- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

FIT Hon Teng And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. stock indexes nearing record highs and European indices reaching fresh levels, investors are increasingly interested in exploring diverse investment opportunities. Penny stocks, often associated with smaller or newer companies, provide a unique chance for growth at lower price points. Despite their vintage name, these stocks can offer significant potential when backed by strong financials and solid fundamentals. In this article, we explore three promising penny stocks that stand out for their balance sheet strength and potential for impressive returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.86 | HK$44.77B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.32 | MYR932.02M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.59B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £152.99M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.855 | £468.01M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.09 | £307.32M | ★★★★☆☆ |

Click here to see the full list of 5,695 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors both in Taiwan and internationally, with a market capitalization of approximately HK$26 billion.

Operations: The company's revenue is primarily derived from its Intermediate Products segment, which generated $3.94 billion, followed by the Consumer Products segment with $690.95 million.

Market Cap: HK$26B

FIT Hon Teng Limited, with a market capitalization of approximately HK$26 billion, derives significant revenue from its Intermediate Products segment. The company's earnings have shown impressive growth of 125.6% over the past year, surpassing the Electronic industry's growth rate. Despite an increase in debt to equity ratio over five years, its net debt to equity remains satisfactory at 12.1%, with interest payments well covered by EBIT and operating cash flow covering debt effectively. However, the stock has experienced high volatility recently and trades slightly below estimated fair value while maintaining stable profit margins and seasoned management.

- Dive into the specifics of FIT Hon Teng here with our thorough balance sheet health report.

- Examine FIT Hon Teng's earnings growth report to understand how analysts expect it to perform.

Qingci Games (SEHK:6633)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qingci Games Inc. is an investment holding company that develops, publishes, and operates mobile games across several international markets including China, Japan, and the United States, with a market cap of HK$1.67 billion.

Operations: The company's revenue is primarily generated from its Computer Graphics segment, amounting to CN¥914.42 million.

Market Cap: HK$1.67B

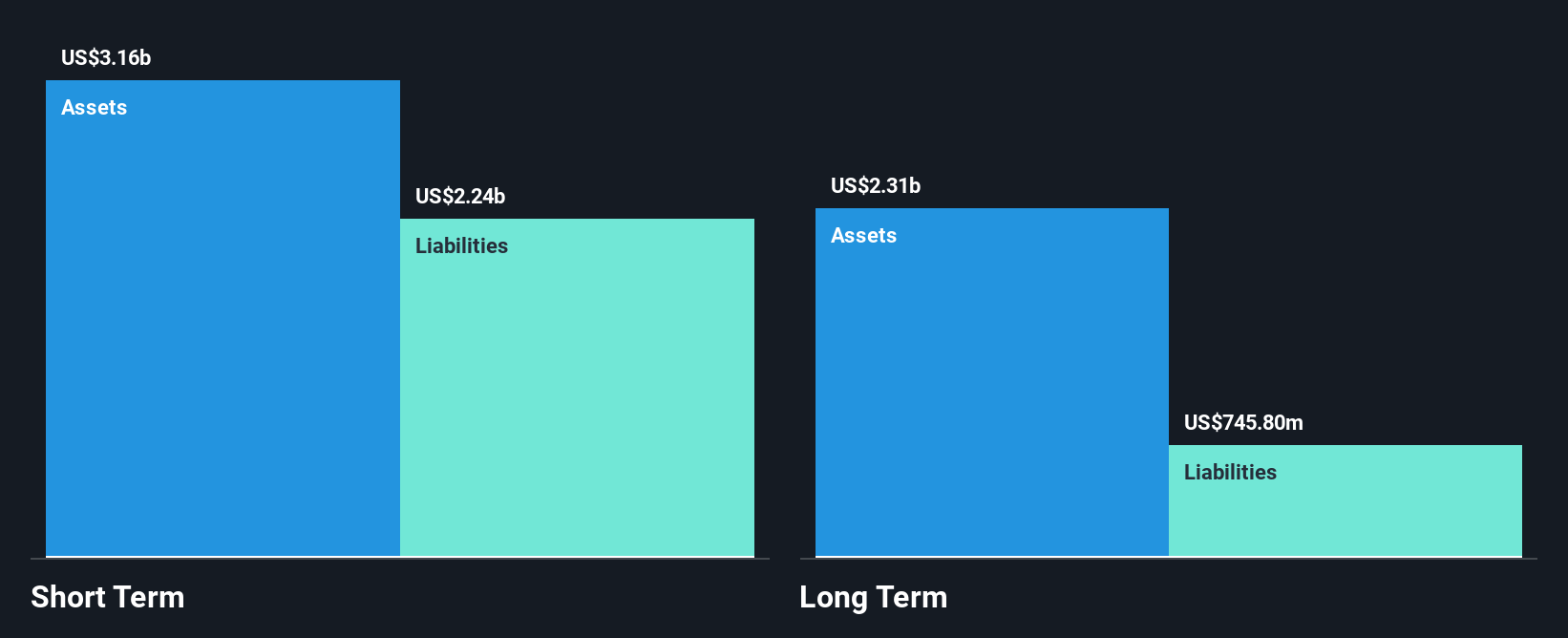

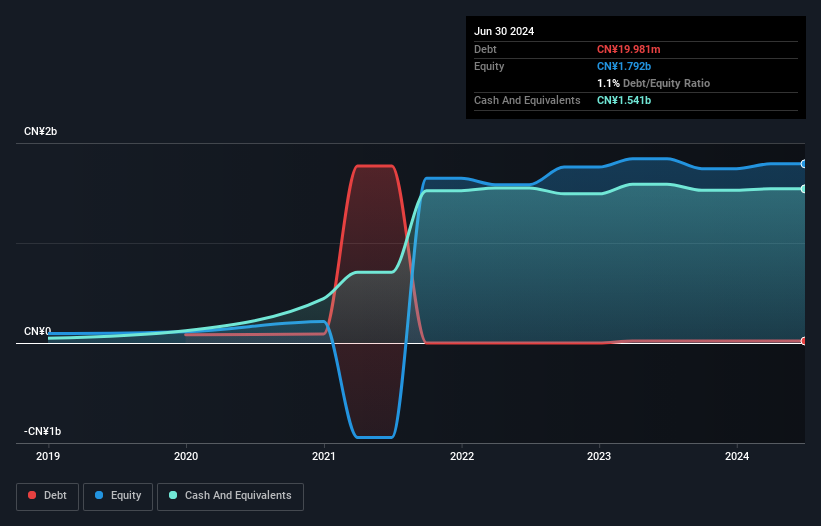

Qingci Games Inc., with a market cap of HK$1.67 billion, is primarily driven by its Computer Graphics segment, generating CN¥914.42 million in revenue. Despite being unprofitable, the company benefits from a strong cash position that exceeds its total debt and provides over three years of runway based on current free cash flow trends. Qingci's short-term assets significantly cover both short and long-term liabilities, indicating financial stability amidst losses that have slightly increased over five years. The management team and board are experienced, with tenures averaging 4.8 and 3.7 years respectively, while shareholders have not faced meaningful dilution recently.

- Navigate through the intricacies of Qingci Games with our comprehensive balance sheet health report here.

- Assess Qingci Games' future earnings estimates with our detailed growth reports.

Anhui Xinke New MaterialsLtd (SHSE:600255)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anhui Xinke New Materials Co., Ltd focuses on the research, development, production, and sales of copper alloy strip products in China with a market cap of CN¥7.10 billion.

Operations: The company generates revenue of CN¥3.81 billion from its processing and manufacturing segment.

Market Cap: CN¥7.1B

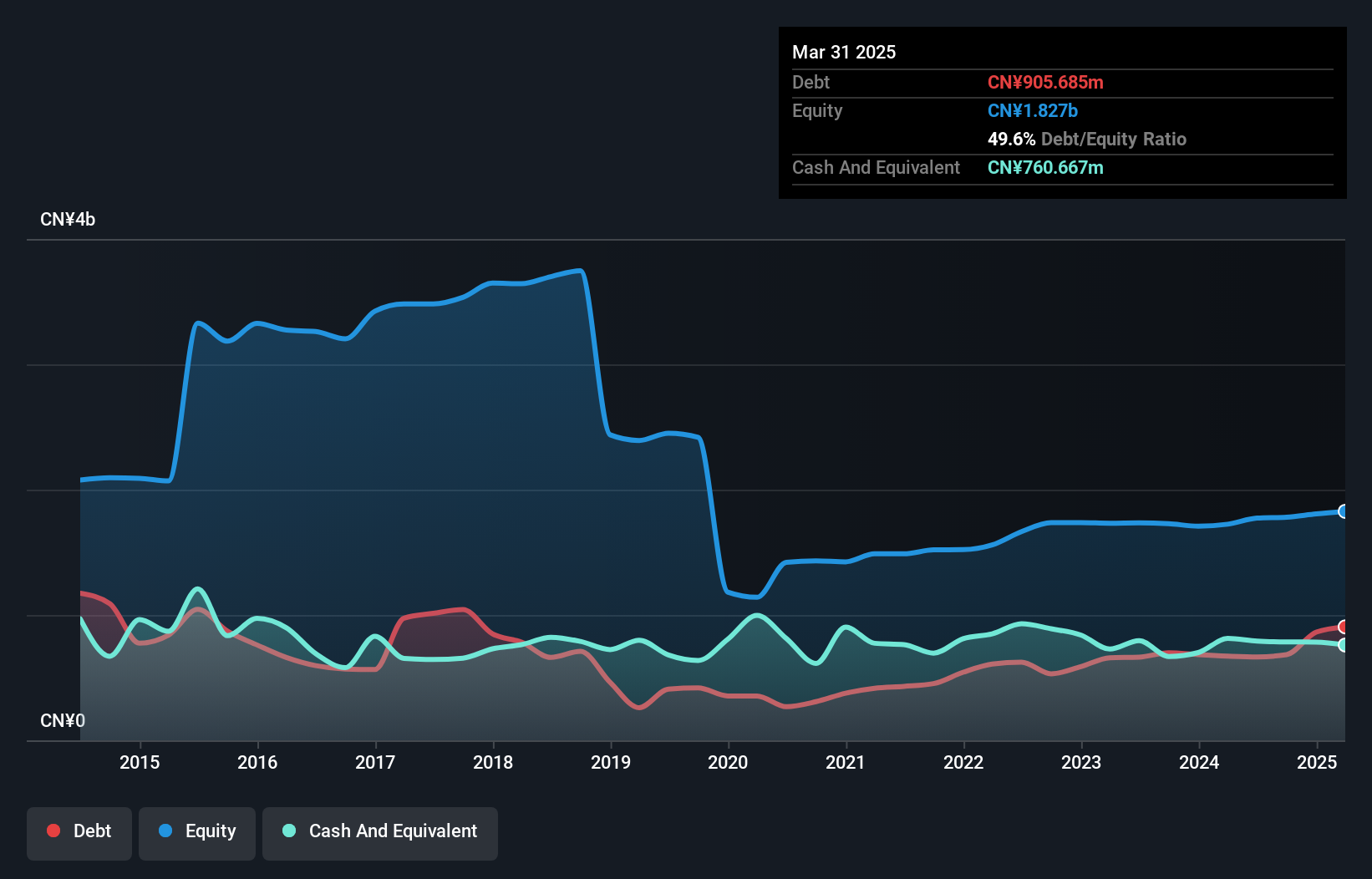

Anhui Xinke New Materials Ltd., with a market cap of CN¥7.10 billion, has recently become profitable, marking a significant shift in its financial trajectory. The company's revenue from copper alloy strip products is CN¥3.81 billion, and it holds more cash than total debt, suggesting strong liquidity despite interest payments being only twice covered by EBIT. Short-term assets match short-term liabilities at CN¥2 billion each, and long-term liabilities are well-covered. While the return on equity is low at 1.3%, earnings quality remains high with no recent shareholder dilution observed amidst increased debt levels over five years.

- Take a closer look at Anhui Xinke New MaterialsLtd's potential here in our financial health report.

- Learn about Anhui Xinke New MaterialsLtd's historical performance here.

Seize The Opportunity

- Embark on your investment journey to our 5,695 Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives