- China

- /

- Paper and Forestry Products

- /

- SHSE:600321

Rightway Holdings Co.,ltd. (SHSE:600321) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Rightway Holdings Co.,ltd. (SHSE:600321) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

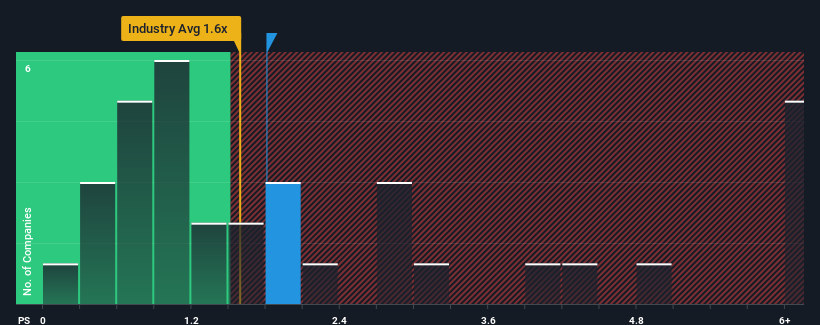

Although its price has dipped substantially, there still wouldn't be many who think Rightway Holdingsltd's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in China's Forestry industry is similar at about 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Rightway Holdingsltd

How Rightway Holdingsltd Has Been Performing

The revenue growth achieved at Rightway Holdingsltd over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Rightway Holdingsltd will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Rightway Holdingsltd?

The only time you'd be comfortable seeing a P/S like Rightway Holdingsltd's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The latest three year period has also seen a 9.6% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Rightway Holdingsltd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Rightway Holdingsltd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Rightway Holdingsltd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 1 warning sign for Rightway Holdingsltd you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600321

Good value with adequate balance sheet.

Market Insights

Community Narratives