Shandong Hualu-Hengsheng Chemical Co., Ltd. (SHSE:600426) Doing What It Can To Lift Shares

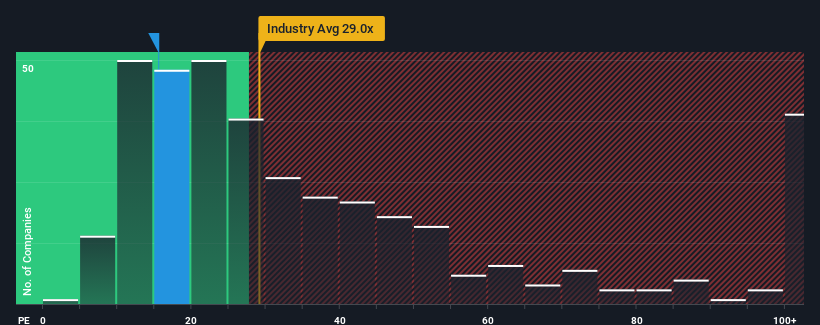

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may consider Shandong Hualu-Hengsheng Chemical Co., Ltd. (SHSE:600426) as an attractive investment with its 15.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Shandong Hualu-Hengsheng Chemical hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Shandong Hualu-Hengsheng Chemical

How Is Shandong Hualu-Hengsheng Chemical's Growth Trending?

Shandong Hualu-Hengsheng Chemical's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 43%. Even so, admirably EPS has lifted 98% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 24% each year over the next three years. With the market only predicted to deliver 20% per year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Shandong Hualu-Hengsheng Chemical is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Shandong Hualu-Hengsheng Chemical's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shandong Hualu-Hengsheng Chemical currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Shandong Hualu-Hengsheng Chemical (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600426

Shandong Hualu-Hengsheng Chemical

Shandong Hualu-Hengsheng Chemical Co., Ltd.

Very undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives