- China

- /

- Metals and Mining

- /

- SHSE:600219

We Ran A Stock Scan For Earnings Growth And Shandong Nanshan AluminiumLtd (SHSE:600219) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Shandong Nanshan AluminiumLtd (SHSE:600219). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Shandong Nanshan AluminiumLtd

How Fast Is Shandong Nanshan AluminiumLtd Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Shandong Nanshan AluminiumLtd has managed to grow EPS by 18% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

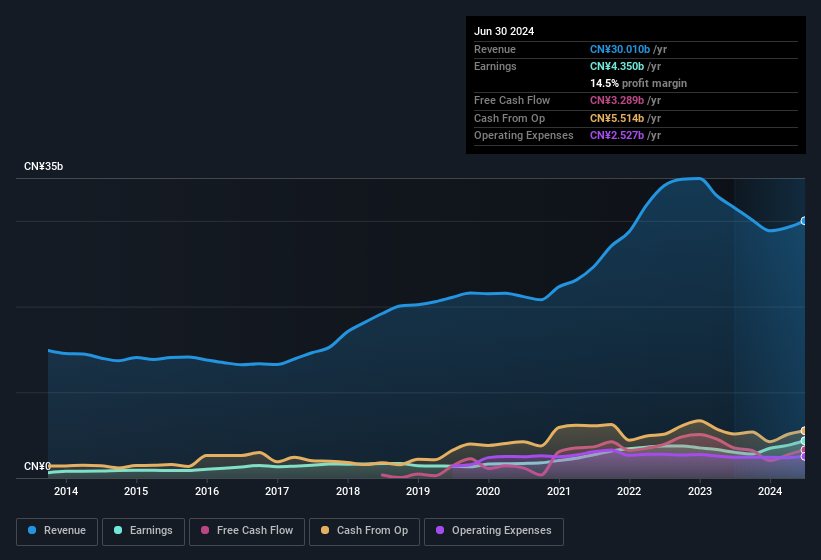

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Shandong Nanshan AluminiumLtd's EBIT margins have actually improved by 3.0 percentage points in the last year, to reach 15%, but, on the flip side, revenue was down 4.9%. That's not a good look.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Shandong Nanshan AluminiumLtd?

Are Shandong Nanshan AluminiumLtd Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥28b and CN¥85b, like Shandong Nanshan AluminiumLtd, the median CEO pay is around CN¥2.1m.

Shandong Nanshan AluminiumLtd offered total compensation worth CN¥1.2m to its CEO in the year to December 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Shandong Nanshan AluminiumLtd Deserve A Spot On Your Watchlist?

For growth investors, Shandong Nanshan AluminiumLtd's raw rate of earnings growth is a beacon in the night. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. However, before you get too excited we've discovered 2 warning signs for Shandong Nanshan AluminiumLtd that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600219

Shandong Nanshan AluminiumLtd

Researches and develops, manufactures, imports, sells, and exports aluminum profiles worldwide.

Very undervalued with flawless balance sheet and pays a dividend.