- China

- /

- Metals and Mining

- /

- SHSE:600259

We Think Rising Nonferrous Metals ShareLtd (SHSE:600259) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Rising Nonferrous Metals Share Co.,Ltd. (SHSE:600259) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Rising Nonferrous Metals ShareLtd

What Is Rising Nonferrous Metals ShareLtd's Debt?

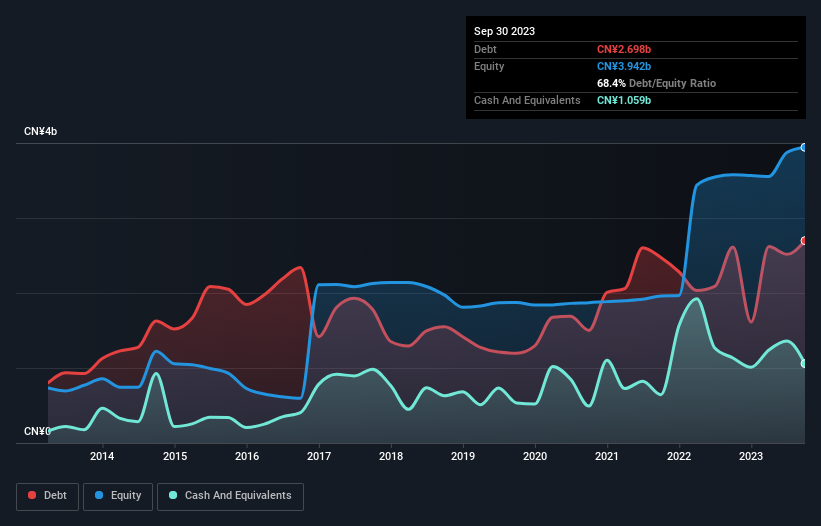

The chart below, which you can click on for greater detail, shows that Rising Nonferrous Metals ShareLtd had CN¥2.70b in debt in September 2023; about the same as the year before. However, it does have CN¥1.06b in cash offsetting this, leading to net debt of about CN¥1.64b.

How Healthy Is Rising Nonferrous Metals ShareLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Rising Nonferrous Metals ShareLtd had liabilities of CN¥4.03b due within 12 months and liabilities of CN¥967.3m due beyond that. Offsetting these obligations, it had cash of CN¥1.06b as well as receivables valued at CN¥668.3m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥3.28b.

Rising Nonferrous Metals ShareLtd has a market capitalization of CN¥10.3b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

As it happens Rising Nonferrous Metals ShareLtd has a fairly concerning net debt to EBITDA ratio of 13.2 but very strong interest coverage of 1k. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Shareholders should be aware that Rising Nonferrous Metals ShareLtd's EBIT was down 80% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Rising Nonferrous Metals ShareLtd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Rising Nonferrous Metals ShareLtd saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Rising Nonferrous Metals ShareLtd's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider Rising Nonferrous Metals ShareLtd to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Rising Nonferrous Metals ShareLtd (of which 1 is significant!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600259

Rising Nonferrous Metals ShareLtd

Engages in the mining, smelting separation, deep processing, and trading of rare earth and non-ferrous metals in China.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives