- China

- /

- Metals and Mining

- /

- SHSE:600490

Frontage Holdings And 2 Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Global markets have recently experienced volatility, with U.S. stocks declining due to cautious Federal Reserve commentary and political uncertainty surrounding a potential government shutdown. Amid such market fluctuations, investors often seek opportunities in various segments, including penny stocks—an investment area that remains relevant despite its somewhat outdated terminology. These smaller or newer companies can offer significant value when they possess strong financials and growth potential, providing a unique opportunity for investors to explore promising options in the current economic landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £145.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.39 | £64.65M | ★★★★☆☆ |

Click here to see the full list of 5,828 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Frontage Holdings (SEHK:1521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontage Holdings Corporation is a contract research organization offering laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies, with a market cap of HK$3.36 billion.

Operations: The company generates revenue from two primary regions, with $198.50 million coming from North America and $61.48 million from the People's Republic of China (PRC).

Market Cap: HK$3.36B

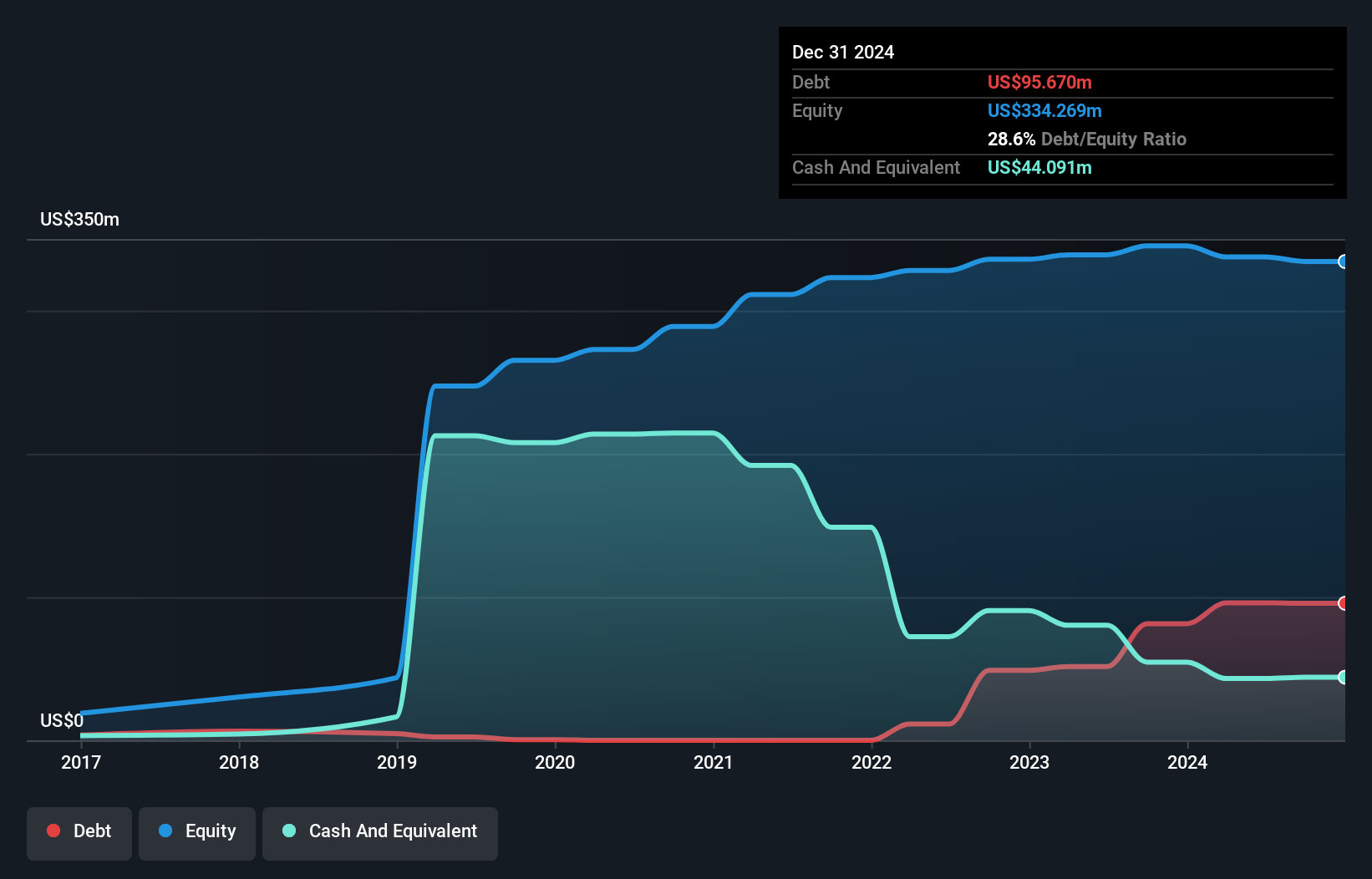

Frontage Holdings Corporation, with a market cap of HK$3.36 billion, generates significant revenue from North America (US$198.50 million) and the PRC (US$61.48 million). The company's short-term assets exceed both its short-term and long-term liabilities, indicating solid liquidity management. However, interest payments are not well covered by EBIT, suggesting potential financial strain in servicing debt despite satisfactory net debt to equity levels. Profit margins have decreased to 2.3% from 6.7% last year due to a large one-off loss of US$3 million impacting recent financial results. Earnings growth is forecasted at 67.6% annually despite recent declines.

- Click here and access our complete financial health analysis report to understand the dynamics of Frontage Holdings.

- Learn about Frontage Holdings' future growth trajectory here.

CT Vision S.L. (International) Holdings (SEHK:994)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CT Vision S.L. (International) Holdings Limited is an investment holding company involved in renewable energy, e-commerce, and building information modelling in China, with a market cap of HK$165.19 million.

Operations: The company's revenue is primarily derived from its Renewable Energy Business, which generated HK$291.15 million, and its e-Commerce Business, contributing HK$43.60 million.

Market Cap: HK$165.19M

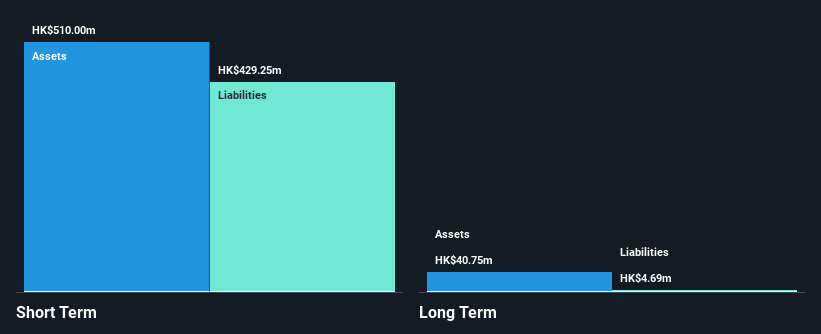

CT Vision S.L. (International) Holdings Limited, with a market cap of HK$165.19 million, primarily generates revenue from its renewable energy and e-commerce sectors in China. Despite being unprofitable, the company has reduced losses by 25.8% annually over the past five years and maintains a positive cash flow, ensuring a cash runway exceeding three years. The firm has improved its financial stability by reducing its debt-to-equity ratio significantly over five years and covering both short-term and long-term liabilities with ample assets. Recent board changes include Dr. Tang Dajie's appointment following Mr. Ng Kwun Wan's resignation due to term expiration.

- Get an in-depth perspective on CT Vision S.L. (International) Holdings' performance by reading our balance sheet health report here.

- Learn about CT Vision S.L. (International) Holdings' historical performance here.

Pengxin International MiningLtd (SHSE:600490)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pengxin International Mining Co., Ltd operates in the non-ferrous metal industry globally, with a market cap of CN¥8.41 billion.

Operations: No specific revenue segments are reported for Pengxin International Mining Co., Ltd.

Market Cap: CN¥8.41B

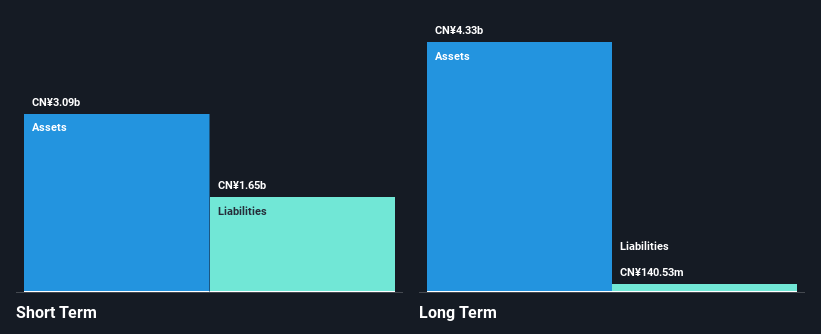

Pengxin International Mining Co., Ltd, with a market cap of CN¥8.41 billion, operates in the non-ferrous metal industry and has reported sales of CN¥3.26 billion for the nine months ended September 30, 2024. However, the company remains unprofitable with a net loss of CN¥117.04 million during this period and has seen earnings decline by an average of 50.5% annually over the past five years. Despite this, Pengxin's short-term assets (CN¥3.1 billion) comfortably cover both its short-term (CN¥1.6 billion) and long-term liabilities (CN¥140.5 million), indicating some financial stability amidst ongoing challenges.

- Take a closer look at Pengxin International MiningLtd's potential here in our financial health report.

- Gain insights into Pengxin International MiningLtd's historical outcomes by reviewing our past performance report.

Key Takeaways

- Reveal the 5,828 hidden gems among our Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600490

Pengxin International MiningLtd

Operates in the non-ferrous metal industry worldwide.

Adequate balance sheet very low.