- China

- /

- Metals and Mining

- /

- SHSE:600255

Anhui Xinke New Materials Co.,Ltd's (SHSE:600255) Shares Climb 69% But Its Business Is Yet to Catch Up

Despite an already strong run, Anhui Xinke New Materials Co.,Ltd (SHSE:600255) shares have been powering on, with a gain of 69% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 80% in the last year.

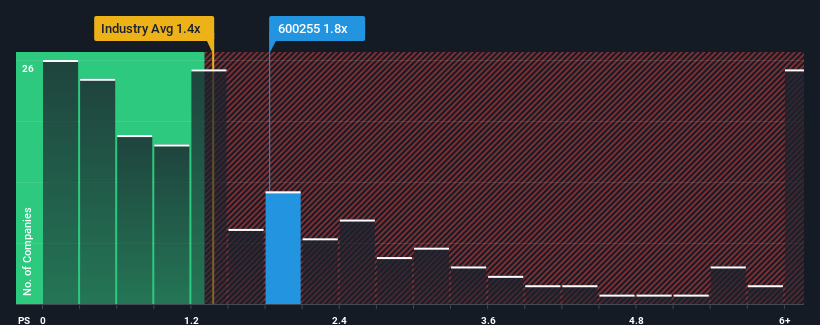

Although its price has surged higher, there still wouldn't be many who think Anhui Xinke New MaterialsLtd's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in China's Metals and Mining industry is similar at about 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Anhui Xinke New MaterialsLtd

How Has Anhui Xinke New MaterialsLtd Performed Recently?

The revenue growth achieved at Anhui Xinke New MaterialsLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Anhui Xinke New MaterialsLtd will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Anhui Xinke New MaterialsLtd?

The only time you'd be comfortable seeing a P/S like Anhui Xinke New MaterialsLtd's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. As a result, it also grew revenue by 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Anhui Xinke New MaterialsLtd's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Anhui Xinke New MaterialsLtd's P/S?

Its shares have lifted substantially and now Anhui Xinke New MaterialsLtd's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Anhui Xinke New MaterialsLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Anhui Xinke New MaterialsLtd with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600255

Anhui Xinke New MaterialsLtd

Engages in the research, development, production, and sales of copper alloy strip products in China.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives