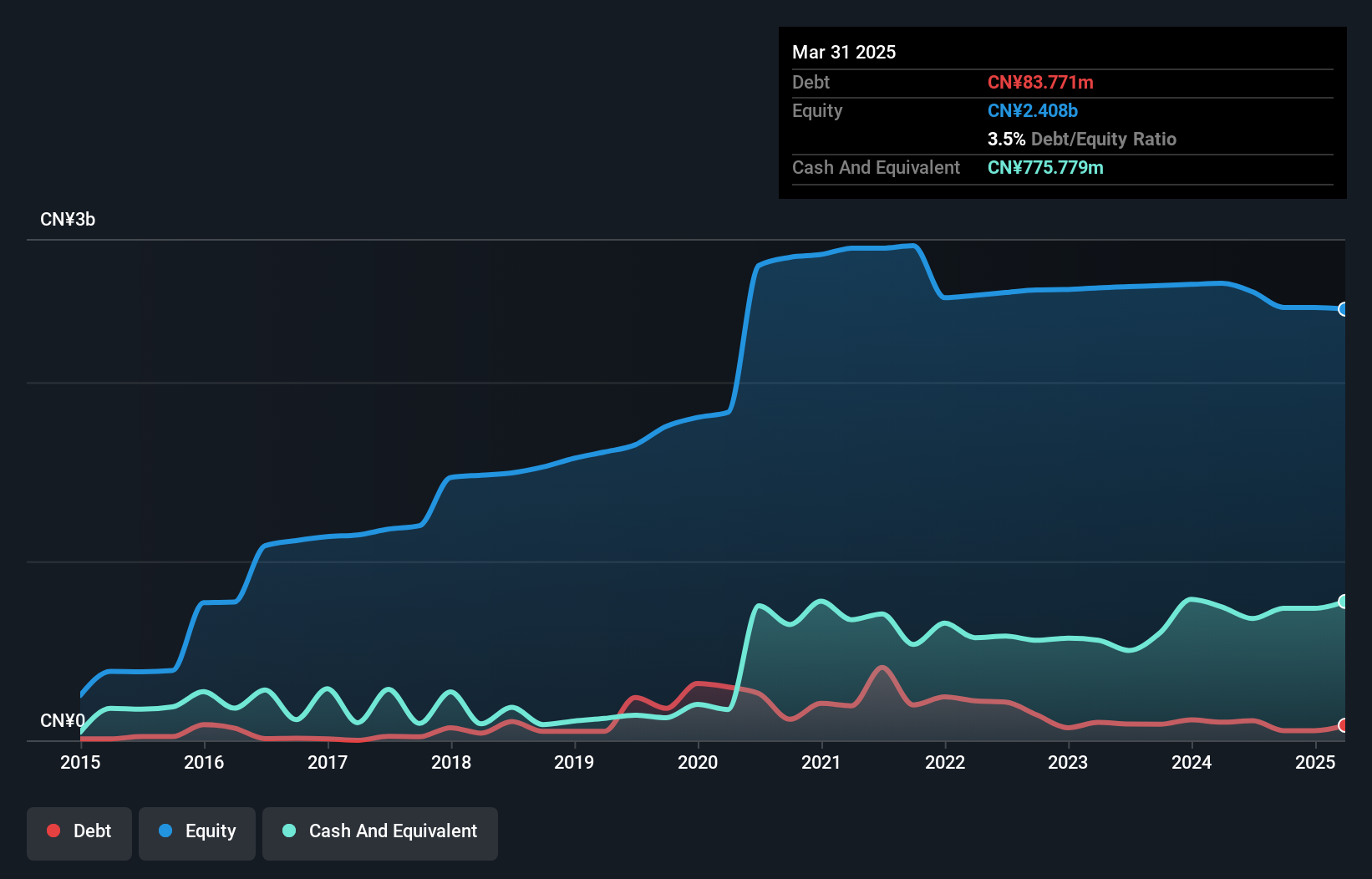

Jiangsu Wuyang Automation Control Technology, with a market cap of CN¥4.03 billion, is currently unprofitable and has seen its earnings decline by 33.7% annually over the past five years. Despite this, the company maintains financial resilience with more cash than debt and a reduced debt-to-equity ratio from 16.3% to 3.5%. Its short-term assets of CN¥1.9 billion comfortably cover both short-term and long-term liabilities, indicating solid liquidity management. However, the board's average tenure of 2.8 years suggests limited experience in navigating the company's strategic direction amidst ongoing challenges in profitability growth.

- Unlock comprehensive insights into our analysis of Jiangsu Wuyang Automation Control Technology stock in this financial health report.

- Evaluate Jiangsu Wuyang Automation Control Technology's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Jump into our full catalog of 3,837 Global Penny Stocks here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002076

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives