- China

- /

- Consumer Durables

- /

- SZSE:300374

Three Asian Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets grapple with heightened trade tensions and economic uncertainties, the Asian market has not been immune to these challenges, experiencing fluctuations amid tariff announcements and broader geopolitical concerns. In such a volatile environment, growth companies with high insider ownership can present unique opportunities due to their potential for alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| UTour Group (SZSE:002707) | 23.5% | 32.7% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

We're going to check out a few of the best picks from our screener tool.

Shenghe Resources Holding (SHSE:600392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenghe Resources Holding Co., Ltd is involved in the R&D, production, and distribution of rare earth products both in China and globally, with a market cap of CN¥19.33 billion.

Operations: Revenue segments for Shenghe Resources Holding Co., Ltd include the research, development, production, and supply of rare earth and related products in both domestic and international markets.

Insider Ownership: 13.5%

Shenghe Resources Holding's earnings are expected to grow significantly at 53.5% annually, outpacing the Chinese market's 23.8%. Revenue is forecasted to increase by 26% per year, surpassing the market average of 12.5%. Despite no substantial insider trading activity recently, high insider ownership aligns management interests with shareholders. However, a low projected return on equity of 9.2% and large one-off items affecting earnings quality warrant caution for investors focusing on sustainable growth metrics.

- Navigate through the intricacies of Shenghe Resources Holding with our comprehensive analyst estimates report here.

- Our valuation report here indicates Shenghe Resources Holding may be overvalued.

UTour Group (SZSE:002707)

Simply Wall St Growth Rating: ★★★★★★

Overview: UTour Group Co., Ltd. operates in the outbound tourism wholesale and retail sector both within China and internationally, with a market cap of CN¥7.99 billion.

Operations: UTour Group Co., Ltd. generates revenue through its operations in the outbound tourism wholesale and retail sectors, serving both domestic and international markets.

Insider Ownership: 23.5%

UTour Group's earnings are projected to grow at 32.7% annually, outpacing the Chinese market's 23.8%. Revenue growth is expected at 27% per year, faster than the market average of 12.5%. Despite no recent insider trading activity, high insider ownership suggests aligned interests between management and shareholders. Recent board changes with new director appointments could influence strategic direction. The stock trades significantly below its estimated fair value, presenting potential investment opportunities amidst its robust growth forecasts.

- Take a closer look at UTour Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, UTour Group's share price might be too optimistic.

China Railway Prefabricated Construction (SZSE:300374)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Railway Prefabricated Construction Co., Ltd. operates in the construction industry, focusing on prefabricated building solutions, with a market capitalization of approximately CN¥4.13 billion.

Operations: I'm sorry, but the Business operations text provided does not contain any specific revenue segment information for China Railway Prefabricated Construction Co., Ltd.

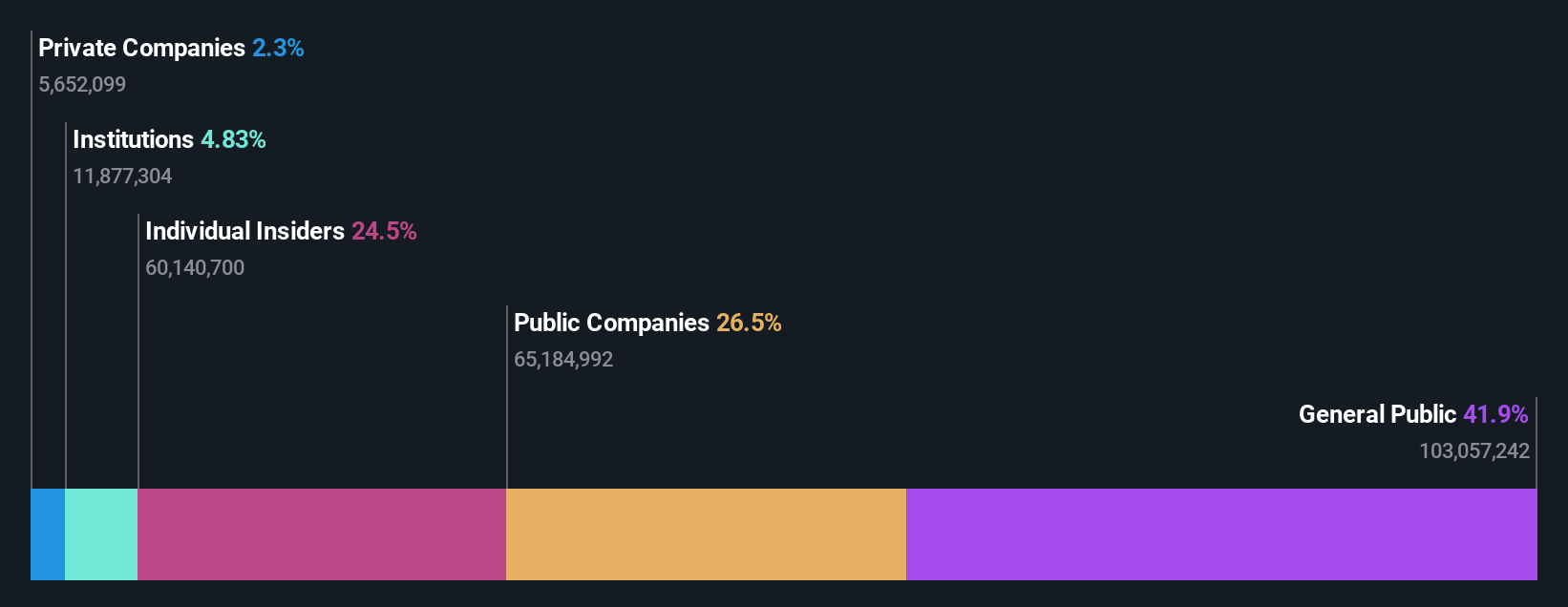

Insider Ownership: 25.1%

China Railway Prefabricated Construction is experiencing strong revenue growth, with recent figures showing CNY 1.90 billion compared to CNY 1.50 billion the previous year. The company reduced its net loss from CNY 162.73 million to CNY 63.72 million, indicating improved financial health. Forecasts suggest it will become profitable within three years, with revenue expected to grow at over 20% annually, surpassing market averages despite a low projected return on equity of 5.4%.

- Click to explore a detailed breakdown of our findings in China Railway Prefabricated Construction's earnings growth report.

- Our expertly prepared valuation report China Railway Prefabricated Construction implies its share price may be too high.

Taking Advantage

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 647 more companies for you to explore.Click here to unveil our expertly curated list of 650 Fast Growing Asian Companies With High Insider Ownership.

- Seeking Other Investments? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300374

China Railway Prefabricated Construction

China Railway Prefabricated Construction Co., Ltd.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives