Market Still Lacking Some Conviction On CNSIG Inner Mongolia Chemical Industry Co.,Ltd. (SHSE:600328)

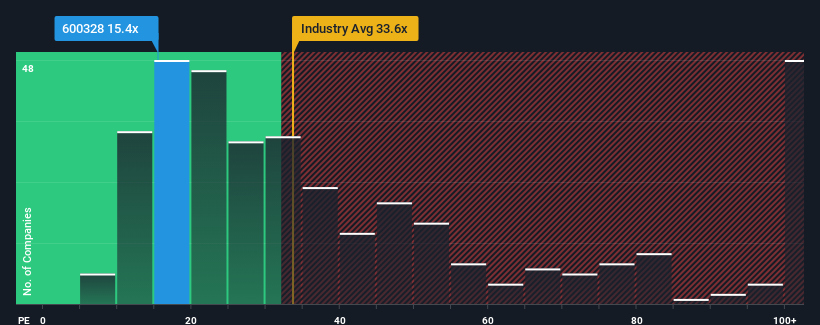

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may consider CNSIG Inner Mongolia Chemical Industry Co.,Ltd. (SHSE:600328) as a highly attractive investment with its 15.4x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

CNSIG Inner Mongolia Chemical IndustryLtd has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for CNSIG Inner Mongolia Chemical IndustryLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like CNSIG Inner Mongolia Chemical IndustryLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. The last three years don't look nice either as the company has shrunk EPS by 44% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 30% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 19% per annum, which is noticeably less attractive.

With this information, we find it odd that CNSIG Inner Mongolia Chemical IndustryLtd is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On CNSIG Inner Mongolia Chemical IndustryLtd's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that CNSIG Inner Mongolia Chemical IndustryLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for CNSIG Inner Mongolia Chemical IndustryLtd you should be aware of.

If you're unsure about the strength of CNSIG Inner Mongolia Chemical IndustryLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600328

CNSIG Inner Mongolia Chemical IndustryLtd

CNSIG Inner Mongolia Chemical Industry Co.,Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives