- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6805

3 Stocks Possibly Trading Below Fair Value By Up To 43.3%

Reviewed by Simply Wall St

Global markets have experienced a mixed performance recently, with major indices such as the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating amid a busy earnings week. As economic indicators send conflicting signals, investors are increasingly focused on identifying stocks that may be trading below their intrinsic value in this complex environment. In such conditions, finding undervalued stocks requires careful analysis of fundamentals and market sentiment to assess whether current prices reflect potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.27 | 49.9% |

| IMAGICA GROUP (TSE:6879) | ¥476.00 | ¥947.55 | 49.8% |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.60 | SEK349.53 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.63 | US$168.45 | 49.8% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| On the Beach Group (LSE:OTB) | £1.534 | £3.07 | 50% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.45 | CN¥22.90 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥3935.00 | ¥7851.33 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.67 | 49.8% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

We'll examine a selection from our screener results.

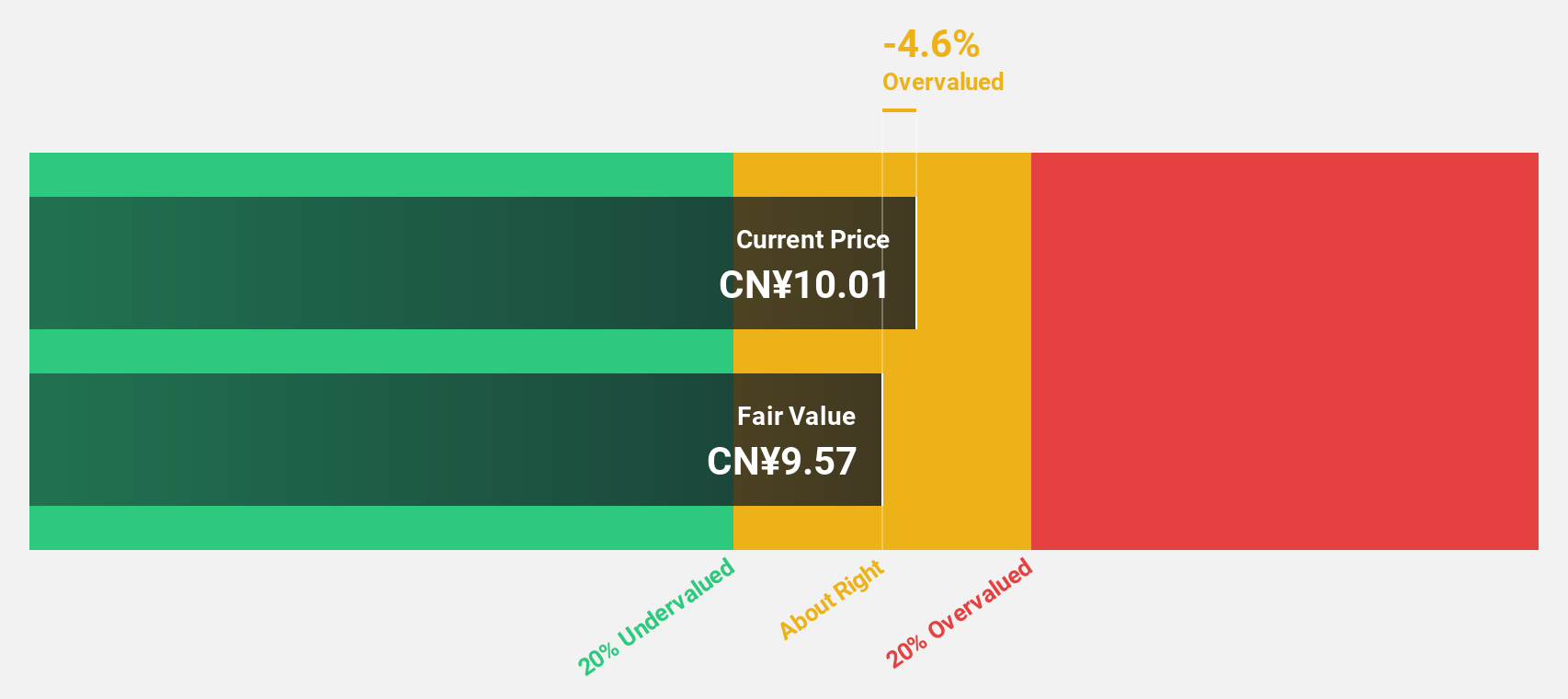

Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707)

Overview: Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on biochemical products, with a market cap of CN¥24.15 billion.

Operations: Unfortunately, there is no specific revenue segment information provided in the text for Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd.

Estimated Discount To Fair Value: 43.3%

Nanjing King-Friend Biochemical Pharmaceutical appears undervalued, trading at CNY 14.95, significantly below its estimated fair value of CNY 26.36. Despite recent earnings declines, with nine-month net income dropping to CNY 605.78 million from CNY 839.31 million a year ago, the company's revenue is forecast to grow annually by 25.9%, outpacing the Chinese market average of 14%. Earnings are expected to grow by over 70% per year, suggesting potential for future profitability improvements.

- Upon reviewing our latest growth report, Nanjing King-Friend Biochemical PharmaceuticalLtd's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Nanjing King-Friend Biochemical PharmaceuticalLtd with our detailed financial health report.

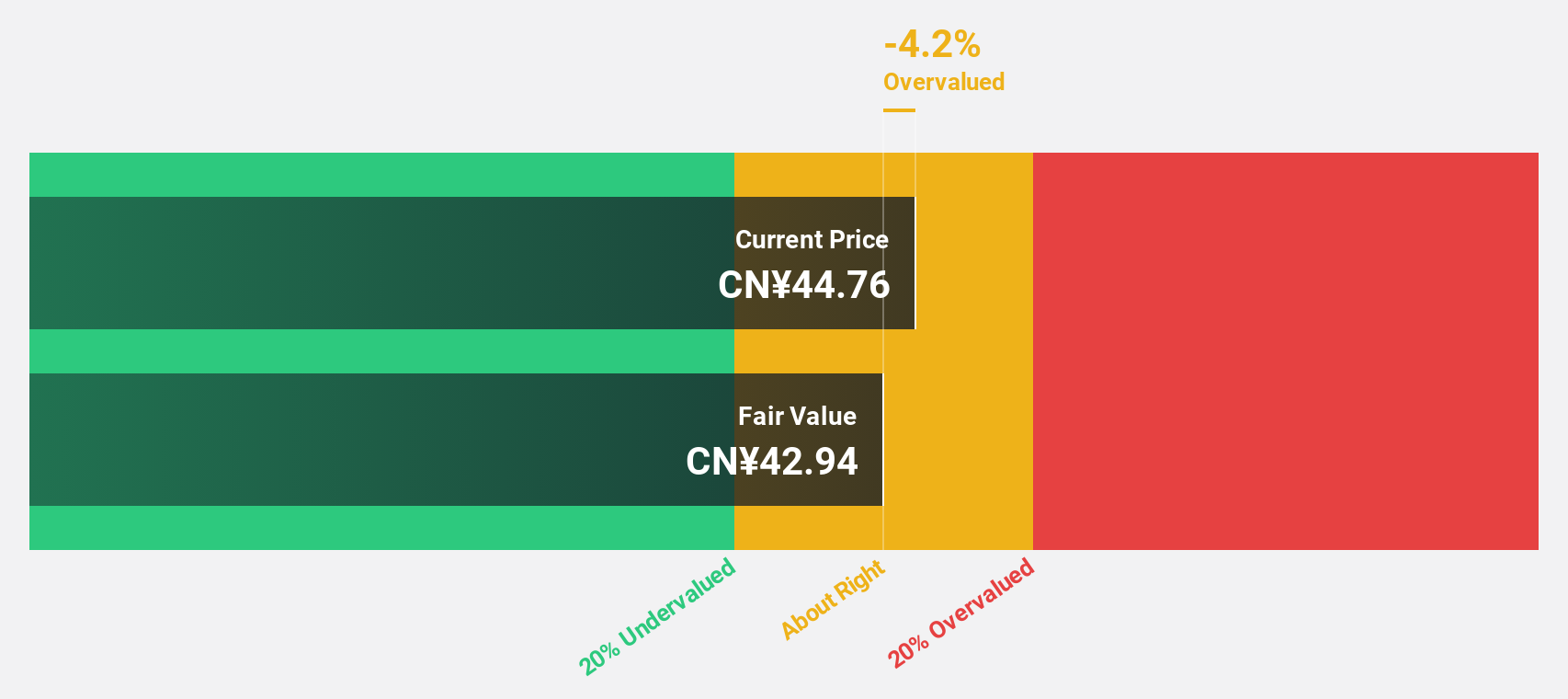

Yunnan Botanee Bio-Technology GroupLTD (SZSE:300957)

Overview: Yunnan Botanee Bio-Technology Group Co. LTD is involved in the manufacture and sale of skincare and makeup products in China, with a market cap of CN¥22.99 billion.

Operations: The company's revenue segments include the manufacture and sale of skincare and makeup products in China.

Estimated Discount To Fair Value: 37.4%

Yunnan Botanee Bio-Technology Group LTD is trading at CN¥54.75, notably below its fair value estimate of CN¥87.5, suggesting it may be undervalued based on cash flows. Despite a volatile share price and reduced profit margins from 20.1% to 9.7%, earnings are projected to grow significantly at 33.85% annually over the next three years, outpacing the market average of 25.9%. Recent nine-month net income fell to CN¥414.77 million from CN¥579.19 million last year amidst large one-off items affecting results.

- Our expertly prepared growth report on Yunnan Botanee Bio-Technology GroupLTD implies its future financial outlook may be stronger than recent results.

- Take a closer look at Yunnan Botanee Bio-Technology GroupLTD's balance sheet health here in our report.

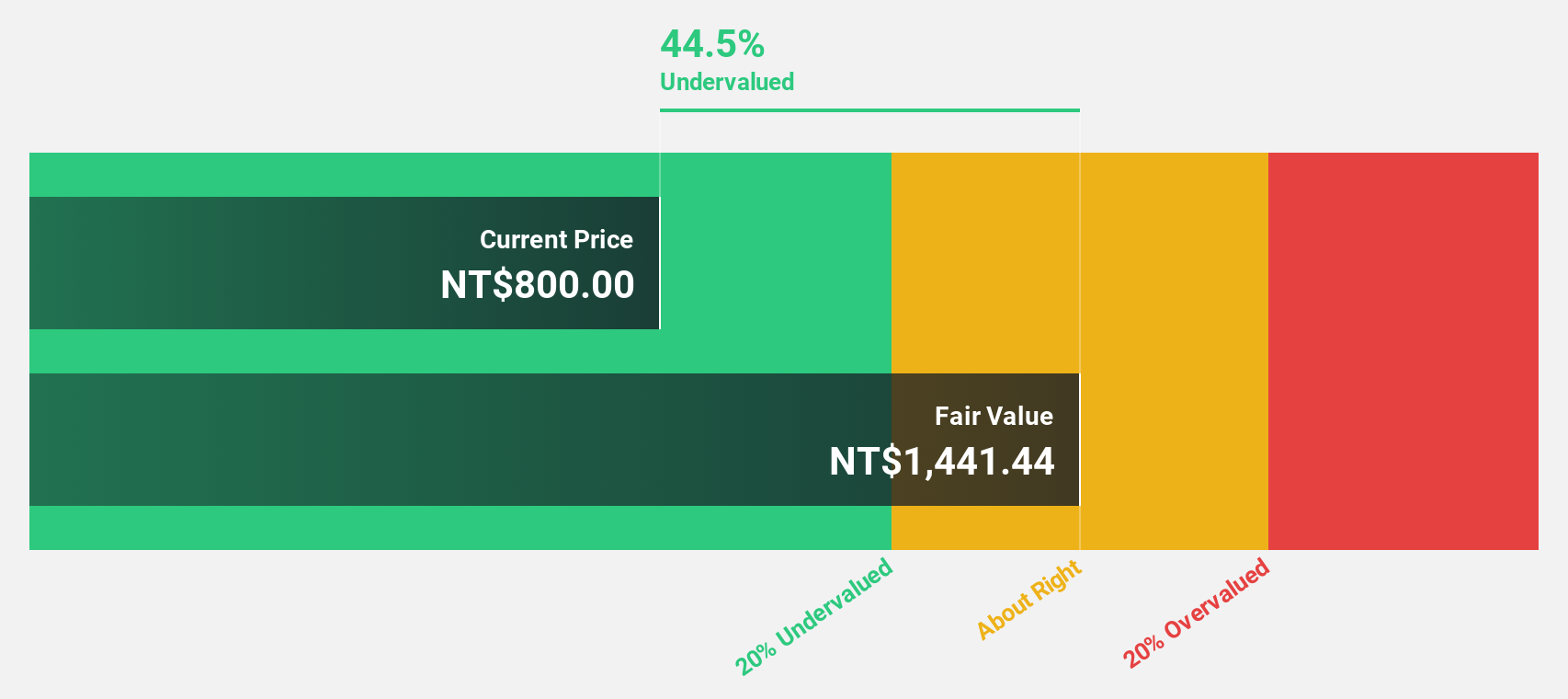

Fositek (TWSE:6805)

Overview: Fositek Corp. is involved in the manufacture and wholesale of electronic materials and components, with a market cap of NT$59.16 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$6.77 billion.

Estimated Discount To Fair Value: 12.6%

Fositek is trading at NT$863, below its fair value estimate of NT$987.06, indicating potential undervaluation based on cash flows. The company reported strong earnings growth of 62.7% over the past year and forecasts suggest revenue will grow at 43.7% annually, outpacing the Taiwanese market average. Analysts agree on a potential 26.5% stock price increase, with earnings expected to rise significantly by 50.35% per year over the next three years.

- According our earnings growth report, there's an indication that Fositek might be ready to expand.

- Unlock comprehensive insights into our analysis of Fositek stock in this financial health report.

Taking Advantage

- Reveal the 963 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6805

Fositek

Engages in the manufacture and wholesale of electronic materials and components.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives