In a week marked by U.S. inflation concerns and political uncertainties, global markets have experienced notable fluctuations, with major indices like the Nasdaq Composite seeing significant declines. Amidst this volatility, investors often turn to dividend stocks for their potential to provide steady income streams and stability within a portfolio. In times of economic unpredictability, reliable dividend stocks can serve as anchors due to their historical propensity for consistent payouts and resilience in various market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.51% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.10% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

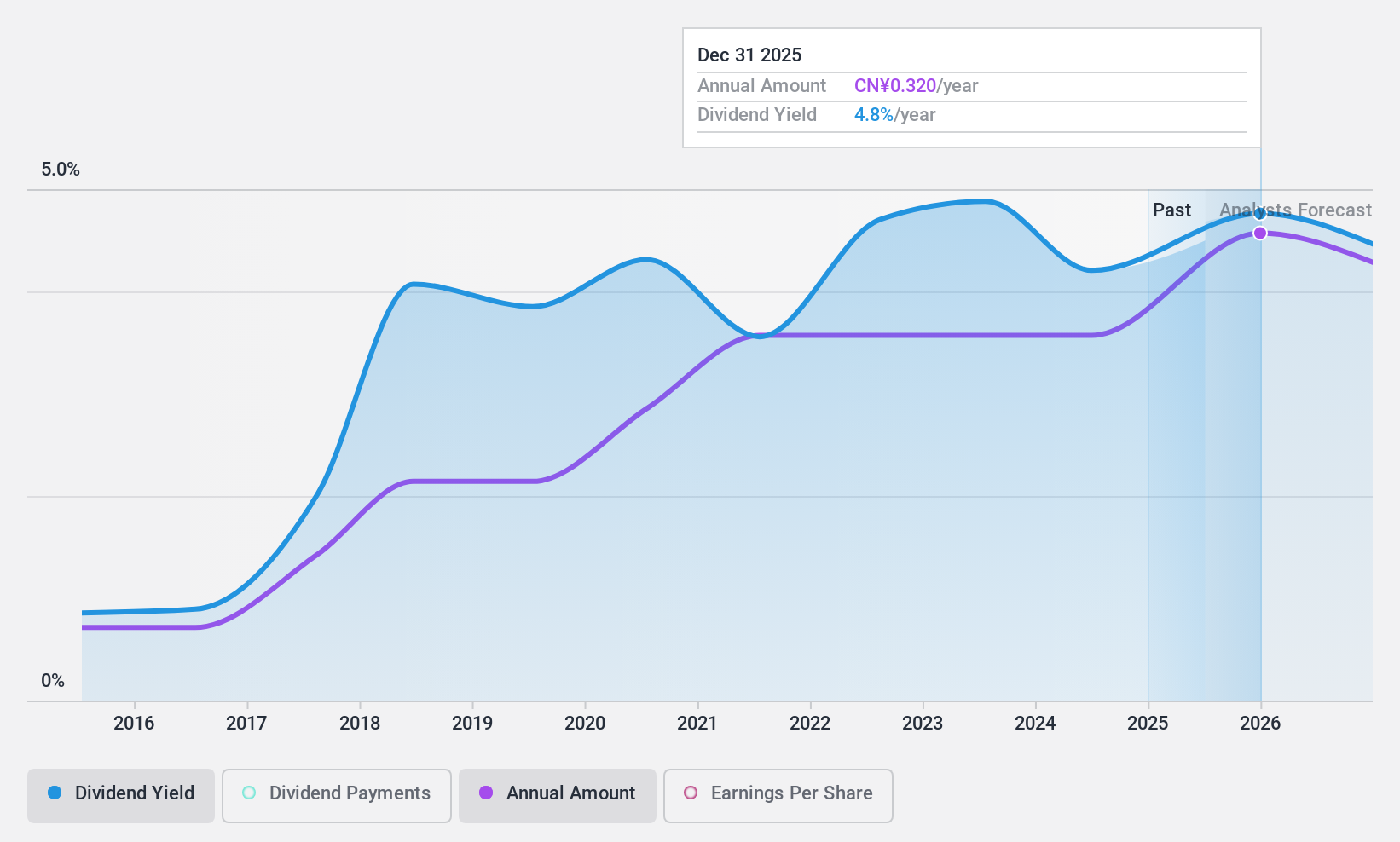

Shanghai Zijiang Enterprise Group (SHSE:600210)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Zijiang Enterprise Group Co., Ltd. operates in the packaging industry and has a market capitalization of CN¥9.71 billion.

Operations: Shanghai Zijiang Enterprise Group Co., Ltd. does not have specific revenue segments detailed in the provided text.

Dividend Yield: 3.9%

Shanghai Zijiang Enterprise Group's dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 59.5% and a cash payout ratio of 23.2%. Despite trading at good value and offering a competitive dividend yield in the Chinese market, its dividends have been historically volatile, experiencing significant annual drops. Recent earnings growth indicates potential for future stability, though past unreliability remains a concern for consistent income investors.

- Click here to discover the nuances of Shanghai Zijiang Enterprise Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Shanghai Zijiang Enterprise Group is priced lower than what may be justified by its financials.

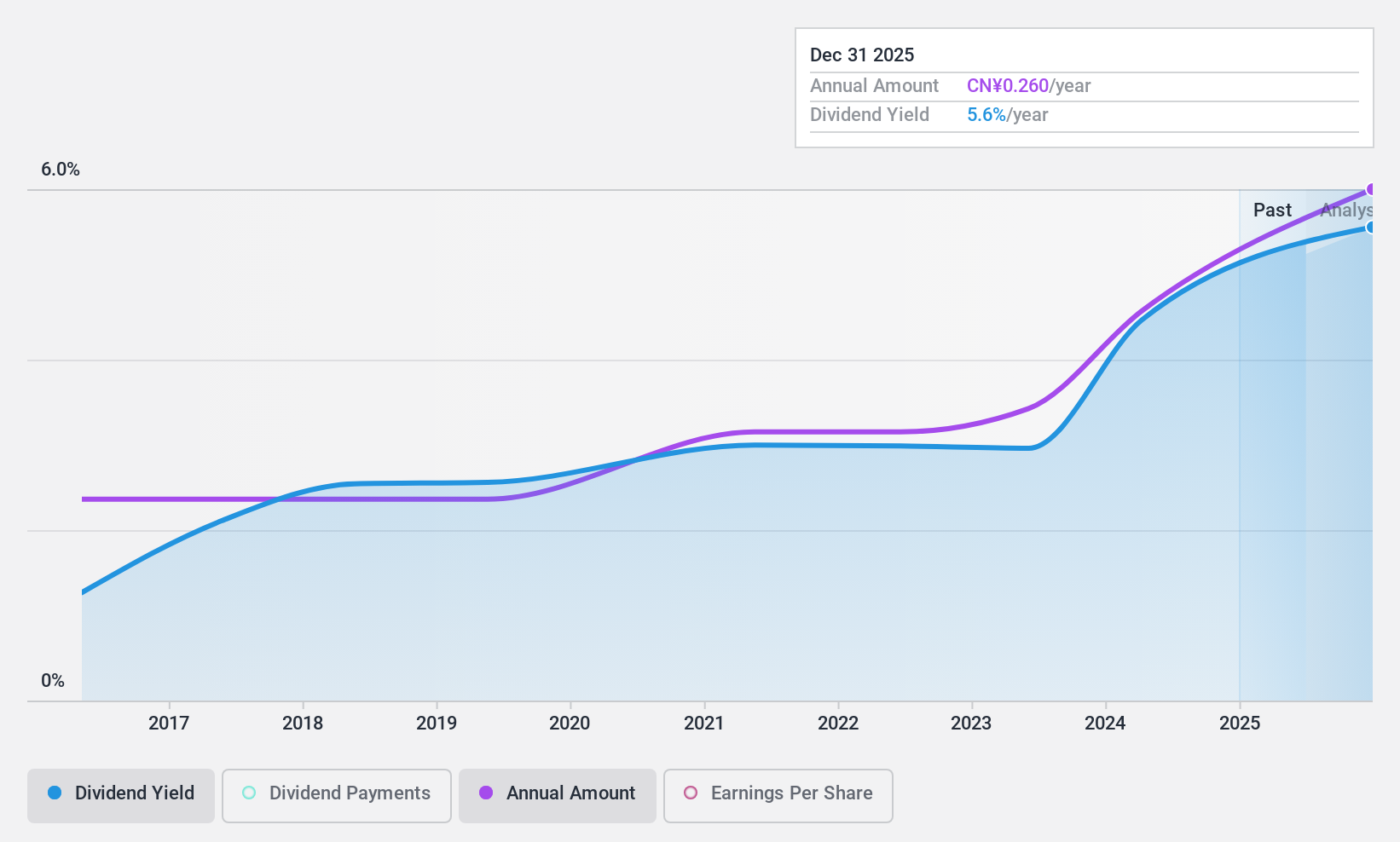

Zhejiang Giuseppe Garment (SZSE:002687)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Giuseppe Garment Co., Ltd, with a market cap of CN¥2.10 billion, produces and sells business wear, men's wear, and casual wear under the George White brands in China.

Operations: Zhejiang Giuseppe Garment Co., Ltd generates revenue through its production and sale of business, men's, and casual wear under the George White brands in China.

Dividend Yield: 4.6%

Zhejiang Giuseppe Garment offers a dividend yield in the top 25% of the Chinese market, supported by earnings and cash flows with payout ratios of 74.7% and 54.3%, respectively. However, its dividend history is marked by volatility over the past decade, despite some growth. Recent financials show decreased sales (CNY 784.9 million) and net income (CNY 52.88 million), which might impact future payouts amidst an ongoing share buyback program worth CNY 80.04 million.

- Navigate through the intricacies of Zhejiang Giuseppe Garment with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Zhejiang Giuseppe Garment is priced higher than what may be justified by its financials.

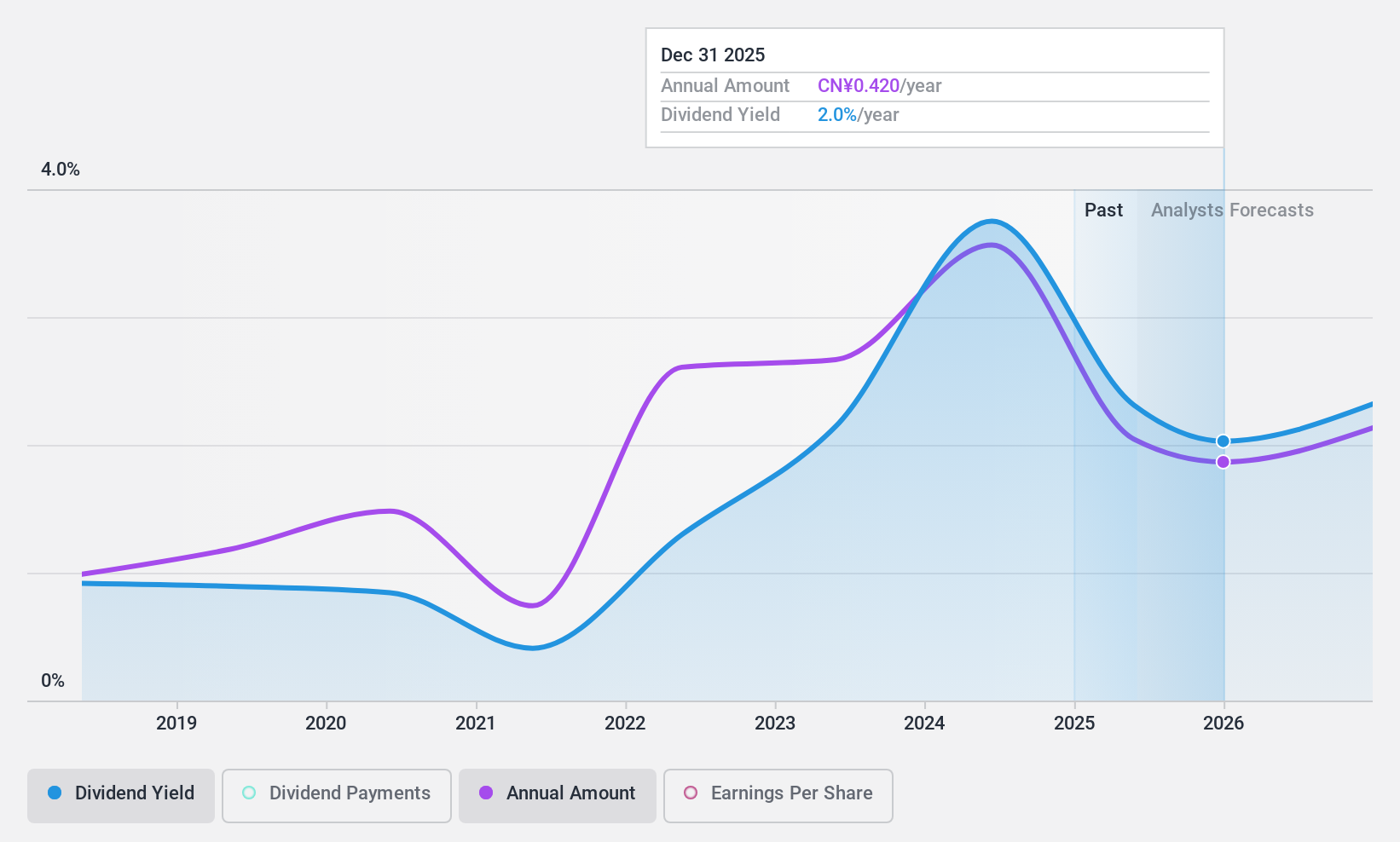

Yantai Zhenghai Biotechnology (SZSE:300653)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yantai Zhenghai Biotechnology Co., Ltd. focuses on the research, development, production, and marketing of regenerative medical materials in China with a market cap of CN¥3.69 billion.

Operations: Yantai Zhenghai Biotechnology Co., Ltd.'s revenue primarily comes from the research, development, production, and sales of bio-renewable materials, amounting to CN¥383.22 million.

Dividend Yield: 3.9%

Yantai Zhenghai Biotechnology's dividend yield ranks in the top 25% of the Chinese market, supported by an earnings payout ratio of 86.3% and a cash payout ratio of 89%. However, its dividend history is unreliable and volatile over seven years. Recent financials show a decline in sales to CNY 291.35 million and net income to CNY 125.06 million for the nine months ending September 2024, alongside completion of a share buyback program worth CNY 49.92 million.

- Unlock comprehensive insights into our analysis of Yantai Zhenghai Biotechnology stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Yantai Zhenghai Biotechnology shares in the market.

Summing It All Up

- Access the full spectrum of 1996 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600210

Shanghai Zijiang Enterprise Group

Shanghai Zijiang Enterprise Group Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.