Further Upside For Hubei Biocause Pharmaceutical Co., Ltd. (SZSE:000627) Shares Could Introduce Price Risks After 32% Bounce

Hubei Biocause Pharmaceutical Co., Ltd. (SZSE:000627) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

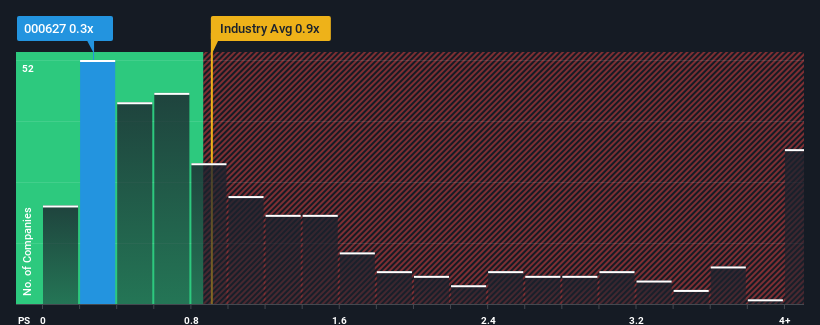

In spite of the firm bounce in price, it would still be understandable if you think Hubei Biocause Pharmaceutical is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in China's Insurance industry have P/S ratios above 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Hubei Biocause Pharmaceutical

How Hubei Biocause Pharmaceutical Has Been Performing

As an illustration, revenue has deteriorated at Hubei Biocause Pharmaceutical over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hubei Biocause Pharmaceutical's earnings, revenue and cash flow.How Is Hubei Biocause Pharmaceutical's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Hubei Biocause Pharmaceutical's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 6.7% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that Hubei Biocause Pharmaceutical's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Hubei Biocause Pharmaceutical's P/S

Hubei Biocause Pharmaceutical's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at the figures, it's surprising to see Hubei Biocause Pharmaceutical currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Hubei Biocause Pharmaceutical (1 doesn't sit too well with us!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Biocause Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000627

Hubei Biocause Pharmaceutical

Primarily provides life and motor insurance products in China.

Slightly overvalued with imperfect balance sheet.