- China

- /

- Metals and Mining

- /

- SHSE:600259

3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 46.7%

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are increasingly seeking opportunities to identify stocks trading below their intrinsic value. In such an environment, a good stock is often characterized by its resilience to macroeconomic pressures and potential for long-term appreciation despite current market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| North Electro-OpticLtd (SHSE:600184) | CN¥10.77 | CN¥22.94 | 53.1% |

| Enento Group Oyj (HLSE:ENENTO) | €18.40 | €36.57 | 49.7% |

| WEX (NYSE:WEX) | US$172.60 | US$343.98 | 49.8% |

| Semiconductor Manufacturing International (SEHK:981) | HK$27.05 | HK$53.78 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2618.00 | ¥5409.74 | 51.6% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

| Energy One (ASX:EOL) | A$5.65 | A$11.04 | 48.8% |

| Sinch (OM:SINCH) | SEK31.45 | SEK62.48 | 49.7% |

We'll examine a selection from our screener results.

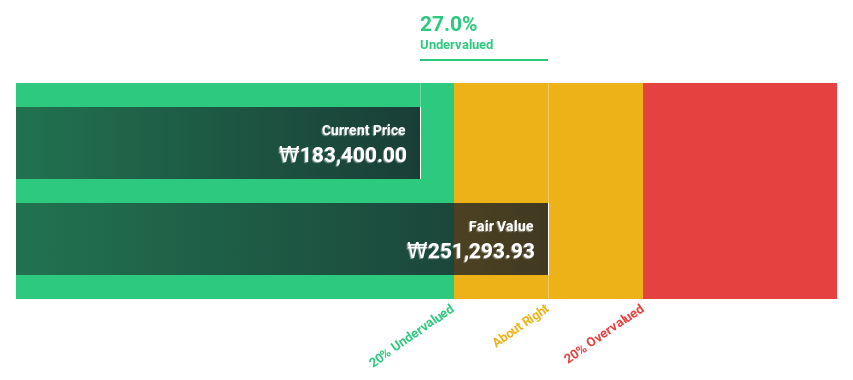

Cosmax (KOSE:A192820)

Overview: Cosmax, Inc. is a company that researches, develops, produces, and manufactures cosmetic and health functional food products both in Korea and internationally, with a market cap of ₩1.71 billion.

Operations: The company's revenue primarily comes from the Cosmetics Division, which generated ₩1.97 billion.

Estimated Discount To Fair Value: 46.7%

Cosmax is trading at ₩153,900, significantly below its estimated fair value of ₩288,839.38, representing a 46.7% discount. Despite high share price volatility recently and substantial debt levels, the company shows promising growth prospects with earnings expected to grow by 27.59% annually over the next three years. Revenue growth is forecasted at 12.7% per year, outpacing the Korean market's average of 10.2%. Analysts anticipate a potential stock price increase of 21%.

- The growth report we've compiled suggests that Cosmax's future prospects could be on the up.

- Take a closer look at Cosmax's balance sheet health here in our report.

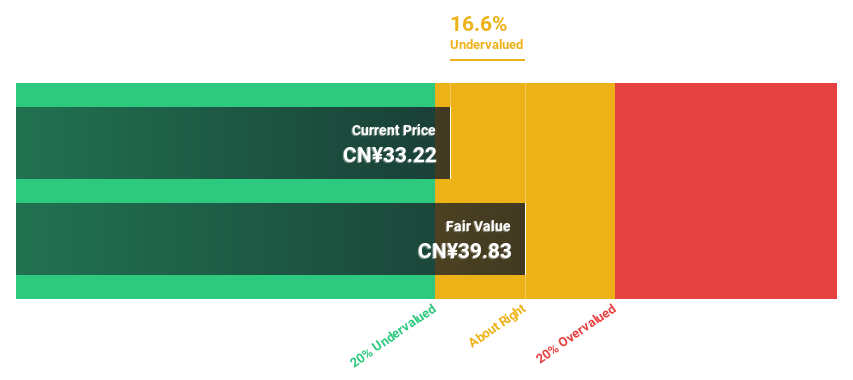

Rising Nonferrous Metals ShareLtd (SHSE:600259)

Overview: Rising Nonferrous Metals Share Co., Ltd. operates in China, focusing on the mining, smelting separation, deep processing, and trading of rare earth and non-ferrous metals with a market cap of approximately CN¥10.16 billion.

Operations: Rising Nonferrous Metals Share Ltd. generates revenue through its activities in mining, smelting separation, deep processing, and trading of rare earth and non-ferrous metals within China.

Estimated Discount To Fair Value: 16.6%

Rising Nonferrous Metals Share Ltd. trades at CN¥33.22, below its fair value estimate of CN¥39.84, indicating it might be undervalued based on cash flows despite recent financial challenges. The company reported a net loss of CN¥275.52 million for the nine months ending September 2024, with sales declining to CN¥8.74 billion from the previous year's CN¥15.56 billion, yet revenue is forecast to grow significantly faster than the Chinese market average annually.

- In light of our recent growth report, it seems possible that Rising Nonferrous Metals ShareLtd's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Rising Nonferrous Metals ShareLtd.

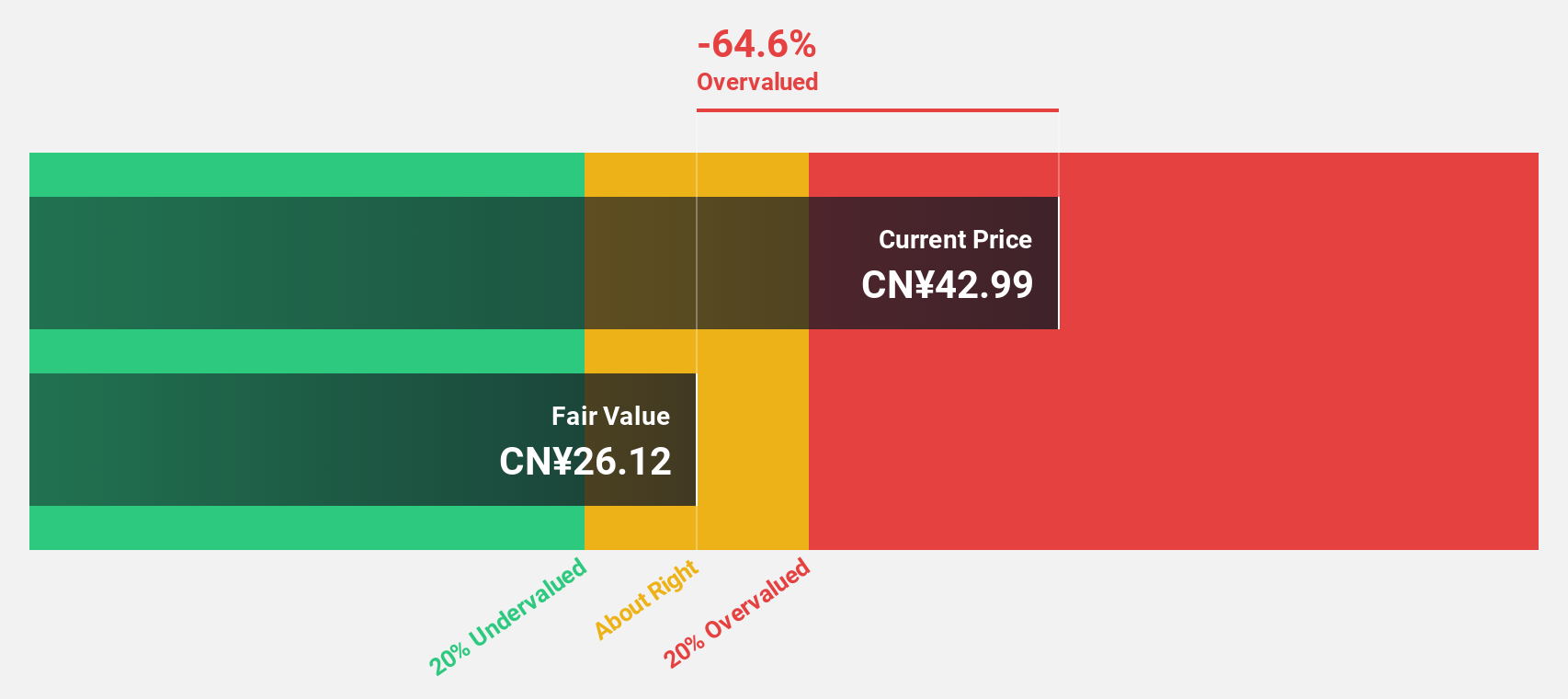

Haisco Pharmaceutical Group (SZSE:002653)

Overview: Haisco Pharmaceutical Group Co., Ltd. engages in the research, development, manufacturing, and sale of pharmaceuticals in China with a market cap of CN¥38.76 billion.

Operations: The company generates revenue from its operations in the research, development, manufacturing, and sale of pharmaceuticals within China.

Estimated Discount To Fair Value: 34.3%

Haisco Pharmaceutical Group, trading at CN¥36.51, is significantly undervalued with a fair value estimate of CN¥55.6. The company reported strong earnings growth of 27.1% over the past year and expects annual profit growth of 35.6%, outpacing the Chinese market average. Despite a low return on equity forecast and dividends not well covered by free cash flows, its revenue is projected to grow faster than both the industry and market averages annually.

- Our expertly prepared growth report on Haisco Pharmaceutical Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Haisco Pharmaceutical Group stock in this financial health report.

Taking Advantage

- Unlock our comprehensive list of 958 Undervalued Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600259

Rising Nonferrous Metals ShareLtd

Engages in the mining, smelting separation, deep processing, and trading of rare earth and non-ferrous metals in China.

Flawless balance sheet and undervalued.